As a business owner in New York, filing sales tax returns is a crucial part of complying with state tax laws. The New York sales tax form, also known as Form ST-100, can seem daunting, but with the right guidance, you can ensure accurate and timely submissions. In this article, we'll explore five ways to fill out the New York sales tax form, providing you with the necessary tools to navigate this process with confidence.

Understanding the New York Sales Tax Form

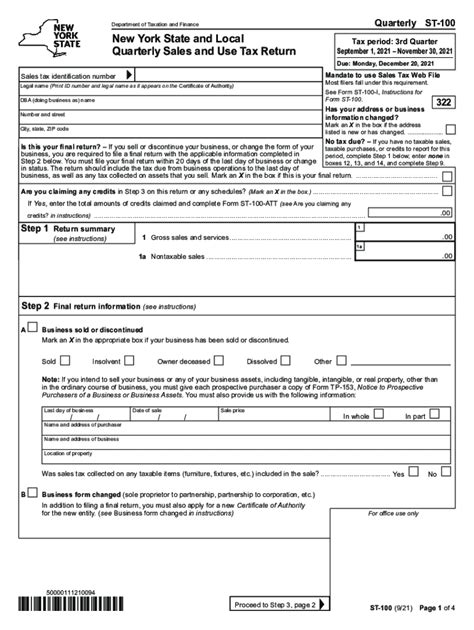

Before diving into the five ways to fill out the form, it's essential to understand the basics of the New York sales tax form. The form is used to report and remit sales tax collected by businesses in New York State. The form consists of several sections, including:

- Business information

- Sales tax period

- Gross sales

- Exempt sales

- Taxable sales

- Sales tax due

Method 1: Manual Calculation

One way to fill out the New York sales tax form is to manually calculate your sales tax liability. This involves keeping track of your business's gross sales, exempt sales, and taxable sales throughout the reporting period. You'll need to calculate the sales tax due by multiplying the taxable sales by the applicable sales tax rate.

To manually calculate your sales tax liability, follow these steps:

- Determine your business's gross sales for the reporting period.

- Identify exempt sales, such as sales to exempt organizations or sales of exempt items.

- Calculate taxable sales by subtracting exempt sales from gross sales.

- Determine the applicable sales tax rate for your business.

- Multiply taxable sales by the sales tax rate to calculate sales tax due.

Method 2: Using Accounting Software

Another way to fill out the New York sales tax form is to use accounting software that integrates with the state's tax system. Many accounting software programs, such as QuickBooks or Xero, allow you to track sales tax and generate reports that can be used to complete the form.

To use accounting software to fill out the form, follow these steps:

- Set up your accounting software to track sales tax.

- Generate a sales tax report for the reporting period.

- Use the report to complete the form, ensuring accurate calculations and data transfer.

Method 3: Hiring a Tax Professional

If you're not comfortable with manual calculations or using accounting software, you can hire a tax professional to fill out the New York sales tax form on your behalf. Tax professionals have the expertise and knowledge to ensure accurate and timely submissions.

To hire a tax professional, follow these steps:

- Research local tax professionals or accounting firms.

- Contact several professionals to discuss your needs and their services.

- Choose a professional who is familiar with New York sales tax laws and regulations.

Method 4: Using Online Sales Tax Tools

Online sales tax tools, such as TaxJar or Avalara, can help simplify the process of filling out the New York sales tax form. These tools provide automated sales tax calculations, reporting, and filing capabilities.

To use online sales tax tools, follow these steps:

- Research and choose an online sales tax tool.

- Set up your account and connect your sales data.

- Use the tool to generate sales tax reports and complete the form.

Method 5: Outsourcing to a Third-Party Provider

Finally, you can outsource the process of filling out the New York sales tax form to a third-party provider. These providers specialize in sales tax compliance and can handle all aspects of the process, from data collection to form submission.

To outsource to a third-party provider, follow these steps:

- Research and choose a reputable provider.

- Provide the necessary data and information.

- Let the provider handle the form completion and submission process.

Benefits of Accurate Sales Tax Filings

Accurate sales tax filings are crucial for businesses in New York State. By following the methods outlined above, you can ensure timely and accurate submissions, avoiding penalties and fines. Some benefits of accurate sales tax filings include:

- Avoiding penalties and fines

- Maintaining good standing with the state

- Reducing audit risk

- Improving financial accuracy and transparency

Common Mistakes to Avoid

When filling out the New York sales tax form, it's essential to avoid common mistakes that can lead to penalties and fines. Some common mistakes to avoid include:

- Inaccurate calculations

- Failure to report exempt sales

- Incorrect sales tax rates

- Late submissions

- Incomplete or missing information

By avoiding these common mistakes, you can ensure accurate and timely submissions, maintaining good standing with the state and reducing audit risk.

Conclusion

Filling out the New York sales tax form can seem daunting, but with the right guidance, you can ensure accurate and timely submissions. By understanding the form's basics, using manual calculations or accounting software, hiring a tax professional, using online sales tax tools, or outsourcing to a third-party provider, you can navigate this process with confidence. Remember to avoid common mistakes and maintain good standing with the state by filing accurate and timely sales tax returns.

We encourage you to share your experiences and tips for filling out the New York sales tax form in the comments below. Don't forget to share this article with your colleagues and friends who may benefit from this information.

What is the New York sales tax form used for?

+The New York sales tax form is used to report and remit sales tax collected by businesses in New York State.

How often do I need to file the New York sales tax form?

+The frequency of filing the New York sales tax form depends on your business's sales tax liability. You may need to file monthly, quarterly, or annually.

What happens if I file the New York sales tax form late?

+If you file the New York sales tax form late, you may be subject to penalties and fines. It's essential to file accurate and timely submissions to avoid these consequences.