As an Illinois resident, understanding the RUT 50 tax form is crucial for your vehicle registration process. The RUT 50 form, also known as the Heavy Vehicle Use Tax Return, is a mandatory document for individuals and businesses that operate heavy vehicles with a gross vehicle weight rating (GVWR) of 55,000 pounds or more. In this article, we will delve into the world of RUT 50, explaining its importance, benefits, and step-by-step instructions on how to fill out the form.

What is the RUT 50 Tax Form?

The RUT 50 tax form is a requirement for Illinois residents who operate heavy vehicles, including trucks, tractors, and buses. The form is used to report and pay the Heavy Vehicle Use Tax (HVUT), which is a federal tax imposed on heavy vehicles that use public highways. The HVUT is calculated based on the vehicle's gross weight and is used to fund highway construction and maintenance projects.

Benefits of Filing RUT 50

Filing the RUT 50 tax form has several benefits for Illinois residents, including:

- Compliance with federal and state regulations

- Reduced risk of penalties and fines for non-compliance

- Eligibility for vehicle registration

- Contribution to the maintenance and improvement of public highways

Who Needs to File RUT 50?

Not all Illinois residents need to file the RUT 50 tax form. The following individuals and businesses are required to file:

- Individuals who operate heavy vehicles with a GVWR of 55,000 pounds or more

- Businesses that operate heavy vehicles, including trucks, tractors, and buses

- Leasing companies that lease heavy vehicles to others

Exemptions from Filing RUT 50

Some individuals and businesses are exempt from filing the RUT 50 tax form, including:

- Government agencies

- Non-profit organizations

- Vehicles that are not used for commercial purposes

How to Fill Out the RUT 50 Tax Form

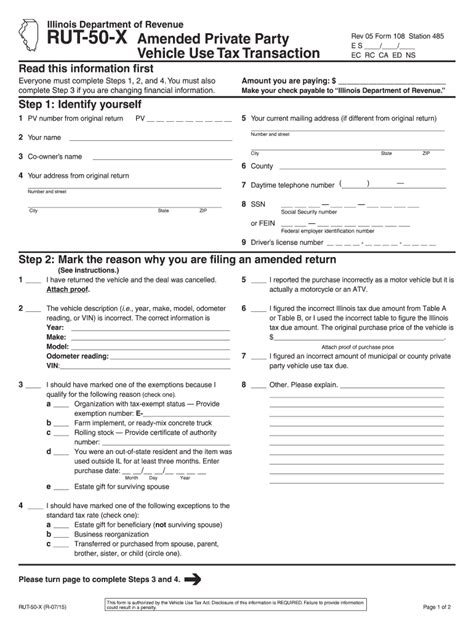

Filling out the RUT 50 tax form can be a complex process, but with the right guidance, it can be done efficiently. Here's a step-by-step guide to help you fill out the form:

- Download the RUT 50 tax form: You can download the form from the Illinois Department of Revenue website or pick one up from your local motor vehicle office.

- Gather required information: You'll need to provide information about your vehicle, including the VIN, GVWR, and license plate number.

- Calculate the HVUT: Use the IRS website to calculate the HVUT based on your vehicle's GVWR.

- Fill out the form: Complete the form by providing the required information and attaching any supporting documents.

- Submit the form: Submit the form to the Illinois Department of Revenue along with the required payment.

Tips for Filing RUT 50

Here are some tips to keep in mind when filing the RUT 50 tax form:

- Make sure to file the form on time to avoid penalties and fines

- Use the correct form and version

- Provide accurate and complete information

- Keep a copy of the form and supporting documents for your records

Penalties for Not Filing RUT 50

Failure to file the RUT 50 tax form can result in penalties and fines, including:

- A penalty of 4.5% of the HVUT due

- A fine of $500 or more

- Suspension or revocation of your vehicle registration

Conclusion

Filing the RUT 50 tax form is a critical step in the vehicle registration process for Illinois residents who operate heavy vehicles. By understanding the importance of the form, its benefits, and the step-by-step instructions for filling it out, you can ensure compliance with federal and state regulations. Remember to file the form on time, provide accurate and complete information, and keep a copy of the form and supporting documents for your records.

We hope this article has provided you with a comprehensive guide to the RUT 50 tax form. If you have any questions or concerns, please don't hesitate to reach out to us. Share your thoughts and experiences with filing the RUT 50 tax form in the comments section below.

What is the deadline for filing the RUT 50 tax form?

+The deadline for filing the RUT 50 tax form is August 31st of each year.

Can I file the RUT 50 tax form online?

+Yes, you can file the RUT 50 tax form online through the Illinois Department of Revenue website.

What is the penalty for not filing the RUT 50 tax form?

+The penalty for not filing the RUT 50 tax form is 4.5% of the HVUT due, plus a fine of $500 or more.