Puerto Rico, known for its beautiful beaches, vibrant culture, and complex tax system. As a business owner or individual with financial obligations in Puerto Rico, you're likely familiar with the various forms and requirements that come with filing taxes on the island. One such form is the Puerto Rico Form 480.6A, which can be a bit overwhelming, especially for those who are new to the process. In this article, we'll break down the essential tips you need to know to navigate Puerto Rico Form 480.6A with confidence.

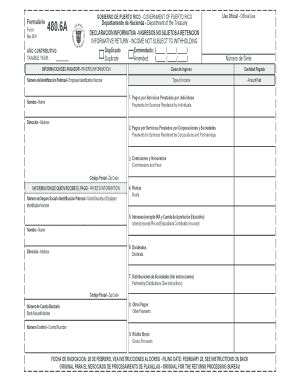

First and foremost, it's essential to understand what Puerto Rico Form 480.6A is and why it's necessary. This form is used to report income and pay taxes on income earned in Puerto Rico. It's a critical document for individuals and businesses with financial obligations on the island, and accuracy is crucial to avoid penalties and fines.

Tip 1: Understand the Filing Requirements

Before diving into the form, it's crucial to understand who needs to file and what the filing requirements are. Puerto Rico Form 480.6A is required for individuals and businesses with income earned in Puerto Rico. This includes residents, non-residents, and foreign entities with a presence on the island. The filing deadline is typically April 15th, but this can vary depending on the specific circumstances.

Who Needs to File?

- Individuals with income earned in Puerto Rico

- Businesses with income earned in Puerto Rico

- Non-residents with income earned in Puerto Rico

- Foreign entities with a presence in Puerto Rico

Tip 2: Gather Required Documents

To accurately complete Puerto Rico Form 480.6A, you'll need to gather specific documents and information. This includes:

- Identification number (Social Security number or Employer Identification Number)

- Gross income earned in Puerto Rico

- Deductions and exemptions

- Supporting documentation (W-2s, 1099s, etc.)

Required Documents:

- Identification number

- Gross income earned in Puerto Rico

- Deductions and exemptions

- Supporting documentation (W-2s, 1099s, etc.)

Tip 3: Calculate Gross Income

Calculating gross income is a critical step in completing Puerto Rico Form 480.6A. This includes income from all sources, including wages, salaries, tips, and self-employment income. You'll need to report this income accurately to avoid penalties and fines.

Types of Income:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividend income

- Rental income

Tip 4: Claim Deductions and Exemptions

Deductions and exemptions can significantly reduce your tax liability. It's essential to understand what deductions and exemptions you're eligible for and claim them accurately on Puerto Rico Form 480.6A.

Common Deductions and Exemptions:

- Standard deduction

- Itemized deductions

- Personal exemptions

- Business deductions

Tip 5: Seek Professional Help

Navigating Puerto Rico Form 480.6A can be complex, especially for those who are new to the process. Seeking professional help from a tax professional or accountant can ensure accuracy and avoid costly mistakes.

Benefits of Professional Help:

- Accuracy and attention to detail

- Expert knowledge of tax laws and regulations

- Time-saving and reduced stress

- Maximizing deductions and exemptions

In conclusion, navigating Puerto Rico Form 480.6A requires attention to detail, accuracy, and a solid understanding of the filing requirements and tax laws. By following these essential tips, you'll be well on your way to completing the form with confidence. Remember to seek professional help if needed, and don't hesitate to reach out to the Puerto Rico tax authority with any questions or concerns.

Who needs to file Puerto Rico Form 480.6A?

+Individuals and businesses with income earned in Puerto Rico, including residents, non-residents, and foreign entities with a presence on the island.

What is the filing deadline for Puerto Rico Form 480.6A?

+The filing deadline is typically April 15th, but this can vary depending on the specific circumstances.

What are the required documents for Puerto Rico Form 480.6A?

+Identification number, gross income earned in Puerto Rico, deductions and exemptions, and supporting documentation (W-2s, 1099s, etc.).