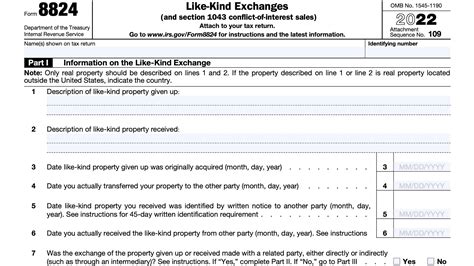

Selling your home or investment property can be a daunting task, especially when it comes to navigating the complex world of tax forms. One of the most important forms you'll need to complete is IRS Form 8824, also known as the "Like-Kind Exchanges" form. In this article, we'll break down the 7 steps to complete IRS Form 8824 like a pro, helping you to avoid costly mistakes and ensure a smooth transaction.

What is IRS Form 8824?

IRS Form 8824 is used to report like-kind exchanges, also known as 1031 exchanges, under Section 1031 of the Internal Revenue Code. A like-kind exchange is a transaction in which you exchange one investment property for another, without recognizing gain or loss for tax purposes. This form is typically used by real estate investors, business owners, and individuals who have exchanged properties.

Step 1: Gather Required Information

Before starting to complete IRS Form 8824, gather all the necessary information and documents. You'll need:

- The names and taxpayer identification numbers (TINs) of all parties involved in the exchange

- A description of the properties exchanged, including the address, type of property, and date of exchange

- The fair market value of each property at the time of exchange

- The adjusted basis of each property

- The gain or loss realized on the exchange

Why is IRS Form 8824 Important?

Completing IRS Form 8824 accurately is crucial to avoid potential tax liabilities and penalties. If you fail to report a like-kind exchange correctly, you may be subject to:

- Recognition of gain or loss on the exchange

- Penalty for failure to file or pay taxes

- Interest on unpaid taxes

Step 2: Identify the Type of Exchange

Determine the type of exchange you're reporting:

- A simultaneous exchange, where the properties are exchanged at the same time

- A deferred exchange, where the properties are exchanged over a period of time

- A reverse exchange, where the replacement property is acquired before the relinquished property is sold

How to Calculate Gain or Loss

To calculate gain or loss on the exchange, you'll need to determine the fair market value of each property and the adjusted basis of each property. The gain or loss is calculated as follows:

- Gain = Fair Market Value of Replacement Property - Adjusted Basis of Relinquished Property

- Loss = Adjusted Basis of Relinquished Property - Fair Market Value of Replacement Property

Step 3: Complete Part I - Identification of Properties

Complete Part I of the form by providing the required information about the properties exchanged:

- Description of the properties

- Date of exchange

- Fair market value of each property

- Adjusted basis of each property

Step 4: Complete Part II - Calculation of Gain or Loss

Complete Part II of the form by calculating the gain or loss on the exchange:

- Calculate the gain or loss using the formula above

- Report the gain or loss on the form

Step 5: Complete Part III - Statement of Deferred Exchanges

If you're reporting a deferred exchange, complete Part III of the form:

- Provide the date of the exchange

- Describe the properties exchanged

- Report the fair market value of each property

Step 6: Complete Part IV - Signature and Verification

Complete Part IV of the form by signing and verifying the information:

- Sign the form as the taxpayer or authorized representative

- Verify that the information is accurate and complete

Step 7: File the Form

File IRS Form 8824 with the IRS by the due date of your tax return:

- Attach the form to your tax return (Form 1040 or Form 1120)

- File the form electronically or by mail

Conclusion

Completing IRS Form 8824 accurately is crucial to avoid potential tax liabilities and penalties. By following these 7 steps, you'll be able to complete the form like a pro and ensure a smooth transaction. Remember to gather all required information, identify the type of exchange, calculate gain or loss, and file the form on time.

Additional Resources

For more information on IRS Form 8824, visit the IRS website or consult with a tax professional.

What is the deadline for filing IRS Form 8824?

+The deadline for filing IRS Form 8824 is the same as the deadline for filing your tax return (Form 1040 or Form 1120).

Can I file IRS Form 8824 electronically?

+Yes, you can file IRS Form 8824 electronically through the IRS website or through a tax preparation software.

What is the penalty for failure to file IRS Form 8824?

+The penalty for failure to file IRS Form 8824 can range from $100 to $10,000, depending on the circumstances.