As a US taxpayer with foreign income, navigating the complexities of foreign tax credits can be a daunting task. However, with the right guidance, claiming foreign tax credits can be a straightforward process. In this article, we will delve into the world of Form 1116 Schedule B, exploring its purpose, benefits, and step-by-step instructions on how to claim foreign tax credits.

Understanding Foreign Tax Credits

Foreign tax credits are designed to alleviate the burden of double taxation on US taxpayers with foreign income. When a US taxpayer earns income abroad, they are subject to taxation in both the foreign country and the United States. To mitigate this double taxation, the US government allows taxpayers to claim a credit against their US tax liability for taxes paid to foreign governments.

The Role of Form 1116 Schedule B

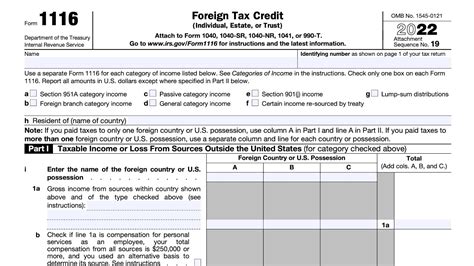

Form 1116, also known as the Foreign Tax Credit (Individual, Estate, or Trust), is used to calculate the foreign tax credit that can be claimed against US tax liability. Schedule B, in particular, is used to report income from foreign sources and calculate the foreign tax credit.

Benefits of Claiming Foreign Tax Credits

Claiming foreign tax credits can have numerous benefits for US taxpayers with foreign income. Some of the most significant advantages include:

- Reduced US tax liability: By claiming foreign tax credits, taxpayers can reduce their US tax liability, resulting in lower taxes owed.

- Avoidance of double taxation: Foreign tax credits help to alleviate the burden of double taxation, ensuring that taxpayers are not taxed twice on the same income.

- Increased refund: In some cases, claiming foreign tax credits can result in a larger refund or a reduced tax bill.

Step-by-Step Instructions for Claiming Foreign Tax Credits

Claiming foreign tax credits using Form 1116 Schedule B involves several steps. Here's a step-by-step guide to help you navigate the process:

Step 1: Gather Required Documents

Before starting the process, gather all necessary documents, including:

- Foreign tax returns and receipts

- W-2 and 1099 forms

- Foreign income statements

- Tax treaties and agreements

Step 2: Complete Form 1116

Complete Form 1116, ensuring to report all foreign income and taxes paid. This includes income from:

- Foreign employment

- Foreign investments

- Foreign real estate

- Foreign business income

Step 3: Calculate Foreign Tax Credit

Use Schedule B to calculate the foreign tax credit. This involves:

- Calculating the foreign tax credit limitation

- Determining the amount of foreign tax credit available

- Applying the foreign tax credit to US tax liability

Step 4: Report Foreign Tax Credit on US Tax Return

Report the foreign tax credit on your US tax return (Form 1040). This includes:

- Reporting the foreign tax credit on Line 48 of Form 1040

- Attaching Form 1116 and Schedule B to the tax return

Practical Examples and Statistical Data

To illustrate the benefits of claiming foreign tax credits, let's consider an example:

Suppose a US taxpayer earns $100,000 in foreign income and pays $20,000 in foreign taxes. Without claiming the foreign tax credit, the taxpayer would owe $24,000 in US taxes (24% of $100,000). However, by claiming the foreign tax credit, the taxpayer can reduce their US tax liability to $4,000 (4% of $100,000), resulting in a tax savings of $20,000.

According to the IRS, in 2020, over 1.3 million taxpayers claimed foreign tax credits, resulting in a total tax savings of over $10 billion.

Frequently Asked Questions

What is the purpose of Form 1116 Schedule B?

+Form 1116 Schedule B is used to report income from foreign sources and calculate the foreign tax credit.

What are the benefits of claiming foreign tax credits?

+Claiming foreign tax credits can result in reduced US tax liability, avoidance of double taxation, and increased refund.

What documents are required to claim foreign tax credits?

+Required documents include foreign tax returns and receipts, W-2 and 1099 forms, foreign income statements, and tax treaties and agreements.

Take Action Today

Don't miss out on the opportunity to reduce your US tax liability and avoid double taxation. Claiming foreign tax credits using Form 1116 Schedule B is a straightforward process that can result in significant tax savings. Gather the necessary documents, complete Form 1116, and report the foreign tax credit on your US tax return.

Share your experiences and tips on claiming foreign tax credits in the comments below.