As a business owner or individual in Michigan, understanding the intricacies of tax compliance is crucial to avoid any penalties or fines. One of the most important forms for tax compliance in Michigan is the Rd 108 form. In this article, we will delve into the details of the Rd 108 form, its purpose, and how to fill it out correctly.

What is the Rd 108 Form?

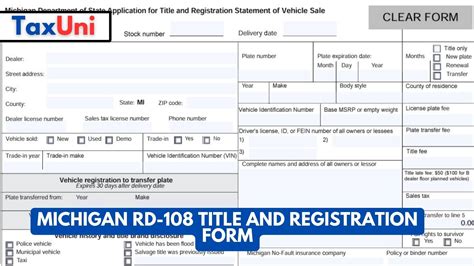

The Rd 108 form is a document used by the Michigan Department of Treasury to report and remit withholding taxes. It is typically used by employers, payroll processors, and other entities that are required to withhold Michigan income tax from employee wages. The form is used to report the amount of tax withheld and remit the tax to the state.

Who Needs to File the Rd 108 Form?

The Rd 108 form is required to be filed by any entity that withholds Michigan income tax from employee wages. This includes:

- Employers with employees who reside in Michigan

- Payroll processors who handle payroll for Michigan-based businesses

- Other entities that are required to withhold Michigan income tax

How to Fill Out the Rd 108 Form

Filling out the Rd 108 form correctly is crucial to avoid any penalties or fines. Here are the steps to follow:

- Obtain the form: You can download the Rd 108 form from the Michigan Department of Treasury website or obtain it from a tax professional.

- Identify the reporting period: The Rd 108 form is typically filed on a quarterly basis. Identify the reporting period for which you are filing the form.

- Enter employer information: Enter your employer identification number, business name, and address.

- Report withholding tax: Report the total amount of Michigan income tax withheld from employee wages during the reporting period.

- Report tax deposits: Report the total amount of tax deposits made during the reporting period.

- Calculate the tax due: Calculate the total tax due by subtracting the tax deposits from the total tax withheld.

- Sign and date the form: Sign and date the form to certify that the information is accurate.

Penalties for Non-Compliance

Failure to file the Rd 108 form or pay the tax due can result in penalties and fines. The Michigan Department of Treasury can impose the following penalties:

- Late filing penalty: 5% of the tax due for each month or part of a month that the return is late

- Late payment penalty: 5% of the tax due for each month or part of a month that the payment is late

- Interest on unpaid tax: 1% of the unpaid tax per month or part of a month

Avoiding Penalties and Fines

To avoid penalties and fines, it is essential to file the Rd 108 form on time and pay the tax due. Here are some tips to avoid penalties and fines:

- File the form electronically to avoid delays and errors

- Pay the tax due by the due date to avoid late payment penalties

- Keep accurate records of tax withholding and deposits to avoid errors on the form

Conclusion

In conclusion, understanding the Rd 108 form is crucial for tax compliance in Michigan. By following the steps outlined in this article, you can ensure that you file the form correctly and avoid any penalties or fines. Remember to file the form electronically, pay the tax due on time, and keep accurate records to avoid errors and penalties.

We would love to hear from you! Share your experiences or ask questions about the Rd 108 form in the comments below.

What is the purpose of the Rd 108 form?

+The Rd 108 form is used to report and remit withholding taxes to the Michigan Department of Treasury.

Who needs to file the Rd 108 form?

+Employers, payroll processors, and other entities that withhold Michigan income tax from employee wages need to file the Rd 108 form.

What are the penalties for non-compliance?

+The Michigan Department of Treasury can impose penalties and fines for late filing, late payment, and interest on unpaid tax.