Claiming tax exemption can be a daunting task, especially for those who are new to the world of taxation. However, with the ICICI 15G form, claiming tax exemption has become a relatively straightforward process. In this article, we will delve into the world of tax exemption, explore the ICICI 15G form, and provide a step-by-step guide on how to claim tax exemption easily.

Tax exemption is a privilege granted to individuals who meet certain conditions, allowing them to reduce their tax liability. The Indian government offers various tax exemptions to encourage savings, investments, and economic growth. One such exemption is the Tax Deduction at Source (TDS) exemption, which can be claimed using the ICICI 15G form.

What is the ICICI 15G Form?

The ICICI 15G form is a declaration form that individuals can submit to claim tax exemption on their fixed deposits, recurring deposits, and other investments. The form is used to declare that the individual's income is below the taxable limit, and therefore, they are eligible for tax exemption.

Eligibility Criteria for ICICI 15G Form

To be eligible to claim tax exemption using the ICICI 15G form, individuals must meet the following conditions:

- The individual's age should be 60 years or less.

- The individual's income should be below the taxable limit.

- The individual should not have any tax liability for the previous year.

Benefits of ICICI 15G Form

The ICICI 15G form offers several benefits to individuals, including:

- Tax exemption on fixed deposits, recurring deposits, and other investments.

- Reduced tax liability.

- Increased savings.

How to Fill ICICI 15G Form

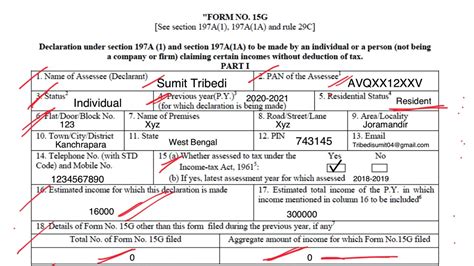

Filling the ICICI 15G form is a relatively straightforward process. Here's a step-by-step guide:

- Download the ICICI 15G form from the ICICI Bank website or obtain it from the bank branch.

- Fill in the required details, including name, address, PAN number, and bank account details.

- Declare that the individual's income is below the taxable limit and that they are eligible for tax exemption.

- Sign the form and submit it to the bank branch or online.

ICICI 15G Form Submission Process

The ICICI 15G form can be submitted online or offline. Here's a step-by-step guide:

Online Submission:

- Log in to the ICICI Bank internet banking portal.

- Click on the "Forms" tab and select "15G Form".

- Fill in the required details and submit the form.

Offline Submission:

- Visit the nearest ICICI Bank branch.

- Submit the filled and signed ICICI 15G form to the bank representative.

- Verify the details and confirm the submission.

ICICI 15G Form Status Check

Once the ICICI 15G form is submitted, individuals can check the status online or offline. Here's a step-by-step guide:

Online Status Check:

- Log in to the ICICI Bank internet banking portal.

- Click on the "Forms" tab and select "15G Form Status".

Offline Status Check:

- Visit the nearest ICICI Bank branch.

- Contact the bank representative and provide the PAN number or bank account details.

- Verify the status of the ICICI 15G form submission.

ICICI 15G Form FAQs

Here are some frequently asked questions about the ICICI 15G form:

Q: What is the ICICI 15G form? A: The ICICI 15G form is a declaration form that individuals can submit to claim tax exemption on their fixed deposits, recurring deposits, and other investments.

Q: Who is eligible to claim tax exemption using the ICICI 15G form? A: Individuals who are 60 years or less, have an income below the taxable limit, and do not have any tax liability for the previous year are eligible to claim tax exemption using the ICICI 15G form.

Q: How do I fill the ICICI 15G form? A: The ICICI 15G form can be filled by downloading it from the ICICI Bank website or obtaining it from the bank branch. Fill in the required details, declare that the individual's income is below the taxable limit, and sign the form.

Q: How do I submit the ICICI 15G form? A: The ICICI 15G form can be submitted online or offline. Online submission can be done through the ICICI Bank internet banking portal, while offline submission can be done by visiting the nearest ICICI Bank branch.

What is the ICICI 15G form?

+The ICICI 15G form is a declaration form that individuals can submit to claim tax exemption on their fixed deposits, recurring deposits, and other investments.

Who is eligible to claim tax exemption using the ICICI 15G form?

+Individuals who are 60 years or less, have an income below the taxable limit, and do not have any tax liability for the previous year are eligible to claim tax exemption using the ICICI 15G form.

How do I fill the ICICI 15G form?

+The ICICI 15G form can be filled by downloading it from the ICICI Bank website or obtaining it from the bank branch. Fill in the required details, declare that the individual's income is below the taxable limit, and sign the form.

In conclusion, claiming tax exemption using the ICICI 15G form is a relatively straightforward process. By following the steps outlined in this article, individuals can easily claim tax exemption and reduce their tax liability. We hope this article has been informative and helpful in understanding the ICICI 15G form. If you have any further questions or concerns, please feel free to comment below.