As a business owner or individual seeking financing, you may have come across the 4506-C form, especially when working with American Express. This form is a crucial document required by lenders to verify your income and tax returns, and it's essential to understand its purpose, benefits, and how it works.

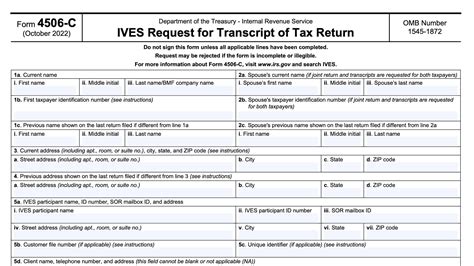

The 4506-C form, also known as the "Request for Copy of Tax Return," is a document provided by the Internal Revenue Service (IRS) that allows taxpayers to request copies of their tax returns or transcripts. American Express, like many other lenders, requires this form to verify the accuracy of the income and tax information provided by applicants. This helps to reduce the risk of loan defaults and ensures compliance with tax laws.

In this article, we'll delve deeper into the 4506-C form, its significance, and how it affects your loan application process with American Express.

What is the Purpose of the 4506-C Form?

The primary purpose of the 4506-C form is to allow lenders to verify the accuracy of an applicant's income and tax returns. This form grants permission to the lender to request copies of tax returns or transcripts from the IRS, which helps to:

- Verify income and employment status

- Assess creditworthiness

- Determine loan eligibility

- Reduce the risk of loan defaults

By verifying tax information, American Express can make more informed lending decisions and ensure that borrowers have the necessary means to repay their loans.

How Does the 4506-C Form Affect My Loan Application?

When applying for a loan with American Express, you'll typically be required to provide personal and financial information, including your income and tax returns. The 4506-C form is an essential part of this process, as it allows American Express to verify the accuracy of the information you provide.

If you're unsure about the 4506-C form or have concerns about the loan application process, don't hesitate to reach out to American Express's customer support team. They'll be happy to guide you through the process and address any questions or concerns you may have.

What Information Do I Need to Provide on the 4506-C Form?

To complete the 4506-C form, you'll need to provide the following information:

- Your name and Social Security number or Individual Taxpayer Identification Number (ITIN)

- The tax year(s) for which you're requesting copies of tax returns or transcripts

- The type of tax return or transcript you're requesting (e.g., Form 1040, Form W-2, etc.)

- The reason for your request (e.g., loan application, etc.)

You'll also need to sign and date the form, granting permission to American Express to request copies of your tax returns or transcripts from the IRS.

How Long Does it Take to Process the 4506-C Form?

The processing time for the 4506-C form can vary depending on the IRS's workload and the complexity of your request. Typically, it can take anywhere from 2-6 weeks for the IRS to process your request and send the requested tax returns or transcripts to American Express.

Once American Express receives the tax returns or transcripts, they'll review the information to verify your income and tax status. This can take an additional 1-2 weeks, depending on the lender's processing time.

What Are the Benefits of Using the 4506-C Form?

Using the 4506-C form provides several benefits, including:

- Faster loan processing times

- Increased accuracy in income and tax verification

- Reduced risk of loan defaults

- Improved compliance with tax laws

By using the 4506-C form, American Express can make more informed lending decisions and provide borrowers with faster and more accurate loan processing times.

What Are the Common Challenges Associated with the 4506-C Form?

While the 4506-C form is an essential part of the loan application process, there are some common challenges associated with it, including:

- Delays in processing times

- Incomplete or inaccurate information

- Difficulty in obtaining tax returns or transcripts from the IRS

To avoid these challenges, it's essential to ensure that you provide accurate and complete information on the 4506-C form and follow up with American Express to ensure that the form is processed correctly.

Conclusion

In conclusion, the 4506-C form is a crucial document required by American Express to verify income and tax returns. By understanding the purpose, benefits, and challenges associated with this form, you can ensure a smoother loan application process and increase your chances of approval.

If you have any questions or concerns about the 4506-C form or the loan application process, don't hesitate to reach out to American Express's customer support team. They'll be happy to guide you through the process and address any questions or concerns you may have.

We hope this article has provided you with a comprehensive understanding of the 4506-C form and its significance in the loan application process. If you have any further questions or concerns, please don't hesitate to comment below.

What is the purpose of the 4506-C form?

+The primary purpose of the 4506-C form is to allow lenders to verify the accuracy of an applicant's income and tax returns.

How long does it take to process the 4506-C form?

+The processing time for the 4506-C form can vary depending on the IRS's workload and the complexity of your request. Typically, it can take anywhere from 2-6 weeks for the IRS to process your request and send the requested tax returns or transcripts to American Express.

What are the benefits of using the 4506-C form?

+Using the 4506-C form provides several benefits, including faster loan processing times, increased accuracy in income and tax verification, reduced risk of loan defaults, and improved compliance with tax laws.