The Omma Ownership Disclosure Form is a crucial document that helps to maintain transparency and accountability in various industries, particularly in the realm of financial transactions and business operations. As a result, understanding the requirements and compliance guidelines for this form is essential for individuals and organizations that deal with financial activities.

The significance of the Omma Ownership Disclosure Form lies in its ability to provide stakeholders with a clear understanding of the ownership structure of a company or entity. This information is vital in preventing illicit activities, such as money laundering and terrorist financing, and ensuring that businesses operate with integrity. Moreover, the form helps to promote a culture of transparency and accountability, which is essential for building trust among investors, customers, and other stakeholders.

In this article, we will delve into the world of Omma Ownership Disclosure Form requirements and compliance guidelines. We will explore the purpose of the form, the information required, and the steps to ensure compliance. Additionally, we will discuss the benefits of compliance and the consequences of non-compliance.

Understanding the Omma Ownership Disclosure Form

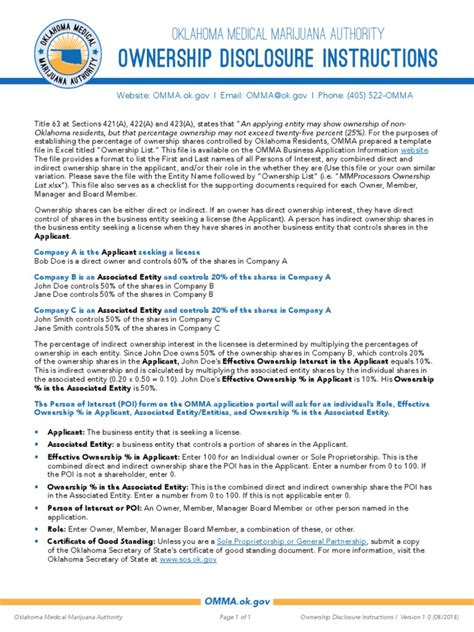

The Omma Ownership Disclosure Form is a document that requires individuals or entities to disclose their ownership interests in a company or business. The form is typically used in industries that are prone to financial crimes, such as banking, finance, and real estate. The information provided in the form helps to identify the ultimate beneficial owners of a company, which is essential for preventing illicit activities.

Purpose of the Omma Ownership Disclosure Form

The primary purpose of the Omma Ownership Disclosure Form is to provide transparency and accountability in business operations. By requiring individuals and entities to disclose their ownership interests, the form helps to:

- Prevent money laundering and terrorist financing

- Promote a culture of transparency and accountability

- Identify the ultimate beneficial owners of a company

- Ensure compliance with regulatory requirements

Information Required in the Omma Ownership Disclosure Form

The Omma Ownership Disclosure Form requires individuals and entities to provide specific information about their ownership interests. The information required may vary depending on the jurisdiction and the type of business, but generally includes:

- Name and address of the individual or entity

- Type of ownership interest (e.g., shares, partnership, etc.)

- Percentage of ownership interest

- Date of acquisition of ownership interest

- Identity of the ultimate beneficial owner (if different from the reporting individual or entity)

Steps to Ensure Compliance

To ensure compliance with the Omma Ownership Disclosure Form requirements, individuals and entities should follow these steps:

- Review the regulatory requirements: Familiarize yourself with the regulatory requirements for the Omma Ownership Disclosure Form in your jurisdiction.

- Gather required information: Collect the necessary information about your ownership interests, including the name and address of the individual or entity, type of ownership interest, percentage of ownership interest, and date of acquisition.

- Complete the form: Fill out the Omma Ownership Disclosure Form accurately and completely, using the information gathered in step 2.

- Submit the form: Submit the completed form to the relevant regulatory authority or business partner, as required.

Benefits of Compliance

Compliance with the Omma Ownership Disclosure Form requirements offers several benefits, including:

- Reduced risk of financial crimes: By providing transparency and accountability, compliance with the form helps to prevent money laundering and terrorist financing.

- Improved reputation: Compliance with regulatory requirements enhances an organization's reputation and credibility.

- Increased trust: Transparency and accountability promote trust among stakeholders, including investors, customers, and business partners.

- Avoidance of penalties: Compliance with the form requirements helps to avoid penalties and fines associated with non-compliance.

Consequences of Non-Compliance

Non-compliance with the Omma Ownership Disclosure Form requirements can have severe consequences, including:

- Penalties and fines: Regulatory authorities may impose penalties and fines on individuals and entities that fail to comply with the form requirements.

- Reputation damage: Non-compliance can damage an organization's reputation and credibility.

- Loss of business: Non-compliance can lead to loss of business and revenue, as stakeholders may view the organization as untrustworthy.

- Regulatory action: Regulatory authorities may take action against non-compliant individuals and entities, including suspension or revocation of licenses.

Conclusion

The Omma Ownership Disclosure Form is a critical document that promotes transparency and accountability in business operations. Compliance with the form requirements is essential for preventing financial crimes, promoting a culture of transparency, and ensuring regulatory compliance. By understanding the requirements and compliance guidelines, individuals and entities can avoid the consequences of non-compliance and reap the benefits of compliance.

We encourage you to share your thoughts and experiences with the Omma Ownership Disclosure Form in the comments section below. Have you encountered any challenges or benefits in complying with the form requirements? Your input can help others navigate the complexities of regulatory compliance.

FAQ Section:

What is the purpose of the Omma Ownership Disclosure Form?

+The primary purpose of the Omma Ownership Disclosure Form is to provide transparency and accountability in business operations, particularly in industries prone to financial crimes.

What information is required in the Omma Ownership Disclosure Form?

+The form requires individuals and entities to provide specific information about their ownership interests, including name and address, type of ownership interest, percentage of ownership interest, and date of acquisition.

What are the consequences of non-compliance with the Omma Ownership Disclosure Form requirements?

+Non-compliance can lead to penalties and fines, reputation damage, loss of business, and regulatory action, including suspension or revocation of licenses.