The NYS Sales Tax Certificate is a crucial document for businesses operating in New York State, allowing them to collect and remit sales tax on taxable goods and services. Obtaining a Sales Tax Certificate is a relatively straightforward process, but it can be confusing for new businesses or those unfamiliar with the requirements. In this article, we will explore six ways to obtain an NYS Sales Tax Certificate, ensuring your business is compliant with state regulations.

Understanding the NYS Sales Tax Certificate

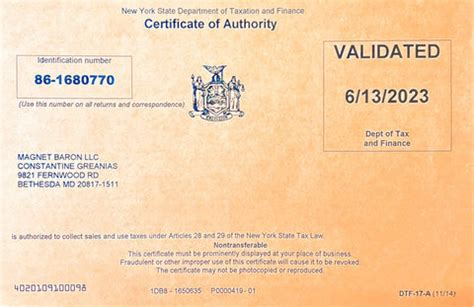

Before we dive into the ways to obtain a Sales Tax Certificate, it's essential to understand its purpose and significance. The Sales Tax Certificate, also known as a Certificate of Authority, is a permit issued by the New York State Department of Taxation and Finance (DTF) that authorizes businesses to collect sales tax on taxable goods and services. This certificate is required for any business that sells taxable goods or services in New York State.

Why Do I Need an NYS Sales Tax Certificate?

A Sales Tax Certificate is necessary for several reasons:

- It allows your business to collect sales tax from customers, which is then remitted to the state.

- It ensures compliance with state regulations, avoiding potential penalties and fines.

- It provides a unique identifier for your business, which is required for tax filings and other state communications.

6 Ways to Obtain an NYS Sales Tax Certificate

Now that we've covered the importance of a Sales Tax Certificate, let's explore the six ways to obtain one:

1. Online Application through the NYS DTF Website

The fastest and most convenient way to obtain a Sales Tax Certificate is through the NYS DTF website. You can apply online and receive your certificate instantly. To apply online, you'll need to:

- Visit the NYS DTF website ()

- Click on "Register a Business" and follow the prompts

- Fill out the online application form, providing required business information

- Pay the required registration fee (if applicable)

2. Mail or Fax Application

If you prefer not to apply online, you can submit a paper application by mail or fax. You can download the application form (DTF-17) from the NYS DTF website or request one by calling the DTF at (518) 485-2889.

- Complete the application form, providing required business information

- Sign and date the form

- Mail or fax the application to the address or fax number listed on the form

3. In-Person Application at a NYS DTF Office

You can also apply in person at a NYS DTF office. This option is ideal if you have questions or need assistance with the application process.

- Find a NYS DTF office near you ()

- Bring required business documents and identification

- Meet with a DTF representative to complete the application process

4. Application through a Certified Public Accountant (CPA) or Tax Professional

If you work with a CPA or tax professional, they can assist you with the application process.

- Provide your business information and required documents to your CPA or tax professional

- They will complete and submit the application on your behalf

- You'll receive your Sales Tax Certificate once the application is processed

5. Application through a Business Formation Service

Some business formation services, such as Incfile or ZenBusiness, offer assistance with obtaining a Sales Tax Certificate as part of their business formation packages.

- Choose a business formation service that offers Sales Tax Certificate application assistance

- Provide required business information and documents

- The service will complete and submit the application on your behalf

6. Application through the NYS Business Express System

The NYS Business Express system is a one-stop-shop for businesses to register and obtain necessary licenses and permits, including the Sales Tax Certificate.

- Visit the NYS Business Express website ()

- Create an account and log in to the system

- Follow the prompts to complete the Sales Tax Certificate application

What to Expect After Applying

Once you've submitted your application, you can expect the following:

- Processing time: 2-4 weeks for mail or fax applications, instant for online applications

- Certificate issuance: You'll receive your Sales Tax Certificate via email or mail, depending on your application method

- Registration fee: You may need to pay a registration fee, which varies depending on your business type and location

Conclusion

Obtaining an NYS Sales Tax Certificate is a crucial step for businesses operating in New York State. By following the six ways outlined in this article, you can ensure your business is compliant with state regulations and avoid potential penalties. Remember to renew your Sales Tax Certificate periodically to maintain your business's good standing.

What is the difference between a Sales Tax Certificate and a Certificate of Authority?

+A Sales Tax Certificate and a Certificate of Authority are the same document. The terms are often used interchangeably.

Do I need a Sales Tax Certificate if I'm a sole proprietor?

+Yes, as a sole proprietor, you'll need a Sales Tax Certificate if you sell taxable goods or services in New York State.

How long does it take to receive a Sales Tax Certificate?

+Processing time varies depending on the application method. Online applications are typically instant, while mail or fax applications take 2-4 weeks.