As a business owner or taxpayer, you may be required to file Form SSA-7004, also known as the Certificate of Employer's Federal Tax Deposit, with the Social Security Administration (SSA). This form is used to report and pay federal tax deposits for Social Security and Medicare taxes. However, filling out this form can be a complex and daunting task, especially for those who are new to tax compliance.

In this article, we will guide you through the process of filling out Form SSA-7004 correctly, highlighting the essential steps and requirements to ensure accuracy and avoid potential penalties.

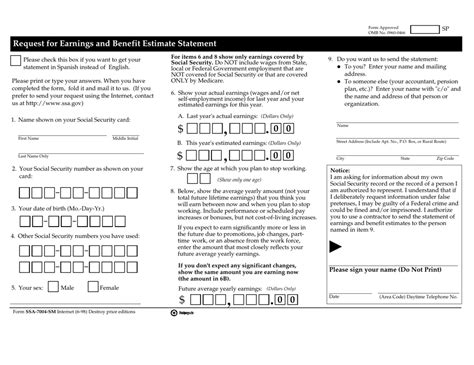

Understanding Form SSA-7004: A Brief Overview

Before we dive into the instructions, it's essential to understand the purpose and scope of Form SSA-7004. This form is used by employers to report and pay federal tax deposits for Social Security and Medicare taxes. The SSA uses this information to update employee records and ensure that taxes are properly credited.

Step 1: Gather Required Information and Documents

To fill out Form SSA-7004 correctly, you'll need to gather the following information and documents:

- Employer Identification Number (EIN)

- Business name and address

- Tax period and deposit frequency

- Total tax liability for the period

- Payment voucher (if applicable)

Make sure you have all the necessary information and documents before proceeding to the next step.

Employer Identification Number (EIN)

Your EIN is a unique identifier assigned to your business by the IRS. You can find your EIN on your tax returns, payment vouchers, or by contacting the IRS.

Tax Period and Deposit Frequency

The tax period and deposit frequency will depend on your business's tax obligations. You'll need to determine whether you're a monthly or semi-weekly depositor.

Step 2: Complete the Form SSA-7004 Header Section

The header section of Form SSA-7004 requires the following information:

- EIN

- Business name and address

- Tax period and deposit frequency

Make sure to enter this information accurately, as it will be used to identify your business and update your tax records.

EIN and Business Name

Enter your EIN and business name in the designated fields. Ensure that the business name matches the one on file with the IRS.

Tax Period and Deposit Frequency

Select the correct tax period and deposit frequency from the options provided.

Step 3: Report Tax Liability and Payments

In this section, you'll report your tax liability and payments for the period.

- Enter the total tax liability for the period

- Report any payments made, including payment dates and amounts

Make sure to calculate your tax liability accurately, as underreporting or overreporting can result in penalties.

Total Tax Liability

Enter the total tax liability for the period, including Social Security and Medicare taxes.

Payments Made

Report any payments made during the period, including payment dates and amounts.

Step 4: Complete the Payment Voucher (If Applicable)

If you're required to make a payment, you'll need to complete the payment voucher section.

- Enter the payment amount and date

- Sign and date the voucher

Make sure to sign and date the voucher, as unsigned vouchers will not be accepted.

Step 5: Review and Submit the Form

Before submitting the form, review it carefully to ensure accuracy and completeness.

- Verify that all information is accurate and complete

- Make sure to sign and date the form

- Submit the form to the SSA by the due date

Failure to submit the form on time can result in penalties and interest.

Verification and Signature

Verify that all information is accurate and complete, and sign and date the form.

Submission

Submit the form to the SSA by the due date to avoid penalties and interest.

By following these steps and taking the time to review and verify your information, you can ensure that your Form SSA-7004 is filled out correctly and submitted on time.

We hope this guide has been helpful in assisting you with completing Form SSA-7004. If you have any further questions or concerns, please don't hesitate to reach out to a tax professional or the SSA for guidance.

Encourage Engagement

If you have any questions or comments about filling out Form SSA-7004, please leave them in the section below. We'd love to hear from you and help address any concerns you may have. Don't forget to share this article with others who may find it helpful.

What is Form SSA-7004 used for?

+Form SSA-7004 is used by employers to report and pay federal tax deposits for Social Security and Medicare taxes.

How often do I need to file Form SSA-7004?

+The frequency of filing Form SSA-7004 depends on your business's tax obligations. You may be required to file monthly or semi-weekly.

What happens if I don't file Form SSA-7004 on time?

+Failing to file Form SSA-7004 on time can result in penalties and interest. It's essential to submit the form by the due date to avoid any consequences.