Kentucky residents, get ready to tackle your state taxes! Filing your taxes can be a daunting task, but with the right guidance, you'll be done in no time. In this article, we'll break down the Kentucky Form K-3, also known as the Kentucky Individual Income Tax Return, and provide a step-by-step guide on how to file your state taxes.

Understanding the Kentucky Form K-3

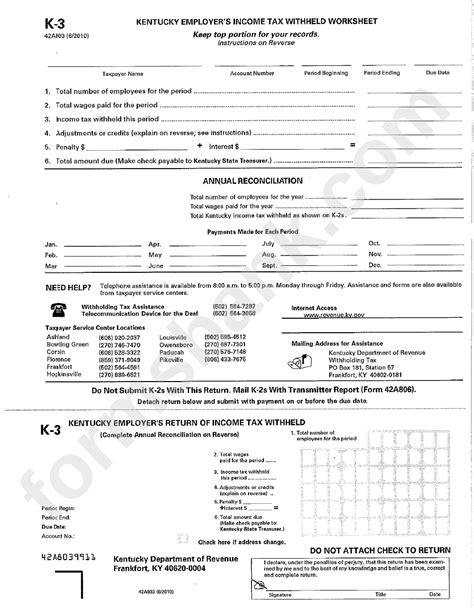

The Kentucky Form K-3 is the official state tax return form for individuals residing in Kentucky. It's used to report income, claim deductions and credits, and pay any taxes owed to the state. The form is relatively straightforward, but it's essential to understand the different sections and requirements to ensure accurate filing.

Who Needs to File a Kentucky Form K-3?

If you're a Kentucky resident, you're required to file a state tax return if your gross income meets or exceeds certain thresholds. For the 2022 tax year, these thresholds are:

- Single filers: $12,000 or more

- Joint filers: $24,000 or more

- Head of household: $18,000 or more

- Qualifying widow(er): $24,000 or more

Even if you don't meet these thresholds, you may still need to file a return if you have taxes withheld from any of the following sources:

- Wages

- Retirement accounts

- Unemployment benefits

- Social Security benefits

Gathering Required Documents

Before starting your Kentucky Form K-3, gather all necessary documents to ensure a smooth filing process. These may include:

- W-2 forms from your employer(s)

- 1099 forms for freelance work, self-employment, or other income

- Interest statements from banks and financial institutions

- Dividend statements from investments

- Charitable donation receipts

- Medical expense receipts

- Child care expense receipts

Completing the Kentucky Form K-3

Now that you have all your documents, it's time to start filling out the Kentucky Form K-3. The form is divided into several sections, each covering a specific aspect of your tax return.

Section 1: Personal Information

Start by filling in your personal information, including your name, address, and Social Security number. Make sure to include your spouse's information if filing jointly.

Section 2: Income

Report your income from all sources, including wages, self-employment, and investments. You'll need to calculate your total income and enter it on Line 1.

Section 3: Adjustments and Deductions

Claim any eligible deductions and adjustments, such as charitable donations, medical expenses, and child care expenses. You'll need to calculate your total deductions and enter it on Line 2.

Section 4: Tax Credits

Claim any tax credits you're eligible for, such as the Kentucky Earned Income Tax Credit (EITC) or the Kentucky Child Tax Credit. Enter the total amount of credits on Line 3.

Section 5: Tax Liability

Calculate your total tax liability by subtracting your deductions and credits from your total income. Enter the result on Line 4.

E-Filing and Mailing Your Return

Once you've completed your Kentucky Form K-3, you can either e-file or mail your return to the Kentucky Department of Revenue. E-filing is the recommended method, as it's faster and more accurate. You can e-file through the Kentucky Department of Revenue's website or through a third-party tax preparation software.

If you choose to mail your return, make sure to sign and date it, and include any required supporting documentation. Mail your return to the address listed on the Kentucky Department of Revenue's website.

Payment Options

If you owe taxes, you can pay online, by phone, or by mail. You can also set up a payment plan if you're unable to pay the full amount at once.

Avoiding Common Mistakes

To avoid any issues with your return, make sure to:

- Double-check your math calculations

- Ensure all required documentation is included

- Sign and date your return

- File on time to avoid penalties and interest

Conclusion

Filing your Kentucky state taxes doesn't have to be a daunting task. By understanding the Kentucky Form K-3 and following the steps outlined in this guide, you'll be able to accurately file your return and avoid any potential issues. Remember to gather all required documents, complete the form carefully, and e-file or mail your return on time.

What is the deadline for filing my Kentucky state taxes?

+The deadline for filing your Kentucky state taxes is April 15th of each year.

Can I e-file my Kentucky state taxes?

+Yes, you can e-file your Kentucky state taxes through the Kentucky Department of Revenue's website or through a third-party tax preparation software.

What if I owe taxes and can't pay the full amount?

+You can set up a payment plan with the Kentucky Department of Revenue to make monthly payments towards your tax debt.