The world of taxes can be overwhelming, especially for small business owners and self-employed individuals. However, understanding and utilizing the right tax forms can be a game-changer when it comes to saving money. One such form is the Schedule C (Form 1040), also known as the "Profit or Loss from Business" form. In this article, we will delve into the world of Schedule C, exploring its benefits, how it works, and providing practical examples to help you navigate this complex form.

What is Schedule C Form?

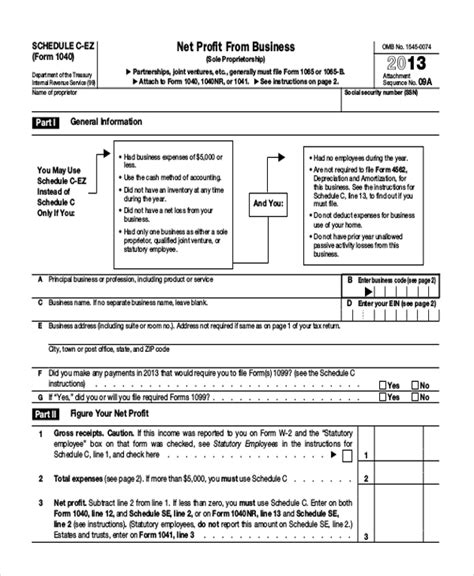

Schedule C is a tax form used by the Internal Revenue Service (IRS) to report the income and expenses of a business. It is typically used by sole proprietors, single-member limited liability companies (LLCs), and single-owner S corporations. The form is used to calculate the net profit or loss of a business, which is then reported on the individual's tax return (Form 1040).

Benefits of Using Schedule C Form

Using Schedule C Form can provide several benefits for small business owners and self-employed individuals. Some of the most significant advantages include:

- Tax Savings: By accurately reporting business expenses, you can reduce your taxable income and lower your tax liability.

- Deduct Business Expenses: Schedule C allows you to deduct business expenses, such as supplies, travel expenses, and equipment, which can help reduce your taxable income.

- Simplified Tax Filing: Schedule C simplifies the tax filing process by providing a single form to report business income and expenses.

How to Fill Out Schedule C Form

Filling out Schedule C Form can seem daunting, but breaking it down into sections can make the process more manageable. Here's a step-by-step guide to help you navigate the form:

- Section A: Business Information: Provide basic business information, such as your business name, address, and type of business.

- Section B: Income: Report all business income, including sales, services, and interest income.

- Section C: Cost of Goods Sold: Calculate the cost of goods sold, including the cost of materials, labor, and overhead.

- Section D: Operating Expenses: Report all business operating expenses, such as salaries, rent, and utilities.

- Section E: Other Expenses: Report any other business expenses, such as travel expenses, equipment, and supplies.

Common Mistakes to Avoid

When filling out Schedule C Form, it's essential to avoid common mistakes that can lead to errors and even audits. Some common mistakes to avoid include:

- Inaccurate Income Reporting: Ensure you accurately report all business income, including cash and credit transactions.

- Insufficient Expense Documentation: Keep accurate records of all business expenses, including receipts and invoices.

- Failure to Report Business Use Percentage: If you use your home or vehicle for business purposes, ensure you report the correct business use percentage.

Tips for Maximizing Tax Savings

To maximize tax savings, consider the following tips:

- Keep Accurate Records: Maintain accurate records of all business income and expenses.

- Take Advantage of Business Expense Deductions: Claim all eligible business expense deductions, including home office deductions and travel expenses.

- Consult a Tax Professional: If you're unsure about any aspect of Schedule C Form, consider consulting a tax professional.

Common Deductions for Small Business Owners

As a small business owner, you may be eligible for several deductions that can help reduce your taxable income. Some common deductions include:

- Home Office Deduction: Deduct a portion of your rent or mortgage interest and utilities as a business expense.

- Travel Expenses: Deduct business-related travel expenses, including transportation, meals, and lodging.

- Equipment and Supplies: Deduct the cost of equipment and supplies, including computers, printers, and software.

Conclusion: Take Control of Your Taxes

Schedule C Form can seem overwhelming, but by understanding its benefits and how to accurately fill it out, you can take control of your taxes and maximize your savings. Remember to keep accurate records, take advantage of business expense deductions, and consult a tax professional if needed. By doing so, you'll be well on your way to reducing your taxable income and saving money on your taxes.

We hope this article has provided you with a comprehensive understanding of Schedule C Form and its benefits. If you have any questions or comments, please feel free to share them below.

What is the purpose of Schedule C Form?

+Schedule C Form is used to report the income and expenses of a business, allowing small business owners and self-employed individuals to calculate their net profit or loss.

What are the benefits of using Schedule C Form?

+The benefits of using Schedule C Form include tax savings, deducting business expenses, and simplifying the tax filing process.

How do I fill out Schedule C Form?

+To fill out Schedule C Form, provide basic business information, report all business income, calculate the cost of goods sold, and report all business operating expenses.