Understanding the Importance of Form 1155 for Domicile Verification

Domicile verification is a crucial process for individuals who wish to establish residency in a particular state or country. It involves providing proof of one's permanent home or residence, which can have significant implications for taxation, voting, and other legal purposes. One of the key documents required for domicile verification is Form 1155, which is used by the Internal Revenue Service (IRS) to determine an individual's residency status. In this article, we will explore five ways to complete Form 1155 for domicile verification.

Why is Form 1155 important for domicile verification?

Form 1155 is an essential document for individuals who want to establish residency in a new state or country. It serves as proof of an individual's permanent home or residence, which can affect their tax obligations, voting rights, and other legal entitlements. By completing Form 1155, individuals can demonstrate their intention to reside in a particular location and establish their domicile.

5 Ways to Complete Form 1155 for Domicile Verification

1. Gather Required Documents

Before completing Form 1155, it is essential to gather all the necessary documents. These may include:

- Proof of identity (passport, driver's license, or state ID)

- Proof of address (utility bills, lease agreement, or mortgage statement)

- Proof of employment or income (pay stubs, W-2 forms, or tax returns)

- Proof of ties to the state or country ( voter registration, library card, or membership in local organizations)

2. Determine Your Residency Status

To complete Form 1155, you need to determine your residency status. You can use the IRS's residency test to determine whether you are a resident or non-resident alien. The test considers factors such as:

- Physical presence in the United States

- Intent to remain in the United States

- Ties to the United States (e.g., family, home, or business)

Residency Status Categories

- Resident Alien: You are a resident alien if you meet the green card test or the substantial presence test.

- Non-Resident Alien: You are a non-resident alien if you do not meet either test.

- Dual-Status Alien: You are a dual-status alien if you are a resident alien for part of the year and a non-resident alien for the rest of the year.

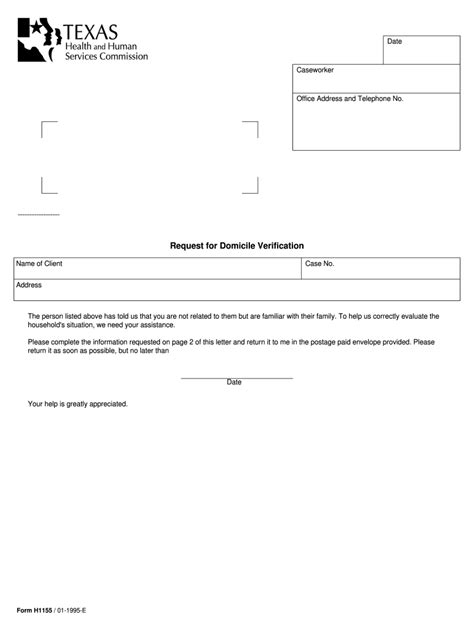

3. Complete Form 1155

Once you have gathered the required documents and determined your residency status, you can complete Form 1155. The form consists of several sections that require you to provide information about your:

- Identity and contact information

- Residency status and address

- Employment and income

- Ties to the state or country

4. Submit Form 1155 and Supporting Documents

After completing Form 1155, you need to submit it to the IRS along with the required supporting documents. You can submit the form by mail or electronically through the IRS's website. Make sure to keep a copy of the form and supporting documents for your records.

5. Follow Up with the IRS

After submitting Form 1155, you should follow up with the IRS to ensure that your application is processed correctly. You can check the status of your application online or by contacting the IRS directly. If there are any issues with your application, the IRS will contact you to request additional information or documentation.

Conclusion

Completing Form 1155 for domicile verification is a crucial step in establishing residency in a new state or country. By following these five steps, you can ensure that your application is processed correctly and that you receive the necessary documentation to support your residency status. Remember to gather all the required documents, determine your residency status, complete Form 1155 accurately, submit the form and supporting documents, and follow up with the IRS to ensure that your application is processed correctly.

Call to Action

If you have any questions or concerns about completing Form 1155 for domicile verification, please share them in the comments section below. We would be happy to help you navigate the process and provide any additional information you may need.

What is Form 1155 used for?

+Form 1155 is used by the IRS to determine an individual's residency status for tax purposes.

What documents do I need to complete Form 1155?

+You will need to provide proof of identity, address, employment or income, and ties to the state or country.

How do I submit Form 1155?

+You can submit Form 1155 by mail or electronically through the IRS's website.