The Form 940 is an annual tax return that employers must file with the Internal Revenue Service (IRS) to report their Federal Unemployment Tax Act (FUTA) tax liability. This form is used to calculate the amount of FUTA tax an employer owes based on the wages paid to their employees. In this article, we will discuss the importance of filing Form 940 annually and provide 5 tips to help employers navigate the process.

Filing Form 940 is a crucial requirement for employers, as it helps to fund state unemployment insurance programs. Failure to file this form can result in penalties and fines, which can be costly for businesses. In addition to the financial implications, filing Form 940 is also essential for maintaining compliance with federal tax laws.

As an employer, it's essential to understand the process of filing Form 940 to avoid any errors or delays. Here are 5 tips to help you file Form 940 annually:

Tip 1: Determine Your FUTA Tax Liability

The first step in filing Form 940 is to determine your FUTA tax liability. This involves calculating the amount of FUTA tax you owe based on the wages paid to your employees. The FUTA tax rate is typically 6% of the first $7,000 of wages paid to each employee during the calendar year. However, you may be eligible for a credit of up to 5.4% if you paid state unemployment taxes on time.

To calculate your FUTA tax liability, you'll need to:

- Determine the total amount of wages paid to your employees during the calendar year

- Calculate the FUTA tax owed based on the first $7,000 of wages paid to each employee

- Apply any credits you're eligible for, such as the credit for paying state unemployment taxes on time

Example of FUTA Tax Calculation

Let's say you paid $100,000 in wages to your employees during the calendar year. The FUTA tax rate is 6%, so you would owe:

- 6% of $100,000 = $6,000

However, if you paid state unemployment taxes on time, you may be eligible for a credit of up to 5.4%. Let's say you're eligible for a credit of 5.4%, so you would owe:

- $6,000 - 5.4% credit = $564

Tip 2: Gather Required Documents and Information

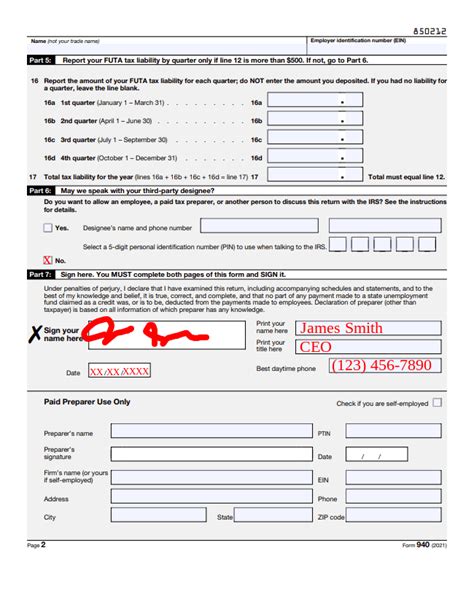

Before filing Form 940, you'll need to gather the required documents and information. This includes:

- Your Employer Identification Number (EIN)

- The total amount of wages paid to your employees during the calendar year

- The amount of FUTA tax owed based on the first $7,000 of wages paid to each employee

- Any credits you're eligible for, such as the credit for paying state unemployment taxes on time

You may also need to provide additional information, such as:

- The number of employees you had during the calendar year

- The amount of state unemployment taxes you paid during the calendar year

Example of Required Documents

Here are some examples of required documents you may need to provide:

- Your EIN confirmation letter from the IRS

- Your W-2 forms for the calendar year

- Your state unemployment tax returns for the calendar year

Tip 3: File Form 940 Electronically or by Mail

You can file Form 940 electronically or by mail. The IRS recommends filing electronically, as it's faster and more accurate. You can file electronically through the IRS website or through a third-party provider.

If you file by mail, you'll need to send the completed form to the IRS address listed in the instructions.

Example of Electronic Filing

To file Form 940 electronically, you'll need to:

- Create an account on the IRS website

- Complete Form 940 online

- Submit the form electronically

Tip 4: Pay Any FUTA Tax Due

If you owe FUTA tax, you'll need to pay it by the due date to avoid penalties and interest. You can pay online, by phone, or by mail.

Example of Payment Options

Here are some examples of payment options:

- Online: You can pay online through the IRS website

- Phone: You can pay by phone by calling the IRS at 1-800-829-1040

- Mail: You can pay by mail by sending a check or money order with a payment voucher

Tip 5: Keep Records of Your Filing

Finally, it's essential to keep records of your filing, including:

- A copy of Form 940

- Proof of payment, such as a payment voucher or cancelled check

- Any correspondence with the IRS

This will help you track your filing and ensure you're in compliance with federal tax laws.

Example of Record Keeping

Here are some examples of record keeping:

- Keep a copy of Form 940 in your business files

- Keep a record of payment, such as a payment voucher or cancelled check

- Keep any correspondence with the IRS, such as emails or letters

By following these 5 tips, you can ensure you're in compliance with federal tax laws and avoid any penalties or fines.

We hope this article has been helpful in guiding you through the process of filing Form 940. If you have any questions or concerns, please don't hesitate to reach out.

What is the deadline for filing Form 940?

+The deadline for filing Form 940 is January 31st of each year.

Can I file Form 940 electronically?

+Yes, you can file Form 940 electronically through the IRS website or through a third-party provider.

What is the penalty for not filing Form 940?

+The penalty for not filing Form 940 can range from 5% to 25% of the unpaid tax, depending on the circumstances.