Filling out Form 4506-C can be a daunting task, especially when it comes to discovery purposes. However, with the right guidance, you can navigate the process with ease. In this article, we will explore the five ways to fill out Form 4506-C for discovery, providing you with a comprehensive understanding of the form's requirements and the steps involved.

Understanding Form 4506-C

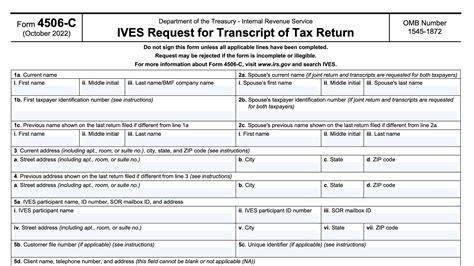

Before we dive into the ways to fill out Form 4506-C, let's take a moment to understand what the form is and its purpose. Form 4506-C, also known as the IVES Request for Transcript of Tax Return, is a document used to request transcripts of tax returns from the Internal Revenue Service (IRS). The form is often used in discovery proceedings to obtain financial information about a party or witness.

What is Discovery?

Discovery is a pre-trial process in which parties involved in a lawsuit exchange information and evidence to prepare for trial. The purpose of discovery is to allow parties to gather facts, identify potential witnesses, and assess the strengths and weaknesses of their case.

5 Ways to Fill Out Form 4506-C for Discovery

Now that we have a basic understanding of Form 4506-C and discovery, let's explore the five ways to fill out the form for discovery purposes.

1. Identify the Purpose of the Request

Before filling out Form 4506-C, it's essential to identify the purpose of the request. Are you requesting transcripts for discovery purposes or for another reason? Make sure you have a clear understanding of why you need the transcripts, as this will help you determine what type of transcripts to request and what information to include on the form.

2. Gather Required Information

To fill out Form 4506-C, you'll need to gather specific information, including:

- The taxpayer's name and Social Security number or Employer Identification Number (EIN)

- The tax year(s) for which you're requesting transcripts

- The type of transcripts you're requesting (e.g., individual, business, or account transcripts)

- Your name and address (if you're requesting transcripts on behalf of the taxpayer)

Types of Transcripts

The IRS offers several types of transcripts, including:

- Individual transcripts: Show the taxpayer's filing status, income, and tax liability

- Business transcripts: Show the business's income, expenses, and tax liability

- Account transcripts: Show the taxpayer's account activity, including payments and penalties

3. Complete Form 4506-C

Once you have the required information, you can complete Form 4506-C. Make sure to fill out the form accurately and completely, as incomplete or inaccurate forms may be rejected by the IRS.

4. Sign and Date the Form

After completing Form 4506-C, sign and date the form. If you're requesting transcripts on behalf of the taxpayer, you'll need to sign the form as the representative.

5. Submit the Form

Finally, submit the completed Form 4506-C to the IRS. You can mail or fax the form to the IRS, depending on your preference.

Additional Tips and Considerations

- Make sure to keep a copy of the completed form for your records.

- If you're requesting transcripts for discovery purposes, be sure to include a cover letter explaining the purpose of the request.

- The IRS typically processes Form 4506-C requests within 10-15 business days.

- If you need expedited processing, you can fax the form to the IRS.

Conclusion: Streamlining the Discovery Process

Filling out Form 4506-C for discovery purposes can be a complex task, but by following these five steps, you can streamline the process and ensure that you receive the necessary transcripts. Remember to identify the purpose of the request, gather required information, complete the form accurately, sign and date the form, and submit it to the IRS.

Final Thoughts

By understanding the requirements and steps involved in filling out Form 4506-C, you can navigate the discovery process with confidence. Whether you're a lawyer, investigator, or researcher, this article has provided you with a comprehensive guide to help you fill out Form 4506-C for discovery purposes.

We invite you to share your thoughts and experiences with filling out Form 4506-C in the comments below. Have you encountered any challenges or successes when requesting transcripts for discovery purposes? Your feedback can help others navigate this complex process.

What is Form 4506-C used for?

+Form 4506-C is used to request transcripts of tax returns from the Internal Revenue Service (IRS). It's often used in discovery proceedings to obtain financial information about a party or witness.

What type of transcripts can I request with Form 4506-C?

+You can request individual, business, or account transcripts using Form 4506-C.

How long does it take for the IRS to process Form 4506-C requests?

+The IRS typically processes Form 4506-C requests within 10-15 business days.