Forming a Limited Liability Company (LLC) in California provides entrepreneurs and small business owners with a flexible and protective business structure. However, maintaining compliance with state regulations is crucial to avoid penalties and potential dissolution. One of the critical annual requirements for California LLCs is filing the Statement of Information with the California Secretary of State. In some cases, business owners may need additional time to prepare and file this document, necessitating the filing of an extension. Here's a comprehensive guide on how to file a California LLC extension form.

Understanding the Importance of Filing a Statement of Information

Before diving into the extension process, it's essential to understand the Statement of Information's role. This document provides the Secretary of State with current information about the LLC, including its name, address, managers/members, and the agent for service of process. The initial statement must be filed within 90 days of the LLC's formation, and subsequent statements are due every two years. Missing the deadline can lead to penalties and even suspension of the LLC's powers, rights, and privileges.

Step 1: Determine the Need for an Extension

Before seeking an extension, ensure you understand the original deadline for your LLC's Statement of Information. The California Secretary of State's office sends reminders, but it's the LLC's responsibility to file on time. If unforeseen circumstances or a significant change in the business necessitate more time, consider filing an extension.

Key Circumstances for Filing an Extension:

- Unforeseen business or personal emergencies that hinder timely filing.

- Recent changes in the LLC's structure or management that require additional time to update records.

- Need for clarification or resolution of issues with the Secretary of State's office.

Step 2: Gather Necessary Information

To file an extension, you'll need specific information readily available:

- LLC Name and Number: Ensure you have the correct spelling of your LLC's name and its identification number issued by the Secretary of State.

- Reason for Extension: While not always required, having a clear reason for requesting an extension can facilitate the process.

- Correct Filing Fee: The fee for filing an extension may vary, so it's crucial to have the correct amount to avoid delays.

Step 3: File the Extension Request

Option 1: Online Filing

The California Secretary of State's website offers an online portal for filing extensions. This method is convenient and generally quicker:

- Visit the Secretary of State's website ().

- Navigate to the business entities section and select "LLC" or "LP" as appropriate.

- Choose the "File a Statement of Information" option and follow the prompts to request an extension.

Option 2: Mail or In-Person Filing

For those who prefer or require a physical filing method:

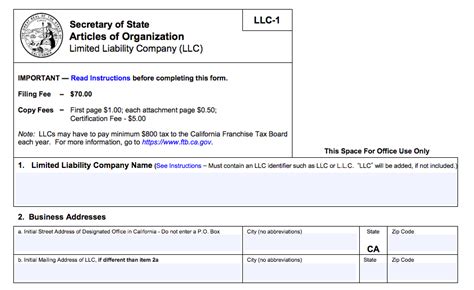

- Download and complete the Statement of Information form from the Secretary of State's website.

- Clearly indicate that you are requesting an extension.

- Attach the required fee and any supporting documentation.

- Mail the package to the Secretary of State's office or submit it in person.

Step 4: Follow Up and Ensure Approval

After submitting your extension request:

- Wait for confirmation from the Secretary of State's office. This may come via email or mail, depending on your chosen filing method.

- Verify that the extension has been approved and take note of the new deadline for filing your Statement of Information.

Step 5: File the Statement of Information Within the Extended Deadline

Once the extension is approved, it's crucial to file the Statement of Information by the new deadline to avoid penalties and potential suspension of your LLC's powers, rights, and privileges.

Best Practices for Filing the Statement of Information:

- Ensure all information is accurate and up-to-date.

- Double-check the filing fee and submit the correct amount.

- Consider filing online for quicker processing.

By following these steps and understanding the importance of timely filing, you can successfully navigate the process of filing a California LLC extension form and maintain compliance with state regulations.

What happens if I miss the deadline for filing the Statement of Information?

+Missing the deadline can result in penalties and potential suspension of your LLC's powers, rights, and privileges. It's crucial to file on time or request an extension if needed.

Can I file an extension request online?

+Yes, the California Secretary of State's website allows for online filing of extension requests. This method is generally quicker and more convenient.

What information do I need to file the Statement of Information?

+You'll need your LLC's name and identification number, correct filing fee, and up-to-date information about your LLC, including its address, managers/members, and agent for service of process.