Filling out a CBP Form 434 Certificate of Origin is a crucial step in the process of exporting goods from the United States. The form serves as a declaration of the country of origin for the goods being exported, and it is required by U.S. Customs and Border Protection (CBP) to ensure compliance with various trade agreements and regulations. In this article, we will guide you through the process of filling out a CBP Form 434 Certificate of Origin, highlighting five key ways to ensure accuracy and compliance.

Understanding the CBP Form 434 Certificate of Origin

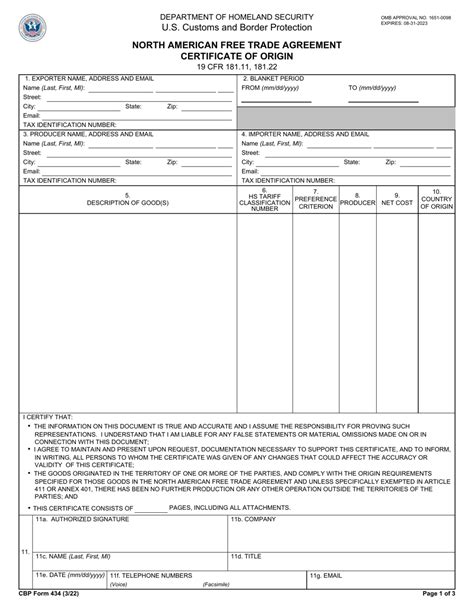

Before we dive into the specifics of filling out the form, it's essential to understand the purpose and scope of the CBP Form 434 Certificate of Origin. The form is used to certify the country of origin for goods being exported from the United States, and it is typically required for goods valued at $2,500 or more. The form is also used to determine eligibility for preferential tariff treatment under various trade agreements, such as the North American Free Trade Agreement (NAFTA) and the Central American Free Trade Agreement (CAFTA).

Way 1: Gather Required Information

Before filling out the CBP Form 434 Certificate of Origin, you will need to gather specific information about the goods being exported. This includes:

- The Harmonized System (HS) number for the goods being exported

- The country of origin for the goods

- The date of export

- The exporter's name and address

- The importer's name and address (if known)

- A detailed description of the goods being exported

Step-by-Step Guide to Gathering Required Information

To gather the required information, follow these steps:

- Determine the HS number for the goods being exported by consulting the Harmonized Tariff Schedule (HTS) or the Schedule B classification system.

- Identify the country of origin for the goods, taking into account any applicable rules of origin or regulations.

- Record the date of export, which is typically the date when the goods are shipped or delivered to the port of export.

- Verify the exporter's name and address, as well as the importer's name and address (if known).

- Prepare a detailed description of the goods being exported, including the type, quantity, and value.

Way 2: Fill Out the Form Accurately

Once you have gathered the required information, it's time to fill out the CBP Form 434 Certificate of Origin. The form consists of several sections, including:

- Section 1: Exporter's Information

- Section 2: Importer's Information (if known)

- Section 3: Goods Description

- Section 4: Country of Origin

- Section 5: Certification

Step-by-Step Guide to Filling Out the Form

To fill out the form accurately, follow these steps:

- Complete Section 1 by providing the exporter's name, address, and contact information.

- Complete Section 2 by providing the importer's name, address, and contact information (if known).

- Complete Section 3 by providing a detailed description of the goods being exported, including the type, quantity, and value.

- Complete Section 4 by identifying the country of origin for the goods, using the HS number and any applicable rules of origin or regulations.

- Complete Section 5 by certifying that the information provided is accurate and true.

Way 3: Use the Correct Format

The CBP Form 434 Certificate of Origin must be completed in a specific format, using a font size and style that is easy to read. The form must also be completed in English, using the metric system for weights and measures.

Step-by-Step Guide to Using the Correct Format

To use the correct format, follow these steps:

- Use a font size of at least 10 points, using a clear and legible font style.

- Complete the form in English, using the metric system for weights and measures.

- Use the correct units of measurement, such as kilograms or liters.

- Ensure that the form is completed neatly and accurately, with no corrections or alterations.

Way 4: Obtain Required Signatures

The CBP Form 434 Certificate of Origin must be signed by the exporter, as well as any other relevant parties, such as the importer or a third-party logistics provider.

Step-by-Step Guide to Obtaining Required Signatures

To obtain the required signatures, follow these steps:

- Obtain the exporter's signature, which must be original and not photocopied.

- Obtain the importer's signature, if known (this is optional but recommended).

- Obtain any other required signatures, such as those from third-party logistics providers.

Way 5: Retain Records

The CBP Form 434 Certificate of Origin must be retained by the exporter for a period of at least five years, along with any supporting documentation, such as commercial invoices and packing lists.

Step-by-Step Guide to Retaining Records

To retain records, follow these steps:

- Retain the original CBP Form 434 Certificate of Origin, along with any supporting documentation.

- Store the records in a secure and accessible location, such as a filing cabinet or electronic database.

- Ensure that the records are easily retrievable, in case of an audit or inspection.

By following these five ways to fill out a CBP Form 434 Certificate of Origin, you can ensure accuracy and compliance with U.S. Customs and Border Protection regulations. Remember to gather required information, fill out the form accurately, use the correct format, obtain required signatures, and retain records for at least five years.

What is the purpose of the CBP Form 434 Certificate of Origin?

+The CBP Form 434 Certificate of Origin is used to certify the country of origin for goods being exported from the United States, and to determine eligibility for preferential tariff treatment under various trade agreements.

What information is required to complete the CBP Form 434 Certificate of Origin?

+The form requires information about the goods being exported, including the Harmonized System (HS) number, country of origin, date of export, exporter's name and address, and importer's name and address (if known).

How long must records of the CBP Form 434 Certificate of Origin be retained?

+Records of the CBP Form 434 Certificate of Origin must be retained for a period of at least five years, along with any supporting documentation.