Filing taxes can be a daunting task, especially when dealing with state-specific forms. For residents of Maryland, one of the most important forms to file is the Form 502, also known as the Maryland Personal Income Tax Return. This form is used to report an individual's income, deductions, and credits to the state of Maryland. In this article, we will provide you with 5 tips to help you file your Form 502 correctly and efficiently.

Understanding the Form 502 Filing Requirements

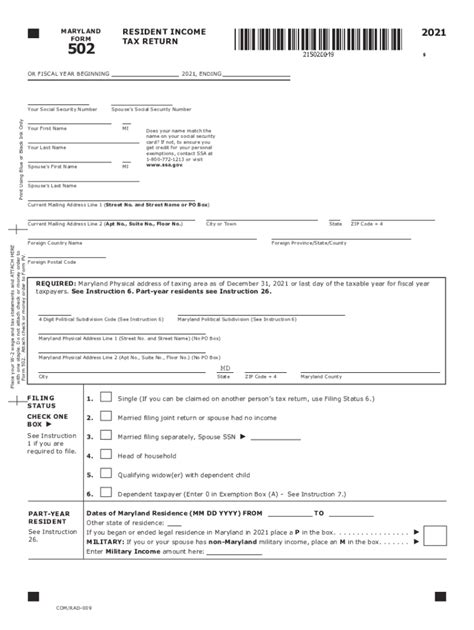

Before we dive into the tips, it's essential to understand who needs to file Form 502 and what the filing requirements are. Generally, you need to file a Maryland state income tax return if you are a resident of Maryland and have a gross income that exceeds the minimum filing threshold. This threshold varies based on your filing status, age, and other factors.

Tip 1: Gather All Necessary Documents and Information

To ensure a smooth filing process, it's crucial to gather all the necessary documents and information before starting to fill out Form 502. Some of the documents you may need include:

- Your W-2 forms from all employers

- Your 1099 forms for freelance work or other income

- Your interest and dividend statements (1099-INT and 1099-DIV)

- Your state and local tax withheld statements

- Your deductions and credits information (e.g., charitable donations, mortgage interest)

Tip 2: Choose the Correct Filing Status

Your filing status plays a significant role in determining your tax liability. Maryland recognizes the same filing statuses as the federal government, including:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the correct filing status to ensure you receive the correct tax rates and deductions.

**Form 502 Filing Methods**

You can file Form 502 using one of the following methods:

E-Filing

E-filing is a convenient and efficient way to file your Form 502. You can use tax software like TurboTax or H&R Block to guide you through the filing process. E-filing also reduces the risk of errors and ensures faster processing of your return.

Mail Filing

If you prefer to file by mail, you can download the Form 502 from the Maryland Comptroller's website or pick one up at a local library or tax office. Make sure to sign and date the form, attach all required documents, and mail it to the address listed in the instructions.

Tax Professional

If you're not comfortable filing Form 502 yourself, you can hire a tax professional to do it for you. They can guide you through the process and ensure that your return is accurate and complete.

Tip 3: Take Advantage of Tax Credits and Deductions

Maryland offers various tax credits and deductions that can help reduce your tax liability. Some of the most common credits and deductions include:

- The Earned Income Tax Credit (EITC)

- The Child Tax Credit

- The Mortgage Interest Deduction

- The Charitable Donations Deduction

Make sure to claim all the credits and deductions you're eligible for to minimize your tax liability.

**Common Tax Credits and Deductions**

- Earned Income Tax Credit (EITC): A refundable credit for low-to-moderate-income working individuals and families.

- Child Tax Credit: A non-refundable credit for families with qualifying children under the age of 17.

- Mortgage Interest Deduction: A deduction for interest paid on a primary residence or second home.

- Charitable Donations Deduction: A deduction for donations to qualified charitable organizations.

Tip 4: File for an Extension if Needed

If you're unable to file your Form 502 by the April 15th deadline, you can file for an automatic six-month extension. This will give you until October 15th to file your return. However, keep in mind that you'll still need to pay any estimated tax due by the original deadline to avoid penalties and interest.

Tip 5: Check Your Refund Status

After filing your Form 502, you can check the status of your refund using the Maryland Comptroller's website or by contacting their customer service department. Make sure to have your Social Security number or Individual Taxpayer Identification Number (ITIN) and your refund amount ready.

**Refund Options**

You can choose to receive your refund via:

- Direct deposit

- Paper check

- Debit card

Direct deposit is the fastest and most secure way to receive your refund.

By following these 5 tips, you'll be well on your way to filing your Form 502 correctly and efficiently. Remember to stay organized, take advantage of tax credits and deductions, and check your refund status to ensure a smooth tax filing experience.

Invite Engagement

Have you filed your Form 502 yet? Share your experience and tips with us in the comments below! If you have any questions or need help with filing your Form 502, feel free to ask. We're here to help.

What is the deadline to file Form 502?

+The deadline to file Form 502 is April 15th. However, you can file for an automatic six-month extension, which will give you until October 15th to file your return.

Can I e-file my Form 502?

+Yes, you can e-file your Form 502 using tax software like TurboTax or H&R Block. E-filing is a convenient and efficient way to file your return and reduces the risk of errors.

How do I check my refund status?

+You can check your refund status using the Maryland Comptroller's website or by contacting their customer service department. Have your Social Security number or ITIN and your refund amount ready.