Filing taxes can be a daunting task, especially when it comes to navigating the complexities of state-specific tax forms. For businesses operating in Hawaii, the General Excise Tax Form G-49 is a crucial document that requires attention to detail and accuracy. In this article, we'll provide five valuable tips to help you file your Hawaii General Excise Tax Form G-49 with confidence.

Understanding the General Excise Tax

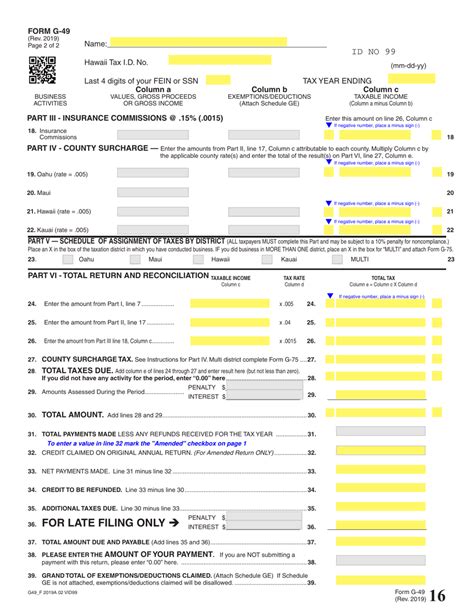

Before we dive into the tips, it's essential to understand the purpose of the General Excise Tax Form G-49. This form is used to report and pay the general excise tax, which is a tax on the gross income of businesses operating in Hawaii. The tax rate is 4.166% for most businesses, but it can vary depending on the type of business and the island where it operates.

Tip 1: Gather All Necessary Documents

To file your General Excise Tax Form G-49 accurately, you'll need to gather all the necessary documents and information. This includes:

- Your business's federal tax ID number

- Your Hawaii tax ID number

- Your business's gross income for the reporting period

- Any deductions or exemptions you're eligible for

- Records of any tax payments made during the reporting period

Make sure to have all these documents readily available to avoid delays or errors in the filing process.

Filing Status and Due Dates

Tip 2: Determine Your Filing Status and Due Date

Your filing status and due date will depend on the type of business you operate and the frequency of your tax payments. In Hawaii, businesses are required to file their General Excise Tax Form G-49 on a monthly, quarterly, or annual basis.

- Monthly filers: Due on the 20th day of the following month

- Quarterly filers: Due on the 20th day of the month following the end of the quarter

- Annual filers: Due on April 20th of the following year

Make sure to determine your filing status and due date to avoid late filing penalties.

Calculating Tax Liability

Tip 3: Calculate Your Tax Liability Accurately

Calculating your tax liability requires careful attention to detail. You'll need to calculate your gross income, deductions, and exemptions to determine your tax liability.

- Gross income: Total revenue from all sources

- Deductions: Allowable deductions, such as cost of goods sold or operating expenses

- Exemptions: Eligible exemptions, such as exemptions for certain types of income

Use the Hawaii Department of Taxation's tax calculator or consult with a tax professional to ensure accuracy.

Avoiding Common Errors

Tip 4: Avoid Common Errors

Common errors can lead to delays, penalties, or even audits. To avoid these issues, make sure to:

- Use the correct form and version

- Report all income and deductions accurately

- Sign and date the form

- Make timely payments

Double-check your form for errors before submitting it to the Hawaii Department of Taxation.

E-Filing and Payment Options

Tip 5: Explore E-Filing and Payment Options

The Hawaii Department of Taxation offers electronic filing and payment options to make the tax filing process more convenient. You can:

- E-file your General Excise Tax Form G-49 through the Hawaii Tax Online system

- Make payments online, by phone, or by mail

Take advantage of these options to streamline your tax filing process and avoid errors.

Staying Compliant

By following these five tips, you'll be well on your way to filing your Hawaii General Excise Tax Form G-49 with confidence. Remember to stay compliant with Hawaii's tax laws and regulations to avoid penalties and audits.

We hope this article has provided you with valuable insights and tips for filing your General Excise Tax Form G-49. If you have any questions or concerns, please don't hesitate to reach out to the Hawaii Department of Taxation or a tax professional for guidance.

Share your experiences and tips for filing the General Excise Tax Form G-49 in the comments below. Help us create a community of informed and compliant taxpayers in Hawaii!

What is the General Excise Tax Form G-49?

+The General Excise Tax Form G-49 is a tax form used to report and pay the general excise tax in Hawaii.

Who needs to file the General Excise Tax Form G-49?

+All businesses operating in Hawaii, including sole proprietorships, partnerships, corporations, and limited liability companies, need to file the General Excise Tax Form G-49.

What is the tax rate for the General Excise Tax?

+The tax rate for the General Excise Tax is 4.166% for most businesses, but it can vary depending on the type of business and the island where it operates.