Filing taxes can be a daunting task, especially for those who are new to the process or are unsure about the requirements. In California, residents are required to file their state income taxes using Form 540 2EZ, which can be overwhelming due to its complexity. However, with the right guidance and tools, you can simplify the process and make it more manageable. In this article, we will explore 7 ways to simplify CA Form 540 2EZ filing, making it easier for you to navigate and complete your taxes.

Understanding CA Form 540 2EZ

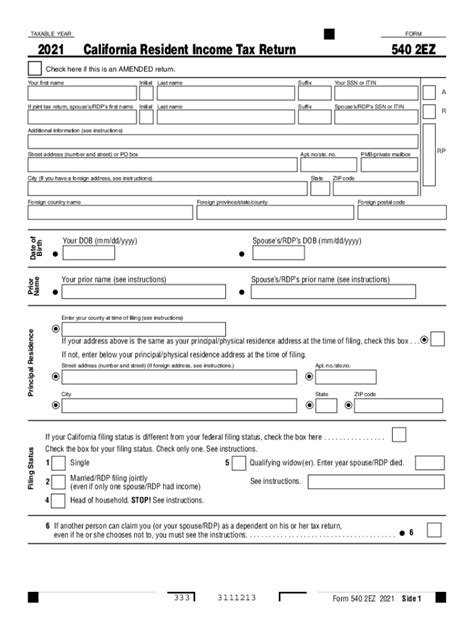

Before we dive into the tips, it's essential to understand what CA Form 540 2EZ is and what it's used for. CA Form 540 2EZ is a simplified income tax return form designed for California residents who have a straightforward tax situation. It's intended for individuals who have only one source of income, such as a job, and don't have any dependents or complex tax situations. If you fit this description, using Form 540 2EZ can save you time and effort when filing your taxes.

1. Gather All Necessary Documents

The first step to simplifying CA Form 540 2EZ filing is to gather all the necessary documents. This includes:

- Your W-2 form(s) from your employer(s)

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- Your dependents' Social Security numbers or ITINs (if applicable)

- Any other relevant tax-related documents, such as 1099 forms or receipts for deductions

Having all the required documents in one place will make it easier to fill out the form and reduce the likelihood of errors.

2. Use Tax Preparation Software

Using tax preparation software can significantly simplify the CA Form 540 2EZ filing process. These programs, such as TurboTax or H&R Block, guide you through the process, ensure accuracy, and help you identify deductions and credits you may be eligible for. Many tax preparation software programs also offer free filing options for simple returns, which can save you money.

3. Take Advantage of the CA Franchise Tax Board's Resources

The California Franchise Tax Board (FTB) offers a range of resources to help you simplify the CA Form 540 2EZ filing process. These include:

- The FTB's website, which provides detailed instructions and FAQs

- The FTB's phone support, which can answer questions and provide guidance

- The FTB's online chat support, which can help you with specific issues

Taking advantage of these resources can help you navigate the process and ensure you're taking advantage of all the deductions and credits you're eligible for.

4. Use the CA Form 540 2EZ Instructions

The CA Form 540 2EZ instructions are a valuable resource that can help you understand the form and ensure you're filling it out correctly. The instructions provide detailed explanations of each section, as well as examples to help you understand how to complete the form.

5. File Electronically

Filing electronically can simplify the CA Form 540 2EZ filing process and reduce the likelihood of errors. Electronic filing also allows you to receive your refund faster, as it's typically processed within a few days. To file electronically, you'll need to use tax preparation software or the FTB's online filing system.

6. Avoid Common Mistakes

Common mistakes can delay the processing of your return and even result in penalties. Some common mistakes to avoid when filing CA Form 540 2EZ include:

- Incorrect Social Security numbers or ITINs

- Missing or incomplete information

- Math errors

- Failing to sign the form

Taking the time to review your return carefully can help you avoid these mistakes and ensure your return is processed smoothly.

7. Seek Professional Help if Needed

If you're unsure about any aspect of the CA Form 540 2EZ filing process, don't hesitate to seek professional help. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), can provide guidance and ensure you're taking advantage of all the deductions and credits you're eligible for.

Getting Started

Simplifying the CA Form 540 2EZ filing process requires some effort and planning, but it's worth it to ensure you're taking advantage of all the deductions and credits you're eligible for. By gathering all necessary documents, using tax preparation software, and taking advantage of the FTB's resources, you can make the process easier and less overwhelming.

Remember, if you're unsure about any aspect of the process, don't hesitate to seek professional help. With the right guidance and tools, you can simplify the CA Form 540 2EZ filing process and make tax season less stressful.

Share Your Thoughts

We'd love to hear from you! Have you filed CA Form 540 2EZ in the past? What challenges did you face, and how did you overcome them? Share your thoughts and experiences in the comments below.

What is CA Form 540 2EZ?

+CA Form 540 2EZ is a simplified income tax return form designed for California residents who have a straightforward tax situation.

Who can use CA Form 540 2EZ?

+CA Form 540 2EZ is intended for individuals who have only one source of income, such as a job, and don't have any dependents or complex tax situations.

How can I simplify the CA Form 540 2EZ filing process?

+You can simplify the CA Form 540 2EZ filing process by gathering all necessary documents, using tax preparation software, and taking advantage of the FTB's resources.