As a resident of Hawaii, it's essential to understand the importance of filing tax forms accurately and on time. One of the most critical forms for Hawaii residents is the N-11 form, which is used to report income tax. In this article, we will delve into the world of Mail Hawaii Form N-11, exploring the easy filing options available to you.

Filing your N-11 form can be a daunting task, especially if you're new to Hawaii or haven't filed taxes before. However, with the right guidance, you can ensure that your tax return is accurate and submitted on time. In this article, we will discuss the various easy filing options available for Mail Hawaii Form N-11, including e-filing, paper filing, and using tax preparation software.

What is the N-11 Form?

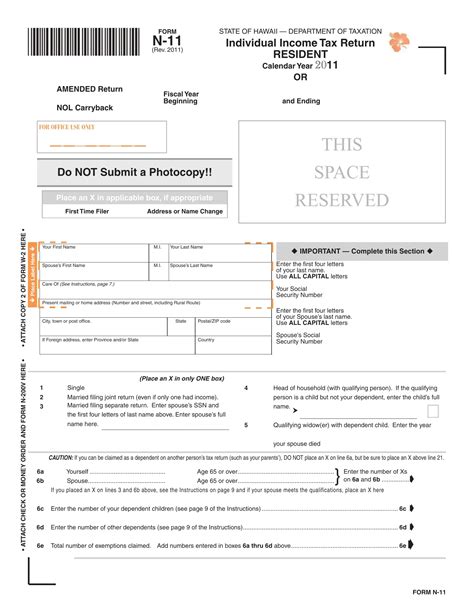

The N-11 form is the individual income tax return form for the state of Hawaii. It's used to report your income, deductions, and credits, and to calculate your tax liability. The form is similar to the federal Form 1040, but it's specific to Hawaii and requires additional information.

The N-11 form is used to report various types of income, including wages, salaries, tips, and self-employment income. You'll also need to report any deductions and credits you're eligible for, such as the standard deduction, mortgage interest deduction, and earned income tax credit.

Easy Filing Options for Mail Hawaii Form N-11

Filing your N-11 form can be a breeze, thanks to the various easy filing options available. Here are some of the most popular options:

E-Filing

E-filing is the fastest and most convenient way to file your N-11 form. You can e-file your return through the Hawaii Department of Taxation's website or through a tax preparation software. E-filing allows you to submit your return electronically, which reduces the risk of errors and ensures that your return is processed quickly.

To e-file your N-11 form, you'll need to create an account on the Hawaii Department of Taxation's website or use a tax preparation software that supports e-filing. You'll need to provide your personal and tax information, including your social security number, address, and income details.

Paper Filing

If you prefer to file your N-11 form by mail, you can do so by downloading the form from the Hawaii Department of Taxation's website or picking one up from a local library or post office. You'll need to fill out the form accurately and completely, making sure to sign and date it.

Once you've completed the form, you can mail it to the Hawaii Department of Taxation at the address listed on the form. Make sure to include any required supporting documentation, such as W-2 forms and 1099 forms.

Tax Preparation Software

Tax preparation software is another easy filing option for Mail Hawaii Form N-11. These programs guide you through the tax filing process, ensuring that you report your income and deductions accurately. Some popular tax preparation software includes TurboTax, H&R Block, and TaxAct.

To use tax preparation software, you'll need to create an account and provide your personal and tax information. The software will guide you through the tax filing process, asking you questions and providing instructions on how to report your income and deductions.

Benefits of Easy Filing Options

The easy filing options for Mail Hawaii Form N-11 offer several benefits, including:

- Convenience: E-filing and tax preparation software make it easy to file your taxes from the comfort of your own home.

- Accuracy: E-filing and tax preparation software reduce the risk of errors, ensuring that your return is accurate and complete.

- Speed: E-filing allows you to submit your return electronically, which reduces processing time and ensures that you receive your refund quickly.

- Security: E-filing and tax preparation software provide a secure way to file your taxes, protecting your personal and financial information.

Common Mistakes to Avoid

When filing your N-11 form, it's essential to avoid common mistakes that can delay processing or result in errors. Here are some common mistakes to avoid:

- Inaccurate or incomplete information: Make sure to provide accurate and complete information, including your social security number, address, and income details.

- Math errors: Double-check your math to ensure that your calculations are accurate.

- Missing supporting documentation: Make sure to include any required supporting documentation, such as W-2 forms and 1099 forms.

- Incorrect filing status: Ensure that you're filing with the correct filing status, such as single, married, or head of household.

Conclusion

Filing your N-11 form doesn't have to be a daunting task. With the easy filing options available, you can ensure that your tax return is accurate and submitted on time. Remember to avoid common mistakes and take advantage of the benefits offered by e-filing, paper filing, and tax preparation software.

We hope this article has provided you with valuable information on Mail Hawaii Form N-11 and the easy filing options available. If you have any questions or concerns, please don't hesitate to comment below.

What is the deadline for filing the N-11 form?

+The deadline for filing the N-11 form is April 20th of each year.

Can I e-file my N-11 form if I have a balance due?

+What is the penalty for late filing of the N-11 form?

+The penalty for late filing of the N-11 form is 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%.