Virginia businesses, particularly those with pass-through entities, need to be aware of the state's tax requirements to ensure compliance and avoid any potential penalties. One key aspect of this is the Virginia Form 502 PtET, which is used for reporting pass-through entity taxes. In this guide, we will delve into the details of the Virginia Form 502 PtET, explaining its purpose, who needs to file it, and how to do so correctly.

Understanding Pass-Through Entities

Before diving into the specifics of Form 502 PtET, it's essential to understand what pass-through entities are. These entities, such as partnerships, S corporations, and certain limited liability companies (LLCs), pass the tax obligations through to their owners or members, who then report their share of income on their individual tax returns. This contrasts with C corporations, which are taxed on their profits at the entity level.

What is Virginia Form 502 PtET?

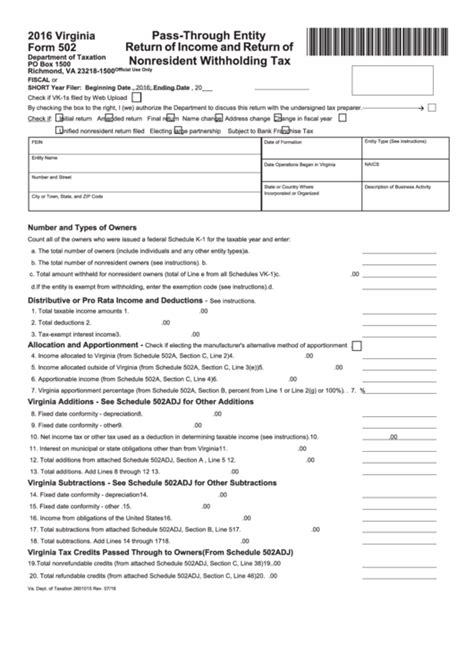

Virginia Form 502 PtET is the Pass-Through Entity Tax Return used by eligible pass-through entities (PTEs) in Virginia to report their income, deductions, and credits at the entity level. The form allows these entities to elect to pay tax at the entity level, rather than passing the tax obligations to their owners. This is part of Virginia's effort to mitigate the impact of the federal State and Local Tax (SALT) deduction cap on businesses and individuals.

Who Needs to File Virginia Form 502 PtET?

Not all pass-through entities are required or eligible to file Form 502 PtET. The eligibility and requirement to file this form are as follows:

-

Eligible Entities: The following types of pass-through entities are eligible to file Form 502 PtET:

- Partnerships (including limited liability partnerships)

- S corporations

- Limited liability companies (LLCs) that are treated as partnerships or S corporations for federal income tax purposes

-

Required Filers: Eligible entities with Virginia sourced income are required to file Form 502 PtET if they have:

- Virginia sourced income

- Entities that have Virginia resident owners

Steps to File Virginia Form 502 PtET

Filing Form 502 PtET requires careful consideration of the entity's financial data and compliance with Virginia's tax regulations. Here are the steps to file the form:

-

Gather Necessary Documents: Ensure you have all relevant financial documents, including federal tax returns, financial statements, and any other records that detail the entity's income, deductions, and credits.

-

Determine the Taxable Income: Calculate the entity's taxable income using the federal return as a starting point and making adjustments for Virginia-specific items.

-

Calculate the Entity-Level Tax: Use the Virginia tax rates to calculate the tax due at the entity level. The tax rates for pass-through entities mirror the individual income tax rates.

-

Complete Form 502 PtET: Fill out the form with the calculated taxable income and tax due. Attach any required schedules or supporting documentation.

-

Submit the Form: File the completed form and any required attachments with the Virginia Department of Taxation by the due date, which is typically April 15th for calendar-year entities.

Benefits and Considerations

Electing to pay tax at the entity level can provide benefits, such as:

-

Mitigating SALT Cap Impact: By paying tax at the entity level, the SALT deduction cap does not directly impact the entity's tax burden, potentially reducing the owners' overall tax liability.

-

Simplified Tax Compliance: For entities with multiple owners, paying tax at the entity level can simplify tax compliance by reducing the complexity of individual tax returns.

However, it's also important to consider the potential drawbacks and consult with a tax professional to determine if electing entity-level taxation is beneficial for your specific situation.

Frequently Asked Questions

Q: Can all pass-through entities file Form 502 PtET?

A: No, only eligible entities with Virginia sourced income can file Form 502 PtET.

Q: What is the deadline for filing Form 502 PtET?

A: The deadline for filing Form 502 PtET is typically April 15th for calendar-year entities.

Q: How do I calculate the entity-level tax?

A: Use the Virginia tax rates to calculate the tax due at the entity level based on the entity's taxable income.

Is there a penalty for late filing of Form 502 PtET?

+Yes, there may be penalties for late filing of Form 502 PtET. It's essential to file on time or request an extension to avoid any potential penalties.

Can I amend a previously filed Form 502 PtET?

+Yes, you can amend a previously filed Form 502 PtET. Submit Form 502 PtET with the "Amended Return" box checked and include any required supporting documentation.

How do I request an extension to file Form 502 PtET?

+You can request an automatic six-month extension by filing Form 502E and paying any estimated tax due by the original due date of the return.

Conclusion and Next Steps

Filing Virginia Form 502 PtET is a critical step for eligible pass-through entities to ensure compliance with Virginia's tax laws and potentially mitigate the impact of the SALT deduction cap. By understanding who is required to file, how to calculate the entity-level tax, and the benefits and considerations of electing entity-level taxation, entities can make informed decisions about their tax strategy.

For specific guidance tailored to your entity's situation, it's recommended to consult with a tax professional. They can provide detailed advice and help navigate the complexities of Virginia's pass-through entity tax regulations.

Stay informed about changes in tax laws and regulations that may affect your business. Share this article with colleagues or peers who might benefit from understanding the Virginia Form 502 PtET. Engage with us in the comments below to discuss your experiences or ask questions about pass-through entity taxation in Virginia.