In the United States, tax forms can be overwhelming, especially for those who are new to the process or are unfamiliar with the various types of forms. The 480.6 tax form, in particular, is one that can cause confusion due to its complex nature and the specific requirements it entails. However, understanding this form is crucial for individuals and businesses that need to report certain types of income or transactions. In this article, we will delve into the world of the 480.6 tax form, explaining its purpose, who needs to use it, and what information is required.

For individuals and businesses involved in specific financial transactions, the 480.6 tax form is a necessary tool for reporting income that falls under certain categories. The form is designed to help the Internal Revenue Service (IRS) track and process these transactions efficiently. By understanding the 480.6 tax form, filers can ensure they are meeting their tax obligations accurately and avoiding any potential penalties or delays.

What is the 480.6 Tax Form Used For?

The 480.6 tax form is used to report income from specific sources, including sales of tangible personal property, sales of real estate, and certain types of services. This form is typically used by individuals and businesses that engage in activities such as buying and selling goods, renting out properties, or providing services that fall under specific categories.

Who Needs to Use the 480.6 Tax Form?

Not everyone needs to use the 480.6 tax form. Generally, individuals and businesses that meet certain criteria are required to file this form. These include:

- Individuals who have sold tangible personal property, such as cars, boats, or equipment, and need to report the sale.

- Businesses that have sold real estate, including rental properties or commercial buildings.

- Service providers who have earned income from specific types of services, such as consulting or freelance work.

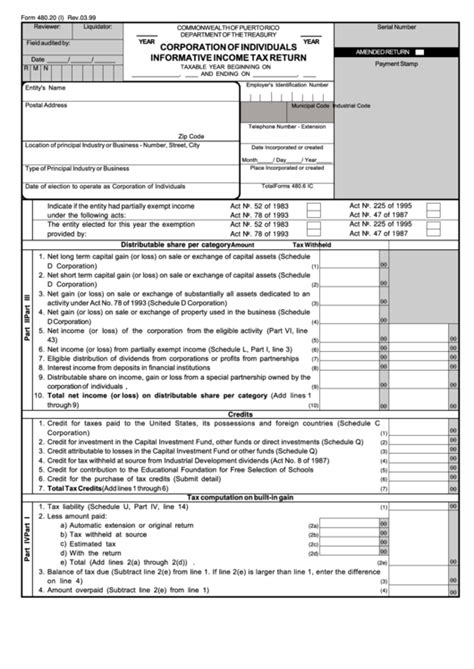

What Information is Required on the 480.6 Tax Form?

The 480.6 tax form requires specific information to be reported accurately. This includes:

- The type of transaction or activity being reported.

- The date of the transaction or activity.

- The gross income earned from the transaction or activity.

- Any deductions or exemptions claimed.

- The taxpayer's identification number (such as a Social Security number or Employer Identification Number).

How to Fill Out the 480.6 Tax Form

Filling out the 480.6 tax form can be a complex process, but it can be broken down into simple steps. Here's a step-by-step guide:

- Determine which type of transaction or activity you need to report.

- Gather all necessary documentation, including receipts, invoices, and records of income earned.

- Fill out the form accurately and completely, using the instructions provided by the IRS.

- Claim any deductions or exemptions you are eligible for.

- Review the form carefully to ensure all information is accurate and complete.

Benefits of Using the 480.6 Tax Form

Using the 480.6 tax form provides several benefits, including:

- Accurate reporting of income and transactions.

- Compliance with IRS regulations and requirements.

- Avoidance of penalties and fines for late or inaccurate filing.

- Simplified tax preparation and processing.

Common Mistakes to Avoid When Filing the 480.6 Tax Form

When filing the 480.6 tax form, it's essential to avoid common mistakes that can lead to delays or penalties. These include:

- Inaccurate or incomplete information.

- Failure to claim deductions or exemptions.

- Late filing or submission.

- Incorrect or missing taxpayer identification numbers.

Conclusion: Mastering the 480.6 Tax Form

Mastering the 480.6 tax form requires a clear understanding of its purpose, who needs to use it, and what information is required. By following the steps outlined in this article and avoiding common mistakes, individuals and businesses can ensure accurate and timely filing of their tax forms. If you have any questions or concerns about the 480.6 tax form, consult with a tax professional or contact the IRS directly.

Stay Ahead of Tax Season: Get the Latest Updates and Resources

Stay ahead of tax season by getting the latest updates and resources from the IRS and tax professionals. Follow these tips to ensure a smooth and stress-free tax filing experience:

- Check the IRS website regularly for updates and changes to tax forms and regulations.

- Consult with a tax professional or accountant to ensure accurate and timely filing.

- Take advantage of tax preparation software and tools to simplify the filing process.

Get Ready to File: A Final Checklist

Before filing your 480.6 tax form, make sure you have everything you need. Here's a final checklist to ensure a smooth and accurate filing experience:

- Gather all necessary documentation, including receipts, invoices, and records of income earned.

- Review the form carefully to ensure all information is accurate and complete.

- Claim any deductions or exemptions you are eligible for.

- Submit the form on time to avoid penalties and fines.

What is the purpose of the 480.6 tax form?

+The 480.6 tax form is used to report income from specific sources, including sales of tangible personal property, sales of real estate, and certain types of services.

Who needs to use the 480.6 tax form?

+Individuals and businesses that engage in activities such as buying and selling goods, renting out properties, or providing services that fall under specific categories need to use the 480.6 tax form.

What information is required on the 480.6 tax form?

+The 480.6 tax form requires specific information, including the type of transaction or activity being reported, the date of the transaction or activity, the gross income earned, and any deductions or exemptions claimed.