In today's lending landscape, transparency and clarity are essential for both lenders and borrowers. One crucial document that facilitates this transparency is the Truth in Lending (TIL) form, also known as a Disclosure Statement. This form is designed to provide borrowers with a clear understanding of the terms and conditions of their loan, helping them make informed decisions about their financial obligations.

The Truth in Lending Act (TILA) requires lenders to provide borrowers with this disclosure statement, which includes vital information such as the Annual Percentage Rate (APR), the total amount financed, the total amount paid, and the number of payments. This helps borrowers grasp the true cost of their loan and avoid hidden fees or surprises down the line.

Understanding the Truth in Lending Form

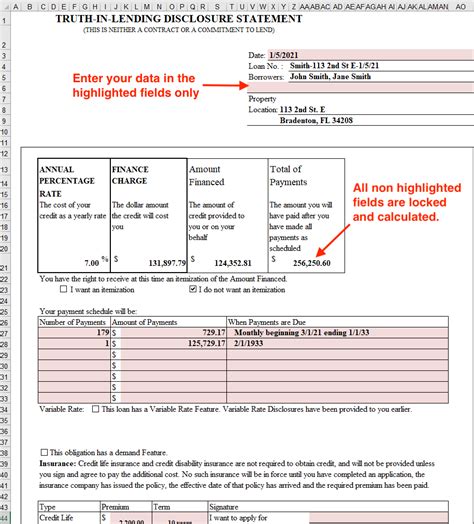

The Truth in Lending form is a comprehensive document that outlines the key terms and conditions of a loan. It is designed to be easy to read and understand, with clear headings and concise language. Here are some of the essential components of a typical TIL form:

Key Components of a TIL Form

- Annual Percentage Rate (APR): The APR is the interest rate charged on the loan, expressed as a yearly rate. This helps borrowers understand the true cost of the loan and compare it to other offers.

- Total Amount Financed: This is the total amount borrowed, including any fees or charges.

- Total Amount Paid: This is the total amount the borrower will pay over the life of the loan, including interest and fees.

- Number of Payments: This is the number of payments the borrower will make, including the payment amount and frequency.

- Payment Schedule: This outlines the payment schedule, including the payment amount, due date, and any late payment fees.

Benefits of Using a Truth in Lending Form

Using a Truth in Lending form provides several benefits for both lenders and borrowers. Here are some of the key advantages:

Benefits for Borrowers

- Transparency: The TIL form provides borrowers with a clear understanding of the loan terms and conditions, helping them make informed decisions.

- Comparison shopping: By comparing TIL forms from different lenders, borrowers can compare rates and terms to find the best deal.

- Avoid surprises: The TIL form helps borrowers avoid hidden fees or surprises down the line.

Benefits for Lenders

- Compliance: Using a TIL form helps lenders comply with TILA regulations and avoid potential fines or penalties.

- Reduced disputes: By providing clear and concise information, lenders can reduce disputes and misunderstandings with borrowers.

- Improved customer satisfaction: By providing transparency and clarity, lenders can improve customer satisfaction and build trust.

How to Fill Out a Truth in Lending Form

Filling out a Truth in Lending form is a relatively straightforward process. Here are the steps to follow:

Step 1: Gather Information

- Gather all relevant information about the loan, including the loan amount, interest rate, fees, and repayment terms.

Step 2: Complete the Form

- Complete the TIL form using the gathered information, making sure to include all required fields and disclosures.

Step 3: Review and Sign

- Review the completed form for accuracy and completeness.

- Sign the form, indicating that the borrower has received and understood the disclosure statement.

Free Truth in Lending Form Fillable Templates

There are several free Truth in Lending form fillable templates available online. Here are a few options:

- Federal Reserve: The Federal Reserve provides a free TIL form template on its website.

- Consumer Financial Protection Bureau: The CFPB also provides a free TIL form template on its website.

- LoanForms.org: LoanForms.org offers a range of free loan forms, including a Truth in Lending form.

By using a Truth in Lending form, lenders and borrowers can ensure transparency and clarity in the lending process. Remember to always review and understand the form before signing, and don't hesitate to seek help if you have any questions or concerns.

We hope this article has provided valuable insights into the Truth in Lending form and its importance in the lending process. If you have any questions or comments, please feel free to share them below.

What is the purpose of a Truth in Lending form?

+The purpose of a Truth in Lending form is to provide borrowers with a clear understanding of the loan terms and conditions, including the Annual Percentage Rate (APR), total amount financed, total amount paid, and number of payments.

Who is required to provide a Truth in Lending form?

+Lenders are required to provide a Truth in Lending form to borrowers under the Truth in Lending Act (TILA).

Where can I find a free Truth in Lending form fillable template?

+There are several free Truth in Lending form fillable templates available online, including those provided by the Federal Reserve and the Consumer Financial Protection Bureau.