As the tax filing season approaches, many individuals in North Carolina are preparing to submit their state income tax returns. For those who owe taxes, it's essential to understand the process of making a payment to the North Carolina Department of Revenue. One crucial document in this process is the NC Form D-400V, also known as the Payment Voucher for Individual Income Tax.

In this article, we'll delve into the details of the NC Form D-400V, explaining its purpose, who needs to use it, and how to fill it out correctly. We'll also provide guidance on making payments and address some frequently asked questions.

What is the NC Form D-400V?

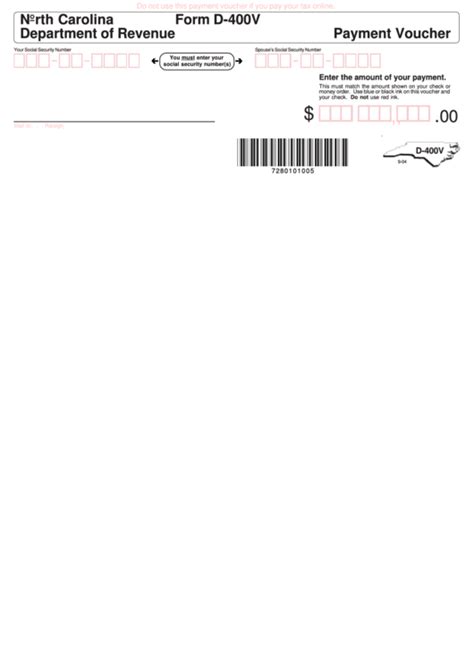

The NC Form D-400V is a payment voucher that individuals use to make a payment for their North Carolina state income taxes. It's a critical document that ensures your payment is processed correctly and applied to your tax account. The form is typically used when you owe taxes and are making a payment by mail or electronically.

Who Needs to Use the NC Form D-400V?

You'll need to use the NC Form D-400V if you're making a payment for your North Carolina state income taxes and:

- You're filing your tax return by mail

- You're making a payment online or by phone

- You're submitting a payment with your tax return

If you're e-filing your tax return and making a payment through the North Carolina Department of Revenue's website, you may not need to use the NC Form D-400V. However, it's always best to check with the department or a tax professional to confirm.

How to Fill Out the NC Form D-400V

Filling out the NC Form D-400V is a straightforward process. Here's a step-by-step guide to help you complete the form correctly:

- Taxpayer Information: Enter your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Tax Year: Enter the tax year for which you're making the payment.

- Payment Amount: Enter the amount you're paying.

- Payment Method: Select the payment method you're using (e.g., check, money order, or electronic payment).

- Sign and Date: Sign and date the form.

Making Payments with the NC Form D-400V

Once you've completed the NC Form D-400V, you can make a payment using one of the following methods:

- Mail: Send the form with a check or money order to the address listed on the form.

- Online: Make a payment through the North Carolina Department of Revenue's website.

- Phone: Call the department's payment hotline to make a payment over the phone.

Electronic Payment Options

The North Carolina Department of Revenue offers several electronic payment options, including:

- eCheck: Pay directly from your checking or savings account.

- Credit or Debit Card: Pay using a credit or debit card.

- Electronic Funds Withdrawal: Authorize the department to withdraw the payment from your bank account.

Frequently Asked Questions

Here are some frequently asked questions about the NC Form D-400V:

- Q: Can I use the NC Form D-400V to make a payment for a different tax year? A: No, you can only use the NC Form D-400V to make a payment for the current tax year or a prior tax year that's still open.

- Q: Can I make a payment online without using the NC Form D-400V? A: Yes, you can make a payment online through the North Carolina Department of Revenue's website without using the NC Form D-400V.

- Q: What happens if I don't use the NC Form D-400V to make a payment? A: If you don't use the NC Form D-400V to make a payment, your payment may not be processed correctly, and you may incur additional penalties and interest.

What is the deadline for making a payment with the NC Form D-400V?

+The deadline for making a payment with the NC Form D-400V is typically April 15th for individual income taxes. However, this deadline may vary depending on the tax year and type of tax.

Can I use the NC Form D-400V to make a payment for a business tax return?

+No, the NC Form D-400V is only used for individual income tax payments. Businesses must use a different form to make tax payments.

What happens if I lose or misplace the NC Form D-400V?

+If you lose or misplace the NC Form D-400V, you can download a new copy from the North Carolina Department of Revenue's website or contact the department's customer service for assistance.

By following the guidance outlined in this article, you'll be able to complete the NC Form D-400V correctly and make a payment for your North Carolina state income taxes. Remember to always check with the North Carolina Department of Revenue or a tax professional if you have any questions or concerns about the payment process.

Share your thoughts and experiences with making payments using the NC Form D-400V in the comments below.