As a homeowner in Montana, you're likely aware of the significant tax burden that comes with owning a property in the state. However, did you know that you might be eligible for a property tax rebate? The Montana Department of Revenue offers a rebate program designed to help homeowners offset the cost of property taxes. In this article, we'll delve into the details of the Montana Property Tax Rebate Form and guide you through the application process.

What is the Montana Property Tax Rebate Program?

The Montana Property Tax Rebate Program is a state-funded initiative aimed at providing financial assistance to eligible homeowners. The program is designed to help homeowners who are struggling to pay their property taxes, particularly those who are low-income, elderly, or disabled. The rebate program can help reduce the financial burden of property taxes, making it easier for homeowners to stay in their homes.

Eligibility Requirements

To be eligible for the Montana Property Tax Rebate Program, you must meet certain requirements. These include:

- Being a Montana resident

- Owning and occupying a primary residence in Montana

- Having a total household income that does not exceed the maximum allowed amount (this amount varies depending on the number of dependents and other factors)

- Being 62 years of age or older, or having a disability

- Having paid property taxes on your primary residence in Montana

How to Apply for the Montana Property Tax Rebate

Applying for the Montana Property Tax Rebate Program is a relatively straightforward process. Here are the steps you need to follow:

- Gather required documents: You'll need to provide proof of income, age, and disability (if applicable). You'll also need to provide documentation showing that you've paid property taxes on your primary residence in Montana.

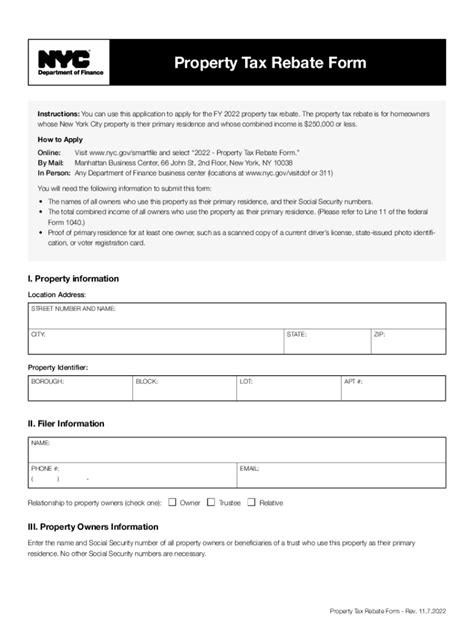

- Download and complete the application form: You can download the Montana Property Tax Rebate Form from the Montana Department of Revenue website. Fill out the form carefully and accurately, making sure to sign and date it.

- Submit your application: You can submit your application by mail or in person at a local Department of Revenue office. Make sure to include all required documentation and a copy of your property tax bill.

What to Expect After Submitting Your Application

After submitting your application, you can expect the following:

- Processing time: The Montana Department of Revenue typically processes rebate applications within 6-8 weeks.

- Rebate amount: The rebate amount will depend on your income level, age, and disability status. The maximum rebate amount is $1,000.

- Rebate payment: If your application is approved, you'll receive a rebate payment in the form of a check or direct deposit.

Additional Tips and Reminders

Here are some additional tips and reminders to keep in mind:

- Application deadline: The application deadline is typically June 30th of each year.

- Income limits: Income limits apply to the rebate program. Make sure to check the Montana Department of Revenue website for the latest income limits.

- Rebate payment schedule: Rebate payments are typically made in the summer months.

Frequently Asked Questions

Here are some frequently asked questions about the Montana Property Tax Rebate Program:

What is the deadline for applying for the Montana Property Tax Rebate Program?

The application deadline is typically June 30th of each year.

How much can I expect to receive in rebates?

The rebate amount will depend on your income level, age, and disability status. The maximum rebate amount is $1,000.

Can I apply for the rebate program online?

No, you cannot apply for the rebate program online. You must download and complete the application form, then submit it by mail or in person at a local Department of Revenue office.

What is the income limit for the Montana Property Tax Rebate Program?

+The income limit varies depending on the number of dependents and other factors. Check the Montana Department of Revenue website for the latest income limits.

Can I apply for the rebate program if I'm a renter?

+No, the rebate program is only available to homeowners who pay property taxes on their primary residence in Montana.

How long does it take to process my rebate application?

+The Montana Department of Revenue typically processes rebate applications within 6-8 weeks.

We hope this guide has provided you with a comprehensive understanding of the Montana Property Tax Rebate Program. If you're eligible, don't hesitate to apply – the rebate could make a significant difference in your financial situation. Share this article with friends and family who may be eligible, and don't forget to comment below with any questions or concerns you may have.