QuickBooks is an accounting software widely used by small businesses, freelancers, and entrepreneurs to manage their financial transactions. One of the key features of QuickBooks is its ability to process payroll, including direct deposits. However, before you can start using direct deposit in QuickBooks, you need to obtain a Direct Deposit Authorization Form from your employees or contractors. In this article, we will explain the QuickBooks Direct Deposit Authorization Form in detail, including its importance, benefits, and how to obtain it.

Importance of QuickBooks Direct Deposit Authorization Form

The QuickBooks Direct Deposit Authorization Form is a mandatory document that you need to obtain from your employees or contractors before you can start making direct deposits into their bank accounts. This form is essential for several reasons:

- It confirms the employee's or contractor's consent to receive direct deposits.

- It provides the necessary bank account information, such as the account number and routing number.

- It helps to prevent errors or misdirected deposits.

Benefits of Using QuickBooks Direct Deposit Authorization Form

Using the QuickBooks Direct Deposit Authorization Form offers several benefits to both employers and employees. Some of the benefits include:

- Convenience: Direct deposit is a convenient way to pay employees or contractors, as it eliminates the need for paper checks.

- Time-saving: Direct deposit saves time and effort, as you don't need to print and distribute paper checks.

- Accuracy: Direct deposit reduces the risk of errors or misdirected deposits.

- Security: Direct deposit is a secure way to transfer funds, as it uses the Automated Clearing House (ACH) network.

How to Obtain a QuickBooks Direct Deposit Authorization Form

Obtaining a QuickBooks Direct Deposit Authorization Form is a straightforward process. Here are the steps to follow:

- Download the form: You can download the QuickBooks Direct Deposit Authorization Form from the QuickBooks website or create your own form using a template.

- Fill out the form: Provide the necessary information, such as the company name, employee or contractor name, and bank account details.

- Get employee or contractor signature: Obtain the employee's or contractor's signature on the form, confirming their consent to receive direct deposits.

- Verify bank account information: Verify the bank account information provided by the employee or contractor to ensure accuracy.

What Information is Required on the QuickBooks Direct Deposit Authorization Form?

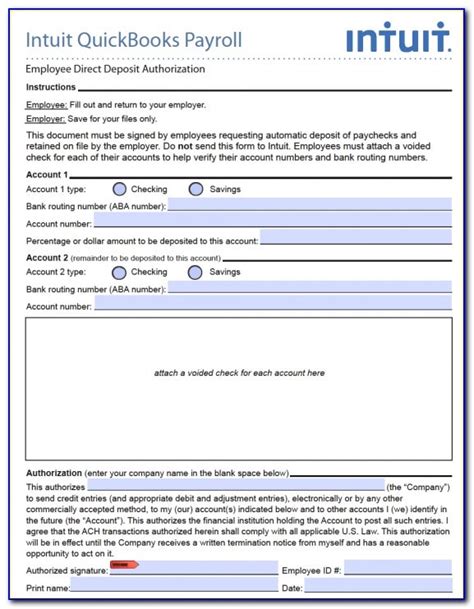

The QuickBooks Direct Deposit Authorization Form requires the following information:

- Company information: Company name and address

- Employee or contractor information: Name, address, and Social Security number or Employer Identification Number (EIN)

- Bank account information: Bank name, account number, and routing number

- Authorization: Employee's or contractor's signature, confirming their consent to receive direct deposits

How to Fill Out the QuickBooks Direct Deposit Authorization Form

Filling out the QuickBooks Direct Deposit Authorization Form is a straightforward process. Here are the steps to follow:

- Company information: Fill out the company name and address.

- Employee or contractor information: Fill out the employee's or contractor's name, address, and Social Security number or EIN.

- Bank account information: Fill out the bank name, account number, and routing number.

- Authorization: Obtain the employee's or contractor's signature, confirming their consent to receive direct deposits.

Example of a Completed QuickBooks Direct Deposit Authorization Form

Here is an example of a completed QuickBooks Direct Deposit Authorization Form:

- Company information: XYZ Inc., 123 Main St, Anytown, USA 12345

- Employee information: John Doe, 456 Elm St, Anytown, USA 12345, SSN: 123-45-6789

- Bank account information: Bank of America, Account Number: 1234567890, Routing Number: 111000025

- Authorization: I, John Doe, authorize XYZ Inc. to make direct deposits into my bank account.

Common Mistakes to Avoid When Filling Out the QuickBooks Direct Deposit Authorization Form

When filling out the QuickBooks Direct Deposit Authorization Form, it's essential to avoid common mistakes that can lead to errors or misdirected deposits. Here are some common mistakes to avoid:

- Inaccurate bank account information: Verify the bank account information provided by the employee or contractor to ensure accuracy.

- Missing or incomplete information: Ensure that all required information is filled out, including the company name, employee or contractor name, and bank account details.

- Invalid or expired authorization: Obtain a new authorization form if the employee or contractor's bank account information changes or if the authorization expires.

Best Practices for Managing QuickBooks Direct Deposit Authorization Forms

Managing QuickBooks Direct Deposit Authorization Forms requires attention to detail and organization. Here are some best practices to follow:

- Store forms securely: Store completed authorization forms in a secure location, such as a locked file cabinet or a password-protected digital folder.

- Verify information regularly: Verify the bank account information and authorization regularly to ensure accuracy and prevent errors.

- Update forms as needed: Update the authorization form if the employee's or contractor's bank account information changes or if the authorization expires.

We hope this article has provided you with a comprehensive understanding of the QuickBooks Direct Deposit Authorization Form. By following the best practices outlined in this article, you can ensure accurate and secure direct deposits for your employees or contractors.

We invite you to share your thoughts and experiences with managing QuickBooks Direct Deposit Authorization Forms in the comments section below. Your feedback will help us create more informative and helpful content in the future.

Additionally, if you have any questions or need further clarification on any of the topics discussed in this article, please don't hesitate to ask. We're here to help.

What is the purpose of the QuickBooks Direct Deposit Authorization Form?

+The QuickBooks Direct Deposit Authorization Form is used to obtain an employee's or contractor's consent to receive direct deposits into their bank account.

What information is required on the QuickBooks Direct Deposit Authorization Form?

+The form requires company information, employee or contractor information, bank account information, and authorization from the employee or contractor.

How often should I verify the information on the QuickBooks Direct Deposit Authorization Form?

+It's recommended to verify the information on the form regularly, such as quarterly or annually, to ensure accuracy and prevent errors.