Filing taxes can be a daunting task, especially for businesses and organizations that need to dissolve or liquidate their assets. One crucial step in this process is submitting Form 966, also known as the Corporate Dissolution or Liquidation. In this article, we will delve into the world of IRS Form 966 instructions and filing requirements, providing you with a comprehensive guide to navigate this complex process.

Why is Form 966 necessary?

When a corporation decides to dissolve or liquidate its assets, it must notify the Internal Revenue Service (IRS) of this change. Form 966 serves as a formal declaration of the corporation's intention to dissolve or liquidate, providing the IRS with essential information about the company's assets, liabilities, and tax obligations. This information is crucial for the IRS to determine the correct tax treatment of the dissolved or liquidated corporation.

Who needs to file Form 966?

Form 966 is required for corporations that are:

- Dissolving or liquidating their assets.

- Merging with another corporation.

- Converting to a different type of entity, such as a partnership or sole proprietorship.

When to file Form 966?

The filing deadline for Form 966 is typically within 30 days of the corporation's dissolution or liquidation date. However, this deadline may vary depending on the specific circumstances of the corporation's dissolution or liquidation.

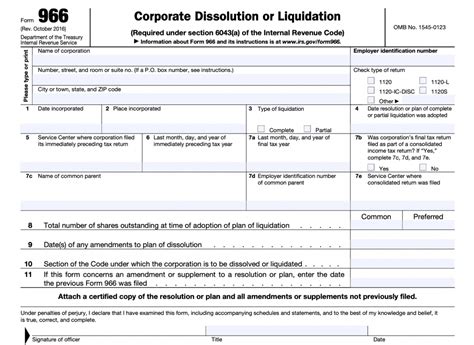

What information is required on Form 966?

Form 966 requires the following information:

- Corporate Information: The corporation's name, address, and Employer Identification Number (EIN).

- Date of Dissolution or Liquidation: The date on which the corporation dissolved or liquidated its assets.

- Reason for Dissolution or Liquidation: A brief explanation of the reason for the corporation's dissolution or liquidation.

- Asset and Liability Information: A detailed list of the corporation's assets and liabilities, including their fair market values.

- Tax Obligations: Information about the corporation's tax obligations, including any outstanding tax liabilities or refunds due.

How to file Form 966?

Form 966 can be filed electronically or by mail. The IRS recommends electronic filing, as it reduces errors and speeds up processing times.

Electronic Filing:

- Create an account on the IRS Electronic Account Resolution (EAR) system.

- Complete Form 966 online, ensuring all required information is accurate and complete.

- Submit the form electronically.

Mail Filing:

- Download and complete Form 966 from the IRS website or request a copy by mail.

- Attach all required supporting documentation, such as financial statements and tax returns.

- Mail the completed form to the IRS address listed in the instructions.

Consequences of Not Filing Form 966

Failure to file Form 966 can result in:

- Penalties and Fines: The IRS may impose penalties and fines for late or non-filing.

- Tax Liabilities: The corporation may remain liable for taxes, even after dissolution or liquidation.

- Loss of Tax Benefits: The corporation may forfeit tax benefits, such as losses or credits, if Form 966 is not filed correctly.

Frequently Asked Questions

Here are some frequently asked questions about Form 966:

Frequently Asked Questions

What is the deadline for filing Form 966?

The filing deadline for Form 966 is typically within 30 days of the corporation's dissolution or liquidation date. However, this deadline may vary depending on the specific circumstances of the corporation's dissolution or liquidation.

Can I file Form 966 electronically?

Yes, Form 966 can be filed electronically through the IRS Electronic Account Resolution (EAR) system.

What happens if I don't file Form 966?

Failure to file Form 966 can result in penalties, fines, and loss of tax benefits.

Can I file Form 966 by mail?

Yes, Form 966 can be filed by mail. However, the IRS recommends electronic filing to reduce errors and speed up processing times.

What is the purpose of Form 966?

+Form 966 is used to notify the IRS of a corporation's intention to dissolve or liquidate its assets.

Who needs to file Form 966?

+Corporations that are dissolving or liquidating their assets, merging with another corporation, or converting to a different type of entity.

What information is required on Form 966?

+Corporate information, date of dissolution or liquidation, reason for dissolution or liquidation, asset and liability information, and tax obligations.

In conclusion, filing Form 966 is a crucial step in the process of dissolving or liquidating a corporation's assets. By understanding the instructions and filing requirements, corporations can ensure a smooth transition and avoid potential penalties and fines. Remember to file Form 966 electronically or by mail, and don't hesitate to seek professional help if you're unsure about any aspect of the process.

Share your thoughts and experiences with us! Have you filed Form 966 before? What challenges did you face, and how did you overcome them? Share your story in the comments below, and help others navigate the complex world of corporate dissolution and liquidation.