Applying for a Big Lots credit card can be a great way to finance your purchases and earn rewards. Here's a comprehensive guide to help you understand the application process and make the most of your Big Lots credit card.

Benefits of a Big Lots Credit Card

Before we dive into the application process, let's take a look at the benefits of having a Big Lots credit card. With a Big Lots credit card, you can enjoy:

- Special financing options on purchases over $299

- 5% off on all Big Lots purchases

- Exclusive discounts and promotions

- No annual fee

- Easy online account management

Types of Big Lots Credit Cards

Big Lots offers two types of credit cards: the Big Lots Credit Card and the Big Lots Platinum Credit Card. Here are the key differences between the two:

- Big Lots Credit Card:

- 5% off on all Big Lots purchases

- Special financing options on purchases over $299

- No annual fee

- Big Lots Platinum Credit Card:

- 5% off on all Big Lots purchases

- Special financing options on purchases over $299

- Exclusive discounts and promotions

- Travel insurance and purchase protection

- Annual fee: $29

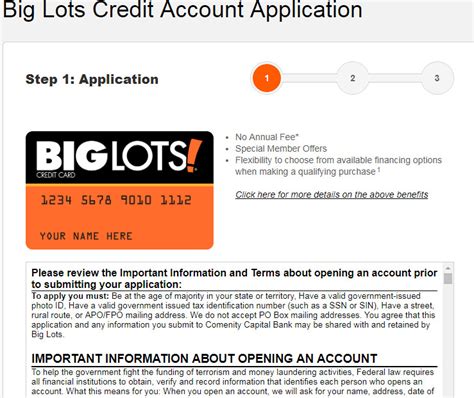

How to Apply for a Big Lots Credit Card

To apply for a Big Lots credit card, follow these steps:

- Check your credit score: Before applying, it's essential to check your credit score to determine your eligibility. You can check your credit score for free on various websites, such as Credit Karma or Credit Sesame.

- Gather required documents: You'll need to provide personal and financial information, such as your name, address, Social Security number, and income.

- Choose your credit card: Decide which Big Lots credit card you want to apply for, either the Big Lots Credit Card or the Big Lots Platinum Credit Card.

- Apply online or in-store: You can apply for a Big Lots credit card online or in-store. To apply online, visit the Big Lots website and click on the "Credit Card" tab. To apply in-store, visit your nearest Big Lots store and ask a sales associate for an application.

- Wait for approval: After submitting your application, wait for approval. This may take a few minutes or up to 24 hours, depending on the method of application.

Big Lots Credit Card Application Form

The Big Lots credit card application form will require you to provide the following information:

- Personal details:

- Name

- Address

- Phone number

- Email address

- Social Security number

- Financial details:

- Income

- Employment status

- Housing status

- Credit history:

- Credit score (optional)

- Card preferences:

- Card type (Big Lots Credit Card or Big Lots Platinum Credit Card)

- Credit limit (optional)

Tips for Approval

To increase your chances of approval, follow these tips:

- Check your credit score: Make sure your credit score is good enough to qualify for a Big Lots credit card.

- Provide accurate information: Ensure that the information you provide on the application form is accurate and up-to-date.

- Meet the income requirements: Make sure you meet the minimum income requirements for the credit card you're applying for.

- Don't apply for multiple credit cards: Applying for multiple credit cards in a short period can negatively affect your credit score.

Managing Your Big Lots Credit Card

Once you're approved for a Big Lots credit card, it's essential to manage it responsibly. Here are some tips:

- Make on-time payments: Pay your credit card bill on time to avoid late fees and interest charges.

- Keep your credit utilization ratio low: Keep your credit utilization ratio below 30% to avoid negatively affecting your credit score.

- Monitor your credit score: Keep track of your credit score to ensure it's improving over time.

- Use the Big Lots credit card app: Download the Big Lots credit card app to manage your account, make payments, and track your rewards.

We hope this guide has provided you with a comprehensive understanding of the Big Lots credit card application process. If you have any questions or concerns, please don't hesitate to ask.

What is the interest rate on a Big Lots credit card?

+The interest rate on a Big Lots credit card varies depending on the type of card and your credit score. The APR for the Big Lots Credit Card is 24.99%, while the APR for the Big Lots Platinum Credit Card is 19.99%.

Can I use my Big Lots credit card at other stores?

+No, the Big Lots credit card can only be used at Big Lots stores or on the Big Lots website.

How do I make a payment on my Big Lots credit card?

+You can make a payment on your Big Lots credit card online, by phone, or by mail. You can also set up automatic payments to ensure you never miss a payment.