Withdrawing from a 401(k) account can be a daunting task, especially when navigating the intricacies of financial institutions and their respective requirements. Bok Financial, a leading financial services company, offers a range of retirement plans, including 401(k) accounts. In this comprehensive guide, we will walk you through the Bok Financial 401(k) withdrawal form requirements, providing you with the necessary information to make informed decisions about your retirement savings.

Understanding 401(k) Withdrawal Rules

Before we dive into the specifics of the Bok Financial 401(k) withdrawal form, it's essential to understand the general rules governing 401(k) withdrawals. Typically, 401(k) accounts are designed for long-term savings, and withdrawals before age 59 1/2 may be subject to a 10% penalty, in addition to income tax. However, there are exceptions to this rule, such as separation from service, disability, or substantial equal periodic payments (SEPP).

Bok Financial 401(k) Withdrawal Form Requirements

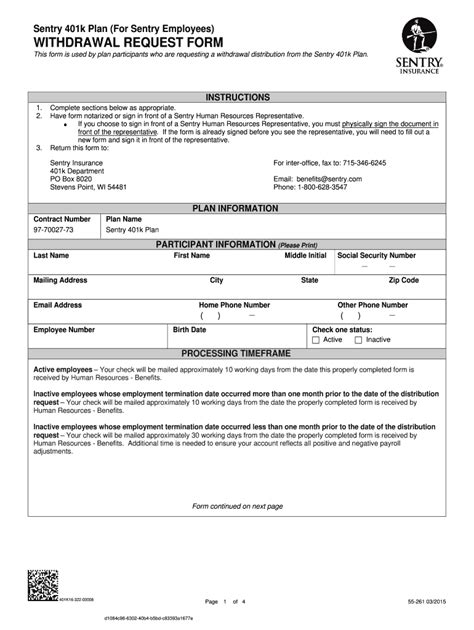

To initiate a withdrawal from your Bok Financial 401(k) account, you will need to complete the necessary forms and provide required documentation. Here are the steps to follow:

- Obtain the Withdrawal Form: You can download the Bok Financial 401(k) withdrawal form from their website or request a paper copy by contacting their customer service department.

- Complete the Form: Fill out the form accurately and thoroughly, providing all required information, including:

- Account holder information (name, address, date of birth, and Social Security number)

- Account details (account number, plan name, and type of withdrawal)

- Withdrawal amount and frequency (lump sum, periodic payments, or loan)

- Distribution reason (e.g., separation from service, disability, or SEPP)

- Gather Required Documents: Depending on the type of withdrawal, you may need to provide additional documentation, such as:

- Proof of age (for age-related withdrawals)

- Proof of disability (for disability-related withdrawals)

- Proof of separation from service (for employment-related withdrawals)

- Submit the Form and Documents: Mail or fax the completed form and supporting documents to the address or fax number listed on the form.

Types of Bok Financial 401(k) Withdrawals

Bok Financial offers various withdrawal options for 401(k) account holders. Here are some of the most common types of withdrawals:

- Lump Sum Withdrawal: A one-time withdrawal of a portion or all of your account balance.

- Periodic Payments: Regular payments from your account, either monthly, quarterly, or annually.

- Loan: Borrowing from your account, typically up to 50% of your account balance, with repayment terms.

Eligibility Requirements

To be eligible for a Bok Financial 401(k) withdrawal, you must meet certain requirements, including:

- Age: 59 1/2 or older (for age-related withdrawals)

- Separation from service: Termination of employment with the plan sponsor

- Disability: Meets the plan's definition of disability

- SEPP: Substantial equal periodic payments, typically over a period of five years or more

Bok Financial 401(k) Withdrawal Form FAQs

Here are some frequently asked questions about the Bok Financial 401(k) withdrawal form:

- Q: How long does it take to process a withdrawal request? A: Typically, 2-4 weeks, depending on the complexity of the request and the speed of documentation submission.

- Q: Can I withdraw from my account online? A: No, Bok Financial requires a paper form and supporting documentation for 401(k) withdrawals.

- Q: Are there any fees associated with withdrawals? A: Yes, Bok Financial may charge fees for withdrawals, loans, or other services. Review your plan documents or contact their customer service for more information.

What is the deadline for submitting a withdrawal request?

+There is no specific deadline for submitting a withdrawal request. However, Bok Financial recommends allowing at least 2-4 weeks for processing.

Can I withdraw from my account if I'm still employed with the plan sponsor?

+Typically, no. However, some plans may allow in-service withdrawals or loans. Review your plan documents or contact Bok Financial's customer service for more information.

How do I report a withdrawal on my taxes?

+Bok Financial will provide a Form 1099-R to report the withdrawal to the IRS. You will need to report the withdrawal on your tax return, using Form 1040.

In conclusion, withdrawing from your Bok Financial 401(k) account requires careful consideration and adherence to specific requirements. By understanding the rules and regulations governing 401(k) withdrawals, you can make informed decisions about your retirement savings. If you have any further questions or concerns, don't hesitate to reach out to Bok Financial's customer service department or consult with a financial advisor.

We invite you to share your thoughts and experiences with Bok Financial 401(k) withdrawals in the comments section below. If you found this guide helpful, please consider sharing it with others who may benefit from this information.