The California tax system can be complex and overwhelming, especially for those who are new to the state or have never had to file taxes before. One form that can be particularly confusing is Form 592-F, also known as the "Resident and Nonresident Withholding Statement". In this article, we will break down what Form 592-F is, who needs to file it, and how to complete it.

What is Form 592-F?

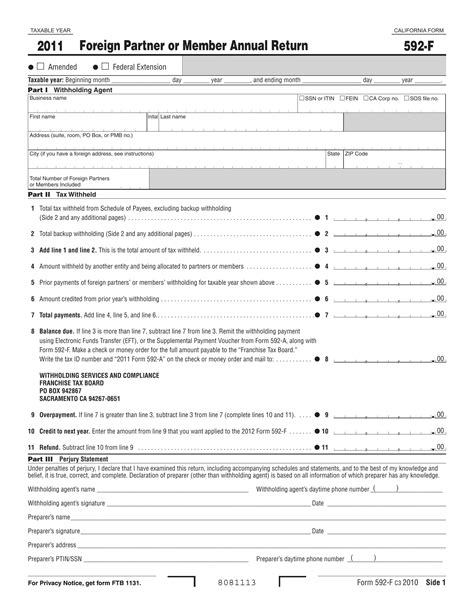

Form 592-F is a tax form used by the California Franchise Tax Board (FTB) to report withholding on California source income for residents and nonresidents. The form is used to report withholding on various types of income, including wages, pensions, and interest. It is typically filed by employers, payers, and withholding agents who have withheld taxes on behalf of California residents and nonresidents.

Who Needs to File Form 592-F?

Form 592-F is required to be filed by anyone who has withheld taxes on behalf of a California resident or nonresident. This includes:

- Employers who have withheld state income taxes from employee wages

- Payroll service providers who have withheld state income taxes on behalf of clients

- Payers of pensions, annuities, and other retirement income

- Withholding agents who have withheld taxes on behalf of nonresidents

When is Form 592-F Due?

The due date for filing Form 592-F varies depending on the type of withholding and the taxpayer's filing status. Generally, the form is due on the last day of the month following the quarter in which the withholding occurred. For example, if the withholding occurred in the first quarter (January 1 - March 31), the form is due on April 30.

Quarterly Filing Schedule

- First quarter (January 1 - March 31): April 30

- Second quarter (April 1 - June 30): July 31

- Third quarter (July 1 - September 30): October 31

- Fourth quarter (October 1 - December 31): January 31

How to Complete Form 592-F

Completing Form 592-F requires careful attention to detail and accurate reporting of withholding information. Here are the steps to follow:

- Gather required information: Collect all necessary information, including the taxpayer's name, address, and taxpayer identification number (TIN), as well as the withholding amount and type.

- Complete the header section: Fill in the header section with the taxpayer's information, including the name, address, and TIN.

- Report withholding amounts: Report the withholding amounts for each type of income, including wages, pensions, and interest.

- Complete the certification section: Sign and date the form, certifying that the information reported is accurate and complete.

Penalties for Late or Inaccurate Filing

Failure to file Form 592-F on time or accurately can result in penalties and interest. The FTB may impose penalties for:

- Late filing: 5% of the withholding amount per month, up to a maximum of 25%

- Inaccurate filing: 5% of the withholding amount per month, up to a maximum of 25%

- Failure to file: 10% of the withholding amount per month, up to a maximum of 50%

Tips for Filing Form 592-F

- File electronically: The FTB recommends filing Form 592-F electronically to reduce errors and improve processing time.

- Use the correct form: Ensure you are using the correct form for the tax year and type of withholding.

- Keep accurate records: Maintain accurate records of withholding amounts and types to ensure accurate reporting.

- Consult a tax professional: If you are unsure about completing Form 592-F, consider consulting a tax professional.

Conclusion

Filing Form 592-F can be a complex and time-consuming process, but it is essential for complying with California tax laws. By understanding who needs to file, when it is due, and how to complete it, you can ensure accurate and timely filing. Remember to file electronically, use the correct form, keep accurate records, and consult a tax professional if needed.

We hope this article has provided you with a comprehensive understanding of Form 592-F and its requirements. If you have any questions or need further clarification, please don't hesitate to ask.

Share your thoughts and experiences with filing Form 592-F in the comments below!

Who is required to file Form 592-F?

+Form 592-F is required to be filed by anyone who has withheld taxes on behalf of a California resident or nonresident, including employers, payroll service providers, payers of pensions and annuities, and withholding agents.

What is the due date for filing Form 592-F?

+The due date for filing Form 592-F varies depending on the type of withholding and the taxpayer's filing status. Generally, the form is due on the last day of the month following the quarter in which the withholding occurred.

What are the penalties for late or inaccurate filing of Form 592-F?

+The FTB may impose penalties for late filing, inaccurate filing, and failure to file, ranging from 5% to 50% of the withholding amount per month.