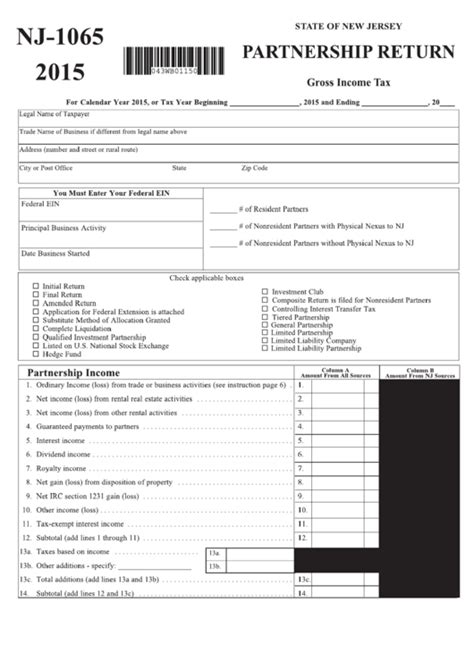

The NJ Form 1065 is a crucial document for partnerships operating in New Jersey, as it enables them to report their income, deductions, and credits to the state. In this article, we will delve into the world of partnership tax returns, exploring the filing requirements, benefits, and intricacies of the NJ Form 1065.

Understanding Partnership Tax Returns

A partnership tax return is a document that partnerships use to report their income, gains, losses, deductions, and credits to the state. The NJ Form 1065 is the official document used by partnerships in New Jersey to fulfill this requirement. Partnerships are required to file this form annually, and it is essential to understand the filing requirements to avoid any penalties or fines.

Benefits of Filing NJ Form 1065

Filing the NJ Form 1065 provides several benefits to partnerships operating in New Jersey. Some of the benefits include:

- Compliance with state tax laws and regulations

- Accurate reporting of income, deductions, and credits

- Avoidance of penalties and fines

- Ability to claim tax credits and deductions

- Improved financial transparency and accountability

Filing Requirements for NJ Form 1065

To file the NJ Form 1065, partnerships must meet certain requirements. These requirements include:

- The partnership must be registered with the New Jersey Department of Treasury

- The partnership must have a valid Federal Employer Identification Number (FEIN)

- The partnership must have a New Jersey tax identification number

- The partnership must have a copy of the federal partnership tax return (Form 1065)

Step-by-Step Guide to Filing NJ Form 1065

Filing the NJ Form 1065 can be a complex process, but it can be broken down into several steps. Here is a step-by-step guide to help partnerships navigate the filing process:

- Gather necessary documents and information, including the federal partnership tax return (Form 1065), financial statements, and tax identification numbers

- Complete the NJ Form 1065, ensuring that all required information is provided

- Attach any required schedules and statements, such as Schedule K-1

- Sign and date the form, ensuring that all partners have signed and dated the document

- Submit the form to the New Jersey Division of Taxation, either electronically or by mail

Tips and Best Practices for Filing NJ Form 1065

To ensure a smooth filing process, partnerships should follow these tips and best practices:

- File the NJ Form 1065 electronically to reduce errors and improve processing time

- Ensure that all required information is provided, including tax identification numbers and financial statements

- Attach any required schedules and statements, such as Schedule K-1

- Sign and date the form, ensuring that all partners have signed and dated the document

- Keep accurate records of the filing process, including receipts and confirmation numbers

Common Mistakes to Avoid When Filing NJ Form 1065

When filing the NJ Form 1065, partnerships should avoid common mistakes that can lead to delays, penalties, and fines. Some of the most common mistakes include:

- Failing to provide required information, such as tax identification numbers and financial statements

- Failing to attach required schedules and statements, such as Schedule K-1

- Failing to sign and date the form, ensuring that all partners have signed and dated the document

- Failing to keep accurate records of the filing process, including receipts and confirmation numbers

Conclusion

Filing the NJ Form 1065 is a crucial requirement for partnerships operating in New Jersey. By understanding the filing requirements, benefits, and intricacies of the form, partnerships can ensure compliance with state tax laws and regulations. By following the tips and best practices outlined in this article, partnerships can avoid common mistakes and ensure a smooth filing process.

We hope this article has provided valuable insights into the world of partnership tax returns and the NJ Form 1065. If you have any questions or comments, please feel free to share them below.

What is the NJ Form 1065?

+The NJ Form 1065 is the official document used by partnerships in New Jersey to report their income, gains, losses, deductions, and credits to the state.

Who is required to file the NJ Form 1065?

+All partnerships operating in New Jersey are required to file the NJ Form 1065 annually.

What are the benefits of filing the NJ Form 1065?

+The benefits of filing the NJ Form 1065 include compliance with state tax laws and regulations, accurate reporting of income, deductions, and credits, avoidance of penalties and fines, and ability to claim tax credits and deductions.