The Texas One in the Same form, also known as the Texas Uniform Unclaimed Property Act (TUUPA) form, is a document used to report and remit unclaimed property to the state of Texas. The form is designed to help businesses and organizations comply with the state's unclaimed property laws, which require them to report and turn over abandoned or unclaimed assets to the state.

In this article, we will delve into the details of the Texas One in the Same form, explaining its purpose, benefits, and requirements. We will also provide guidance on how to complete the form and submit it to the state.

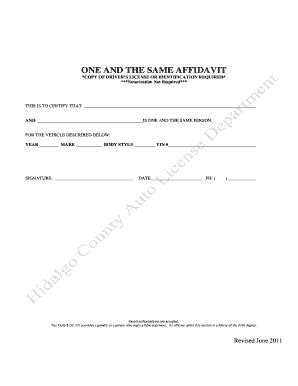

What is the Texas One in the Same Form?

The Texas One in the Same form is a standardized document used to report and remit unclaimed property to the state of Texas. The form is designed to simplify the reporting process and ensure that businesses and organizations comply with the state's unclaimed property laws.

Purpose of the Form

The primary purpose of the Texas One in the Same form is to report and remit unclaimed property to the state. Unclaimed property includes assets such as:

- Bank accounts

- Stocks and bonds

- Insurance proceeds

- Utility deposits

- Wages and salaries

These assets are considered abandoned or unclaimed when the owner cannot be located or has not claimed the asset within a specified period.

Benefits of the Texas One in the Same Form

The Texas One in the Same form provides several benefits to businesses and organizations, including:

- Simplified reporting process: The form provides a standardized format for reporting unclaimed property, making it easier for businesses to comply with the state's laws.

- Reduced administrative burden: By using the form, businesses can reduce the administrative burden associated with reporting unclaimed property.

- Compliance with state laws: The form ensures that businesses comply with the state's unclaimed property laws, reducing the risk of penalties and fines.

Requirements for Completing the Form

To complete the Texas One in the Same form, businesses and organizations must provide the following information:

- Name and address of the holder (business or organization)

- Name and address of the owner (individual or business)

- Type of property (e.g., bank account, stock, etc.)

- Property value

- Date the property became unclaimed

The form must be completed accurately and thoroughly, as incomplete or inaccurate information may result in delays or penalties.

Steps for Completing the Form

To complete the Texas One in the Same form, follow these steps:

- Gather all necessary information, including the name and address of the holder and owner, type of property, property value, and date the property became unclaimed.

- Complete the form accurately and thoroughly, using the required information.

- Review the form for completeness and accuracy.

- Sign and date the form.

- Submit the form to the state, along with any required attachments or supporting documentation.

Submission Requirements

The Texas One in the Same form must be submitted to the state, along with any required attachments or supporting documentation. The form can be submitted electronically or by mail.

- Electronic submission: The form can be submitted electronically through the Texas Comptroller's website.

- Mail submission: The form can be submitted by mail to the Texas Comptroller's office.

Attachments and Supporting Documentation

The following attachments and supporting documentation may be required when submitting the Texas One in the Same form:

- Proof of due diligence (e.g., proof of mailings or attempts to contact the owner)

- Proof of property value (e.g., bank statements or stock certificates)

- Supporting documentation (e.g., copies of checks or drafts)

Penalties and Fines

Failure to comply with the Texas One in the Same form requirements may result in penalties and fines. These penalties can include:

- Late filing fees

- Interest on unpaid property

- Penalties for non-compliance

It is essential to comply with the state's unclaimed property laws and submit the Texas One in the Same form accurately and on time to avoid these penalties.

Conclusion

The Texas One in the Same form is an essential document for businesses and organizations to report and remit unclaimed property to the state. By understanding the form's purpose, benefits, and requirements, businesses can ensure compliance with the state's unclaimed property laws and avoid penalties and fines.

We encourage you to share your experiences and ask questions about the Texas One in the Same form in the comments section below. Your feedback and insights will help others understand the importance of this document and how to complete it accurately.

What is the purpose of the Texas One in the Same form?

+The Texas One in the Same form is used to report and remit unclaimed property to the state of Texas.

What types of property are reported on the form?

+The form reports abandoned or unclaimed assets, including bank accounts, stocks and bonds, insurance proceeds, utility deposits, and wages and salaries.

How do I submit the Texas One in the Same form?

+The form can be submitted electronically or by mail to the Texas Comptroller's office.