The IRS 2019 1040 form can seem daunting at first glance, but understanding its components and requirements can make the tax-filing process much smoother. The 1040 form is the standard form used by the Internal Revenue Service (IRS) for personal income tax returns. In this article, we will break down the key sections and schedules of the 1040 form, providing you with a comprehensive guide to navigate the process with ease.

As you prepare to file your taxes, it's essential to understand the different types of income that need to be reported on the 1040 form. These include wages, salaries, and tips; interest and dividends; capital gains and losses; and self-employment income. You will also need to report any deductions and credits you are eligible for, such as the standard deduction, mortgage interest, and charitable donations.

Understanding the 1040 Form Sections

The 1040 form is divided into several sections, each with its own set of requirements and information.

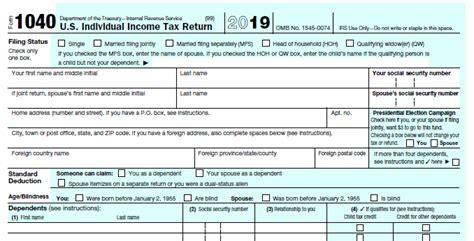

Section 1: Filing Status and Personal Information

The first section of the 1040 form requires you to provide your personal information, including your name, address, and Social Security number. You will also need to indicate your filing status, which determines the tax rates and deductions you are eligible for. The five filing statuses are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Section 2: Income

In this section, you will report all your income from various sources, including:

- Wages, salaries, and tips (Form W-2)

- Interest and dividends (Form 1099-INT and Form 1099-DIV)

- Capital gains and losses (Schedule D)

- Self-employment income (Schedule C)

- Other income, such as alimony and prizes

Section 3: Deductions and Credits

Here, you will report all your deductions and credits, including:

- Standard deduction

- Itemized deductions (Schedule A)

- Credits, such as the earned income tax credit (EITC) and the child tax credit

Schedules and Forms

In addition to the main 1040 form, you may need to complete various schedules and forms, depending on your specific situation. Some of the most common schedules and forms include:

- Schedule A: Itemized deductions

- Schedule B: Interest and dividend income

- Schedule C: Business income and expenses

- Schedule D: Capital gains and losses

- Form 8962: Premium tax credit

- Form 8889: Health savings account (HSA) contributions

Schedule A: Itemized Deductions

If you choose to itemize your deductions, you will need to complete Schedule A. This schedule allows you to deduct expenses such as:

- Medical expenses

- Mortgage interest

- Charitable donations

- State and local taxes

Schedule C: Business Income and Expenses

If you are self-employed or have a side business, you will need to complete Schedule C. This schedule allows you to report your business income and expenses, including:

- Gross income

- Cost of goods sold

- Operating expenses

- Depreciation and amortization

Tips and Tricks for Filing the 1040 Form

Filing the 1040 form can be a daunting task, but with these tips and tricks, you can make the process easier and less stressful:

- Gather all necessary documents and information before starting the filing process.

- Use tax software or consult a tax professional if you are unsure about any part of the process.

- Take advantage of deductions and credits you are eligible for.

- File electronically to reduce errors and speed up the refund process.

- Keep accurate records of your income and expenses throughout the year.

In conclusion, understanding the IRS 2019 1040 form is crucial for a smooth and stress-free tax-filing experience. By breaking down the key sections and schedules, you can navigate the process with ease and confidence. Remember to gather all necessary documents, take advantage of deductions and credits, and file electronically to reduce errors and speed up the refund process.

What is the deadline for filing the 1040 form?

+The deadline for filing the 1040 form is typically April 15th of each year. However, if you need more time, you can file for an automatic six-month extension by submitting Form 4868.

Do I need to file the 1040 form if I don't owe taxes?

+Yes, you still need to file the 1040 form even if you don't owe taxes. This is because the IRS uses the information on the 1040 form to determine your eligibility for refunds and credits.

Can I file the 1040 form electronically?

+Yes, you can file the 1040 form electronically using tax software or the IRS's Free File program. Electronic filing can reduce errors and speed up the refund process.

We hope this comprehensive guide to the IRS 2019 1040 form has been helpful in making the tax-filing process easier and less stressful. If you have any further questions or concerns, please don't hesitate to comment below or share this article with others who may find it helpful.