The Internal Revenue Service (IRS) is responsible for collecting taxes and enforcing tax laws in the United States. When dealing with tax-related matters, it's essential to ensure that you're sending your documents to the correct address to avoid delays or complications. One of the most common forms that individuals need to mail to the IRS is Form 8862, also known as the "Information to Claim Earned Income Tax Credit After Disallowance."

In this article, we'll cover the three key addresses where you can mail your IRS Form 8862, depending on your location and the specific circumstances of your case.

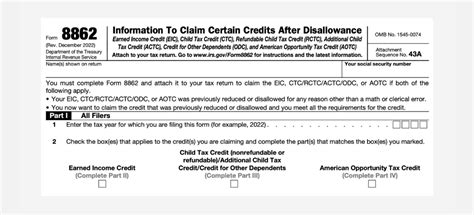

What is IRS Form 8862?

Before we dive into the addresses, let's take a brief look at what IRS Form 8862 is used for. This form is required when you're claiming the Earned Income Tax Credit (EITC) after it has been disallowed in the past. The EITC is a tax credit designed to help low-to-moderate-income working individuals and families. If you've had your EITC claim disallowed in the past, you'll need to complete Form 8862 and attach it to your tax return (Form 1040) to claim the credit.

Why do I need to mail Form 8862?

You'll need to mail Form 8862 if:

- You're claiming the EITC after it was disallowed in the past

- You're responding to an IRS notice or letter regarding your EITC claim

- You're attaching additional documentation to support your EITC claim

Address 1: Internal Revenue Service, 1111 Constitution Ave NW, Washington, DC 20224

If you're a taxpayer from any state, you can mail your Form 8862 to the IRS address in Washington, D.C. This address is the central location for the IRS, and it's where most tax-related documents are processed.

However, it's essential to note that mailing your Form 8862 to this address may result in slower processing times due to the high volume of documents received.

Address 2: Internal Revenue Service, 2970 Market St, Philadelphia, PA 19104

If you're a taxpayer from the following states, you should mail your Form 8862 to the IRS address in Philadelphia, PA:

- Alabama

- Arkansas

- Florida

- Georgia

- Louisiana

- Mississippi

- North Carolina

- Oklahoma

- South Carolina

- Tennessee

- Texas

This address is specifically designated for taxpayers from these states, and it may result in faster processing times compared to mailing to the Washington, D.C. address.

Address 3: Internal Revenue Service, 4330 S 140th St, Fresno, CA 93725

If you're a taxpayer from the following states, you should mail your Form 8862 to the IRS address in Fresno, CA:

- Alaska

- Arizona

- California

- Colorado

- Hawaii

- Idaho

- Montana

- Nevada

- New Mexico

- Oregon

- Utah

- Washington

- Wyoming

This address is specifically designated for taxpayers from these states, and it may result in faster processing times compared to mailing to the Washington, D.C. address.

Additional Tips and Reminders

Before mailing your Form 8862, make sure to:

- Use a trackable mailing method, such as certified mail or a delivery confirmation service

- Keep a copy of your Form 8862 and supporting documentation for your records

- Ensure that you've completed the form accurately and attached all required documentation

- Check the IRS website for any updates or changes to the mailing addresses

By following these tips and using the correct mailing address, you can ensure that your Form 8862 is processed efficiently and effectively.

We hope this article has provided you with the necessary information to mail your IRS Form 8862 correctly. If you have any further questions or concerns, feel free to ask in the comments below!

What is the purpose of IRS Form 8862?

+IRS Form 8862 is used to claim the Earned Income Tax Credit (EITC) after it has been disallowed in the past.

Can I mail my Form 8862 to any IRS address?

+No, you should mail your Form 8862 to the address designated for your state or region. Mailing to the wrong address may result in slower processing times.

Can I e-file my Form 8862?

+No, Form 8862 must be mailed to the IRS. However, you can e-file your tax return (Form 1040) and attach Form 8862 as a supporting document.