The world of taxes can be a daunting and complex place, especially for those who are not familiar with the various forms and regulations. One such form is the Form 8804, also known as the "Annual Return for Partnership Withholding Tax." This form is used by partnerships to report their withholding tax liability on foreign partners' share of effectively connected income. In this article, we will guide you through the 5 essential steps to complete Form 8804 accurately and efficiently.

Step 1: Gather Necessary Information and Documents

Before starting to fill out Form 8804, it's essential to gather all the necessary information and documents. This includes:

- Partnership's name, address, and employer identification number (EIN)

- Tax year and accounting period

- Names, addresses, and taxpayer identification numbers (TINs) of all foreign partners

- Effectively connected income (ECI) allocated to each foreign partner

- Withholding tax liability on ECI

- Any withholding tax credits or overpayments

Having all this information readily available will make the process of completing the form much smoother.

What is Effectively Connected Income (ECI)?

Effectively connected income (ECI) refers to the income of a foreign partner that is effectively connected with the conduct of a trade or business in the United States. This includes income from:

- Sales or exchange of goods or services

- Rent or royalties from real or personal property

- Interest or dividends from stocks or bonds

- Gain or loss from the sale or exchange of property

Step 2: Determine the Withholding Tax Liability

The next step is to determine the withholding tax liability on the foreign partners' share of ECI. This is done by applying the withholding tax rate to the ECI allocated to each foreign partner. The withholding tax rate is typically 21% for corporations and 37% for individuals.

How to Calculate Withholding Tax Liability

To calculate the withholding tax liability, follow these steps:

- Determine the ECI allocated to each foreign partner

- Apply the withholding tax rate to the ECI

- Calculate the withholding tax liability for each foreign partner

- Add up the withholding tax liability for all foreign partners

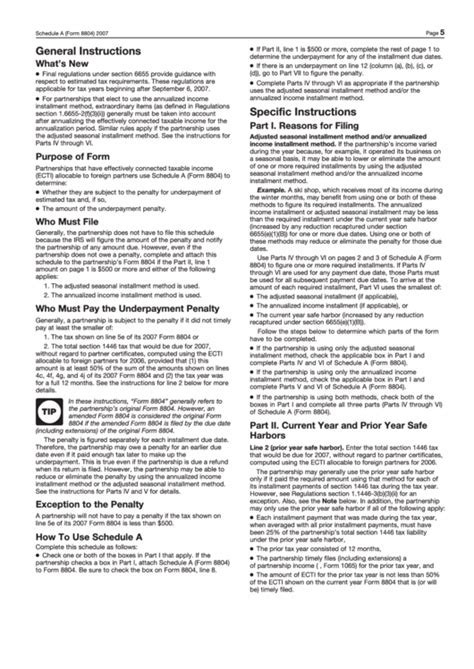

Step 3: Complete Form 8804

Now that you have gathered all the necessary information and calculated the withholding tax liability, it's time to complete Form 8804.

The form consists of several parts, including:

- Part I: Partnership Information

- Part II: Foreign Partner Information

- Part III: Effectively Connected Income (ECI) and Withholding Tax Liability

- Part IV: Withholding Tax Credits and Overpayments

What to Include in Each Part

- Part I: Include the partnership's name, address, EIN, tax year, and accounting period

- Part II: List the names, addresses, and TINs of all foreign partners

- Part III: Report the ECI allocated to each foreign partner and the withholding tax liability

- Part IV: Claim any withholding tax credits or overpayments

Step 4: Attach Supporting Schedules and Statements

In addition to completing Form 8804, you may need to attach supporting schedules and statements. These may include:

- Schedule K-1: Partner's Share of Income, Deductions, Credits, etc.

- Form 8805: Foreign Partner's Information Statement of Section 1446 Withholding Tax

- Form 8288: U.S. Withholding Tax Return for Certain Real Property Transactions

What to Include in Supporting Schedules and Statements

- Schedule K-1: Report each partner's share of income, deductions, credits, etc.

- Form 8805: Provide information about the foreign partner's withholding tax liability

- Form 8288: Report certain real property transactions and withholding tax liability

Step 5: File Form 8804 and Supporting Schedules

Finally, it's time to file Form 8804 and any supporting schedules and statements.

The form and supporting schedules must be filed by the 15th day of the 4th month after the partnership's tax year ends.

Where to File Form 8804

File Form 8804 and supporting schedules with the Internal Revenue Service (IRS) at the following address:

Internal Revenue Service Center for processing Ogden, UT 84409

By following these 5 essential steps, you can ensure that you complete Form 8804 accurately and efficiently. Remember to gather all necessary information and documents, determine the withholding tax liability, complete the form, attach supporting schedules and statements, and file the form and supporting schedules on time.

What is Form 8804 used for?

+Form 8804 is used by partnerships to report their withholding tax liability on foreign partners' share of effectively connected income.

What is effectively connected income (ECI)?

+Effectively connected income (ECI) refers to the income of a foreign partner that is effectively connected with the conduct of a trade or business in the United States.

What is the withholding tax rate for foreign partners?

+The withholding tax rate is typically 21% for corporations and 37% for individuals.