As a taxpayer, navigating the complexities of the US tax system can be overwhelming, especially when it comes to reporting income from various sources. Two forms that often cause confusion are Form 8814 and Form 4972. In this article, we will break down these forms into easy-to-understand steps, helping you master the process and avoid potential errors.

What is Form 8814?

Form 8814, also known as the Parent's Election to Report Child's Interest and Dividends, is a tax form used by parents to report their child's interest and dividend income on their tax return. This form is typically used for children under the age of 18 who have unearned income, such as interest from savings accounts or dividends from stocks.

Why is Form 8814 important?

Reporting your child's unearned income on your tax return can have significant benefits. By doing so, you can avoid having to file a separate tax return for your child, which can be time-consuming and costly. Additionally, reporting your child's income on your tax return can help you qualify for certain tax credits and deductions.

What is Form 4972?

Form 4972, also known as the Tax on Lump-Sum Distributions, is a tax form used to report taxes on lump-sum distributions from a qualified retirement plan or an IRA. This form is typically used by individuals who have received a lump-sum distribution from a retirement account and need to report the taxes owed on that distribution.

Why is Form 4972 important?

Reporting taxes on lump-sum distributions is crucial to avoid penalties and interest. Failure to report these taxes can result in significant penalties and interest, which can add up quickly. By reporting these taxes on Form 4972, you can ensure that you are in compliance with tax laws and avoid any potential penalties.

Step 1: Gather necessary documents

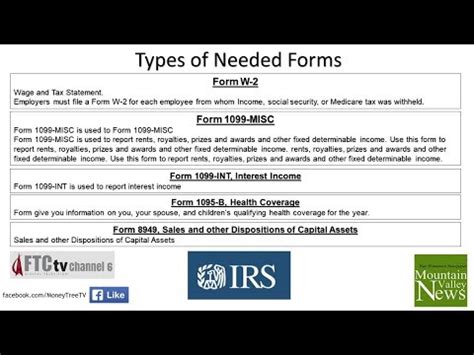

To complete Forms 8814 and 4972, you will need to gather several documents, including:

- Your child's Form 1099-INT and Form 1099-DIV, which show the interest and dividend income earned

- Your Form W-2 and Form 1099-R, which show your income and any lump-sum distributions

- Your tax return from the previous year, which will help you determine if you need to file Form 8814 or 4972

Step 2: Determine if you need to file Form 8814

To determine if you need to file Form 8814, you will need to answer the following questions:

- Is your child under the age of 18?

- Does your child have unearned income, such as interest or dividends?

- Is the unearned income less than $11,000?

If you answered "yes" to these questions, you may need to file Form 8814.

Step 3: Complete Form 8814

To complete Form 8814, you will need to:

- Enter your child's name and Social Security number

- Report your child's interest and dividend income

- Calculate the tax owed on that income

- Report the tax owed on your tax return

Step 4: Determine if you need to file Form 4972

To determine if you need to file Form 4972, you will need to answer the following questions:

- Did you receive a lump-sum distribution from a qualified retirement plan or IRA?

- Is the lump-sum distribution subject to taxes?

If you answered "yes" to these questions, you may need to file Form 4972.

Step 5: Complete Form 4972

To complete Form 4972, you will need to:

- Enter the amount of the lump-sum distribution

- Calculate the tax owed on that distribution

- Report the tax owed on your tax return

By following these 5 easy steps, you can master Forms 8814 and 4972 and ensure that you are in compliance with tax laws. Remember to gather all necessary documents, determine if you need to file each form, and complete the forms accurately to avoid any potential penalties.

Don't forget to share your thoughts and experiences with Forms 8814 and 4972 in the comments below. If you have any questions or need further clarification, please don't hesitate to ask.

What is the purpose of Form 8814?

+Form 8814 is used by parents to report their child's interest and dividend income on their tax return.

What is the purpose of Form 4972?

+Form 4972 is used to report taxes on lump-sum distributions from a qualified retirement plan or IRA.

Do I need to file Form 8814 if my child has no unearned income?

+No, you do not need to file Form 8814 if your child has no unearned income.