The PTAX form, also known as the Illinois Property Tax Appeal Form, is a crucial document for property owners in Illinois who wish to appeal their property tax assessments. Filing a PTAX form can be a daunting task, especially for those who are new to the process. However, understanding the form and its requirements can help property owners navigate the appeal process with ease.

The PTAX form is designed to help property owners dispute their property tax assessments, which are typically determined by the local assessor's office. If a property owner believes that their property tax assessment is incorrect or unfair, they can file a PTAX form to initiate the appeal process. The form requires property owners to provide detailed information about their property, including its value, location, and other relevant factors.

One of the main reasons property owners file a PTAX form is to dispute the assessed value of their property. The assessed value is the value assigned to a property by the local assessor's office, which is then used to calculate the property tax bill. If a property owner believes that the assessed value is too high, they can file a PTAX form to request a lower assessment.

Benefits of Filing a PTAX Form

Filing a PTAX form can have several benefits for property owners. One of the main benefits is the potential to reduce property tax bills. If a property owner is successful in their appeal, they may be able to lower their assessed value, which can result in lower property tax bills.

Another benefit of filing a PTAX form is the opportunity to correct errors or inaccuracies in the property tax assessment. If a property owner discovers an error or inaccuracy in their assessment, they can file a PTAX form to request a correction.

In addition, filing a PTAX form can also help property owners ensure that their property tax assessment is fair and equitable. The appeal process allows property owners to present evidence and arguments to support their claim, which can help ensure that their assessment is accurate and fair.

How to File a PTAX Form

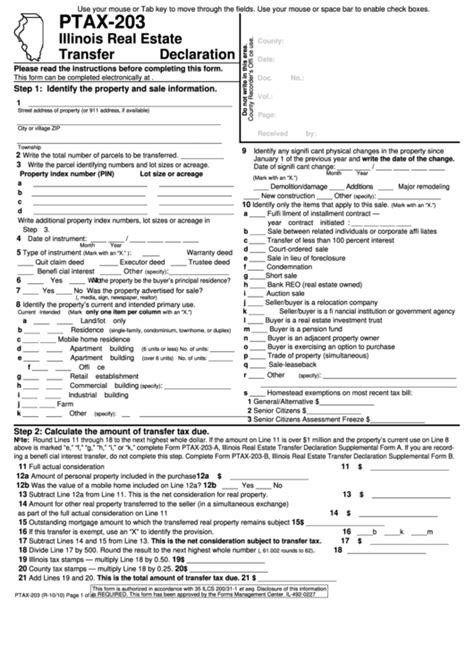

Filing a PTAX form is a relatively straightforward process. Property owners can obtain a PTAX form from the Illinois Department of Revenue or from their local assessor's office. The form requires property owners to provide detailed information about their property, including its value, location, and other relevant factors.

Once the form is completed, property owners must submit it to the local assessor's office or the Illinois Department of Revenue. The deadline for filing a PTAX form varies depending on the location and the type of appeal.

What to Expect During the Appeal Process

The appeal process typically begins with a review of the PTAX form by the local assessor's office or the Illinois Department of Revenue. If the appeal is deemed valid, the property owner will be scheduled for a hearing with the local board of review or the Illinois Property Tax Appeal Board.

During the hearing, the property owner will have the opportunity to present evidence and arguments to support their claim. The board will review the evidence and make a decision regarding the property tax assessment.

Tips for Filing a Successful PTAX Form

Filing a successful PTAX form requires careful attention to detail and a thorough understanding of the appeal process. Here are some tips to help property owners increase their chances of success:

- Ensure that all information on the PTAX form is accurate and complete.

- Provide detailed evidence to support the appeal, including photos, appraisals, and other relevant documents.

- Be prepared to present a clear and concise argument during the hearing.

- Understand the appeal process and the deadlines for filing a PTAX form.

Common Mistakes to Avoid When Filing a PTAX Form

When filing a PTAX form, it's essential to avoid common mistakes that can delay or even deny the appeal. Here are some mistakes to avoid:

- Failing to provide complete and accurate information on the PTAX form.

- Missing the deadline for filing a PTAX form.

- Failing to provide sufficient evidence to support the appeal.

- Not being prepared to present a clear and concise argument during the hearing.

Conclusion

Filing a PTAX form can be a complex and time-consuming process, but understanding the form and its requirements can help property owners navigate the appeal process with ease. By following the tips outlined in this article and avoiding common mistakes, property owners can increase their chances of success and potentially reduce their property tax bills.

We encourage you to share your experiences with filing a PTAX form in the comments section below. Have you successfully appealed your property tax assessment? What tips do you have for other property owners? Share your story and help others navigate the appeal process.

What is the PTAX form used for?

+The PTAX form is used to appeal a property tax assessment in Illinois.

How do I obtain a PTAX form?

+You can obtain a PTAX form from the Illinois Department of Revenue or from your local assessor's office.

What is the deadline for filing a PTAX form?

+The deadline for filing a PTAX form varies depending on the location and the type of appeal. Check with your local assessor's office or the Illinois Department of Revenue for specific deadlines.