Paying taxes is a civic duty, but the process can be overwhelming, especially when dealing with complex forms like the D-400. If you're a resident of North Carolina, understanding this form is crucial to ensure you're in compliance with state tax regulations. In this article, we'll delve into the world of the D-400 tax form, exploring its purpose, key components, and how to navigate it with ease.

What is the D-400 Tax Form?

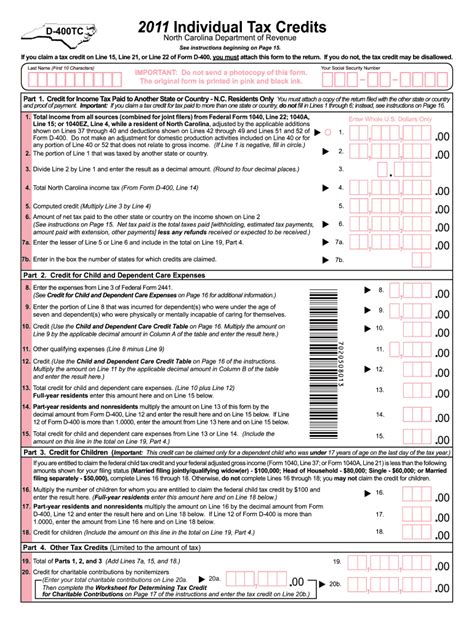

The D-400 is the primary form used by individuals to file their state income tax return in North Carolina. It's a comprehensive document that requires you to report your income, claim deductions and credits, and calculate your tax liability. The form is typically filed annually, with the deadline usually falling on April 15th.

Key Components of the D-400 Tax Form

The D-400 tax form consists of several sections, each designed to capture specific information about your income, deductions, and tax obligations. Here are the main components:

- Personal Information: This section requires you to provide your name, address, Social Security number, and filing status.

- Income: You'll need to report your income from various sources, including wages, salaries, tips, and self-employment income.

- Adjustments to Income: This section allows you to claim deductions for items like student loan interest, alimony payments, and educator expenses.

- Deductions and Credits: You can claim standard or itemized deductions, as well as credits for things like child care expenses, education costs, and charitable donations.

- Tax Liability: Calculate your total tax liability based on your income, deductions, and credits.

D-400 Tax Form Schedules and Worksheets

In addition to the main form, you may need to complete various schedules and worksheets to support your tax return. These include:

- Schedule A: Itemized Deductions

- Schedule B: Interest and Dividend Income

- Schedule C: Business Income and Expenses

- Schedule D: Capital Gains and Losses

- Worksheet for Calculating Tax Liability

Who Needs to File the D-400 Tax Form?

If you're a resident of North Carolina, you're required to file the D-400 tax form if you meet certain criteria:

- You have a federal tax filing requirement.

- You have North Carolina income that's not subject to federal tax withholding.

- You're claiming a refund or making a payment.

How to File the D-400 Tax Form

You can file the D-400 tax form in one of two ways:

- E-File: Submit your tax return electronically through the North Carolina Department of Revenue's website or a tax preparation software.

- Mail: Send a paper copy of your tax return to the North Carolina Department of Revenue.

Common Mistakes to Avoid When Filing the D-400 Tax Form

When filing the D-400 tax form, be aware of these common mistakes:

- Incorrect Social Security number or name

- Inaccurate income reporting

- Missing or incorrect schedules and worksheets

- Insufficient payment or incorrect payment method

- Late filing or payment

Tips for Filing the D-400 Tax Form Accurately

To ensure accuracy when filing the D-400 tax form:

- Gather all necessary documents and information

- Use tax preparation software or consult a tax professional

- Double-check your math and ensure accuracy

- File electronically to reduce errors and processing time

- Keep a copy of your tax return and supporting documents

Conclusion and Next Steps

Understanding the D-400 tax form is essential for North Carolina residents to ensure compliance with state tax regulations. By familiarizing yourself with the form's components, schedules, and worksheets, you'll be better equipped to navigate the tax filing process. Remember to file accurately and on time to avoid penalties and interest.

We hope this article has provided you with a comprehensive understanding of the D-400 tax form. If you have any further questions or concerns, please don't hesitate to comment below or share this article with your friends and family who may benefit from this information.

What is the deadline for filing the D-400 tax form in North Carolina?

+The deadline for filing the D-400 tax form in North Carolina is typically April 15th.

Do I need to file the D-400 tax form if I don't have any income?

+If you have no income and don't owe any taxes, you may not need to file the D-400 tax form. However, it's best to check with the North Carolina Department of Revenue to confirm.

Can I file the D-400 tax form electronically?

+Yes, you can file the D-400 tax form electronically through the North Carolina Department of Revenue's website or a tax preparation software.