In the face of devastating natural disasters, the United States government has implemented various measures to alleviate the financial burdens on affected individuals. One such measure is the Qualified 2020 Disaster Retirement Plan Distributions, which is reported using Form 8915-G. This article delves into the intricacies of this form, explaining its purpose, benefits, and how it can be used to provide tax relief to those affected by disasters.

Understanding Form 8915-G

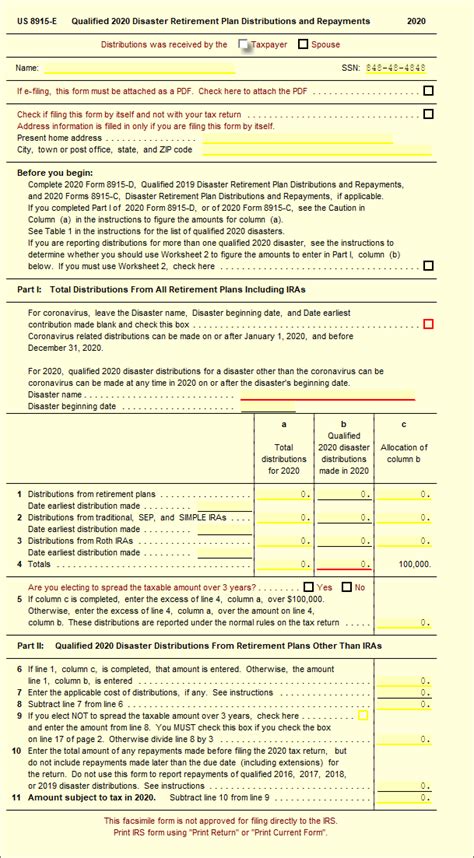

Form 8915-G is a tax form used to report qualified disaster retirement plan distributions. These distributions are made from eligible retirement plans, such as 401(k), 403(b), or individual retirement accounts (IRAs), to individuals affected by qualified disasters. The primary purpose of this form is to provide tax relief to those who have suffered losses due to disasters by allowing them to access their retirement funds without incurring penalties or taxes.

Benefits of Qualified Disaster Retirement Plan Distributions

Qualified disaster retirement plan distributions offer several benefits to affected individuals. Some of the key advantages include:

- Penalty-free access to retirement funds: Individuals can access their retirement funds without incurring the 10% penalty for early withdrawals.

- Tax relief: The distributions may be included in taxable income over a three-year period, reducing the tax burden.

- Repayment flexibility: Repayment of the distribution can be made over a three-year period, providing flexibility in managing finances.

Eligibility for Qualified Disaster Retirement Plan Distributions

To be eligible for qualified disaster retirement plan distributions, individuals must meet specific criteria:

- Affected by a qualified disaster: The individual must have been affected by a qualified disaster, such as a hurricane, wildfire, or flood, declared by the President or the Federal Emergency Management Agency (FEMA).

- Residence or business in the disaster area: The individual's principal residence or business must have been located in the disaster area at the time of the disaster.

- Loss due to the disaster: The individual must have suffered an economic loss due to the disaster.

Reporting Qualified Disaster Retirement Plan Distributions on Form 8915-G

To report qualified disaster retirement plan distributions, individuals must complete Form 8915-G and attach it to their tax return (Form 1040). The form requires the following information:

- Name and taxpayer identification number: The individual's name and taxpayer identification number (Social Security number or Employer Identification Number).

- Type of retirement plan: The type of retirement plan from which the distribution was made.

- Date of the distribution: The date of the distribution.

- Amount of the distribution: The amount of the distribution.

Steps to Complete Form 8915-G

To complete Form 8915-G, follow these steps:

- Gather required information: Collect the necessary information, including the type of retirement plan, date of the distribution, and amount of the distribution.

- Complete the form: Fill out Form 8915-G, ensuring accuracy and completeness.

- Attach to tax return: Attach the completed form to the tax return (Form 1040).

- Submit the tax return: Submit the tax return with the attached Form 8915-G to the Internal Revenue Service (IRS).

Incentive to Take Action

If you have been affected by a qualified disaster and have accessed your retirement funds, it is essential to report the distribution on Form 8915-G. This will help you take advantage of the tax relief and repayment flexibility offered by the qualified disaster retirement plan distributions.

We encourage you to share your experiences with qualified disaster retirement plan distributions in the comments section below. Your insights can help others understand the benefits and process of this tax relief measure.

What is Form 8915-G used for?

+Form 8915-G is used to report qualified disaster retirement plan distributions.

What are the benefits of qualified disaster retirement plan distributions?

+The benefits include penalty-free access to retirement funds, tax relief, and repayment flexibility.

How do I report qualified disaster retirement plan distributions on Form 8915-G?

+To report qualified disaster retirement plan distributions, complete Form 8915-G and attach it to your tax return (Form 1040).