Are you a business owner or non-profit organization in Michigan looking to save on sales tax? If so, you may be eligible for a sales tax exemption. The Michigan Sales Tax Exemption Form, also known as the Michigan Sales and Use Tax Certificate of Exemption, is a document that allows certain businesses and organizations to purchase goods and services without paying sales tax. In this article, we will provide a step-by-step guide on how to fill out the Mi Sales Tax Exemption Form, including the eligibility requirements, necessary documentation, and tips for successful submission.

Eligibility Requirements

To qualify for a sales tax exemption in Michigan, your business or organization must meet certain requirements. These include:

- Being a non-profit organization, such as a charity or church

- Being a government agency or entity

- Being a qualified business, such as a manufacturer or agricultural producer

- Being a qualified organization, such as a school or hospital

Non-Profit Organizations

Non-profit organizations, such as charities and churches, are eligible for a sales tax exemption in Michigan. To qualify, your organization must be recognized as a 501(c)(3) organization by the Internal Revenue Service (IRS). You will need to provide your organization's IRS determination letter and a copy of your articles of incorporation.

Necessary Documentation

To complete the Mi Sales Tax Exemption Form, you will need to provide certain documentation. This includes:

- Your business or organization's name and address

- Your business or organization's Federal Tax ID Number (FEIN)

- A description of the goods or services being purchased

- The total cost of the goods or services being purchased

- A signature from an authorized representative of your business or organization

Step-By-Step Guide to Filling Out the Mi Sales Tax Exemption Form

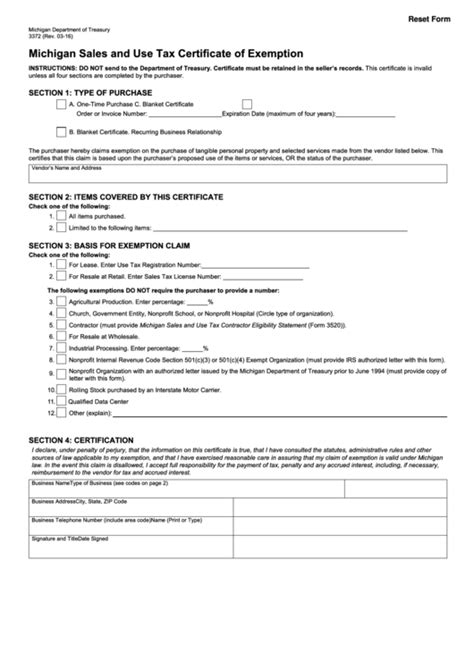

Filling out the Mi Sales Tax Exemption Form is a straightforward process. Here's a step-by-step guide to help you complete the form successfully:

- Section 1: Exemption Certificate Number

- If you have previously been assigned an exemption certificate number, enter it in this section. Otherwise, leave it blank.

- Section 2: Purchaser's Information

- Enter your business or organization's name and address.

- Enter your business or organization's FEIN.

- Section 3: Purchaser's Exemption Reason

- Select the reason for your exemption from the drop-down menu.

- Provide additional information, if required.

- Section 4: Goods or Services Being Purchased

- Describe the goods or services being purchased.

- Enter the total cost of the goods or services being purchased.

- Section 5: Authorized Representative's Signature

- Sign and date the form.

Tips for Successful Submission

To ensure successful submission of your Mi Sales Tax Exemption Form, follow these tips:

- Double-check your information: Make sure all information is accurate and complete.

- Use the correct form: Use the latest version of the Mi Sales Tax Exemption Form.

- Provide necessary documentation: Attach all required documentation, including your organization's IRS determination letter and articles of incorporation.

- Submit the form on time: Submit the form to the Michigan Department of Treasury within the required timeframe.

Common Mistakes to Avoid

When filling out the Mi Sales Tax Exemption Form, avoid these common mistakes:

- Incomplete information: Make sure all required fields are completed.

- Incorrect form: Use the latest version of the form.

- Missing documentation: Attach all required documentation.

Conclusion

The Mi Sales Tax Exemption Form is a valuable tool for businesses and organizations in Michigan to save on sales tax. By following the step-by-step guide outlined in this article and avoiding common mistakes, you can successfully complete the form and enjoy the benefits of a sales tax exemption.

We hope this article has been helpful in guiding you through the process of filling out the Mi Sales Tax Exemption Form. If you have any further questions or concerns, please don't hesitate to reach out.

Share Your Thoughts

Have you successfully completed the Mi Sales Tax Exemption Form? Share your experiences and tips in the comments section below.

Stay Informed

Stay up-to-date with the latest news and updates on sales tax exemptions in Michigan by following our blog.

What is the purpose of the Mi Sales Tax Exemption Form?

+The purpose of the Mi Sales Tax Exemption Form is to allow certain businesses and organizations to purchase goods and services without paying sales tax.

Who is eligible for a sales tax exemption in Michigan?

+Non-profit organizations, government agencies, qualified businesses, and qualified organizations are eligible for a sales tax exemption in Michigan.

What documentation is required to complete the Mi Sales Tax Exemption Form?

+Your business or organization's name and address, FEIN, a description of the goods or services being purchased, and the total cost of the goods or services being purchased are required to complete the form.