The SD100 tax form is an essential document for businesses operating in Virginia, serving as an application for a business tax exemption or a return for state business taxes. Given its importance, mastering the SD100 tax form filing process is crucial to avoid errors, potential penalties, and delays in processing your tax returns. In this article, we will delve into five practical tips to help you efficiently manage and complete the SD100 tax form filing process.

Understanding the SD100 Tax Form

Before diving into the tips for mastering the SD100 tax form filing process, it's essential to understand what the form is and its purpose. The SD100 form is a critical document required by the Virginia Department of Taxation for businesses to report their annual gross receipts and pay any applicable taxes. This form is particularly relevant for businesses that have not obtained a certificate of exemption.

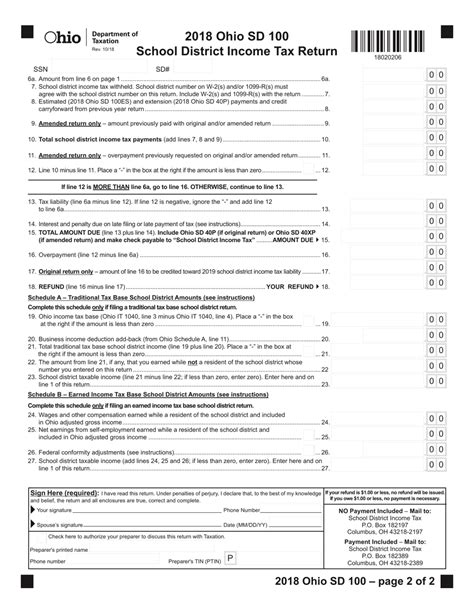

What Information Does the SD100 Tax Form Require?

The SD100 tax form requires various pieces of information, including the business name, address, federal tax ID number, type of business, total annual gross receipts, and the tax amount due. Accurately providing this information is crucial for a smooth filing process.

Tips for Mastering the SD100 Tax Form Filing

1. Ensure Timely Filing

One of the most critical tips for mastering the SD100 tax form filing is to ensure timely filing. The Virginia Department of Taxation requires businesses to file the SD100 form by May 1st each year. Missing this deadline can result in penalties and interest, which can significantly add to the overall tax liability.

2. Maintain Accurate Records

Maintaining accurate and detailed financial records is essential for accurately completing the SD100 tax form. Ensure that your business keeps track of all income and expenses throughout the year. This includes receipts for all sales, purchases, and expenses, as well as records of depreciation, inventory, and accounts payable and receivable.

3. Understand Business Tax Exemptions

Understanding business tax exemptions is another crucial tip for mastering the SD100 tax form filing process. If your business is exempt from paying certain taxes, ensure you claim these exemptions on the SD100 form. This can help reduce your tax liability and ensure compliance with Virginia tax laws.

4. Seek Professional Assistance

Given the complexity of tax laws and the potential consequences of errors, seeking professional assistance is highly recommended. A qualified accountant or tax professional can help guide you through the SD100 tax form filing process, ensuring accuracy and compliance with all applicable laws.

Benefits of Professional Assistance

- Ensures accuracy and reduces the risk of errors

- Provides guidance on claiming tax exemptions and deductions

- Helps navigate complex tax laws and regulations

- Offers expert advice on tax planning and optimization strategies

5. Stay Informed About Tax Law Changes

Finally, staying informed about changes to tax laws and regulations is essential for mastering the SD100 tax form filing process. Tax laws and regulations are subject to change, and it's crucial to stay up-to-date to ensure compliance and accuracy.

How to Stay Informed

- Regularly visit the Virginia Department of Taxation website

- Subscribe to tax law updates and newsletters

- Attend tax seminars and workshops

- Consult with a tax professional

What is the purpose of the SD100 tax form?

+The SD100 tax form is used by businesses in Virginia to report their annual gross receipts and pay any applicable taxes.

What is the deadline for filing the SD100 tax form?

+The SD100 tax form must be filed by May 1st each year.

Why is it essential to maintain accurate records for the SD100 tax form filing?

+Maintaining accurate records ensures that your business accurately reports its annual gross receipts and claims any applicable tax exemptions or deductions.

By following these five tips, businesses in Virginia can master the SD100 tax form filing process, ensuring compliance with tax laws and regulations, and avoiding potential penalties and interest. If you have any questions or need further guidance, don't hesitate to share your thoughts or seek professional assistance.