Filing Your Minnesota State Tax Form: What You Need to Know

As a resident of Minnesota, it's essential to understand the process of filing your state tax form. The Minnesota Department of Revenue requires individuals to file their tax returns by April 15th of each year. In this article, we'll provide you with five valuable tips to help you navigate the process of filing your Minnesota state tax form.

When it comes to filing your state tax form, it's crucial to gather all necessary documents and information before starting the process. This includes your W-2 forms, 1099 forms, and any other relevant tax-related documents. Make sure to review your documents carefully to ensure accuracy and avoid any potential errors.

Tips for Filing Your Minnesota State Tax Form

1. Understand Your Filing Status

Your filing status plays a significant role in determining your tax liability. Minnesota recognizes the same filing statuses as the federal government, including single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Ensure you choose the correct filing status to avoid any errors or delays in processing your tax return.

2. Choose the Right Filing Method

The Minnesota Department of Revenue offers various filing methods, including e-file, paper file, and free file. E-file is the fastest and most convenient method, allowing you to submit your tax return electronically. Paper file is suitable for those who prefer to mail their tax return. Free file is available for eligible taxpayers with income below a certain threshold.

3. Take Advantage of Tax Credits and Deductions

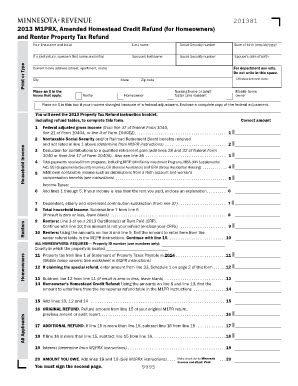

Minnesota offers various tax credits and deductions to help reduce your tax liability. Some of the most common tax credits include the Working Family Credit, the Child and Dependent Care Credit, and the Education Credit. Additionally, you may be eligible for deductions such as the mortgage interest deduction, charitable contributions deduction, and medical expense deduction.

4. Be Aware of Tax Law Changes

Tax laws and regulations can change frequently, so it's essential to stay informed about any updates or changes that may affect your tax return. The Minnesota Department of Revenue website provides information on recent tax law changes, including any new credits or deductions.

5. Seek Professional Help When Needed

Filing your state tax form can be a complex process, especially if you have multiple sources of income or claim various tax credits and deductions. If you're unsure about any aspect of the filing process, consider seeking help from a tax professional. They can provide guidance and ensure your tax return is accurate and complete.

Minnesota State Tax Form: Common Questions and Answers

Q: What is the deadline for filing my Minnesota state tax form?

A: The deadline for filing your Minnesota state tax form is April 15th of each year.

Q: Can I file my Minnesota state tax form electronically?

A: Yes, you can file your Minnesota state tax form electronically using the e-file method.

Q: What are the eligible income thresholds for the free file program?

A: The eligible income thresholds for the free file program vary depending on your filing status and the number of dependents you claim.

Q: Can I claim the Working Family Credit if I'm self-employed?

A: Yes, self-employed individuals may be eligible to claim the Working Family Credit.

Q: How do I check the status of my Minnesota state tax refund?

A: You can check the status of your Minnesota state tax refund by visiting the Minnesota Department of Revenue website or by contacting their customer service department.

Minnesota State Tax Form: Additional Resources

For more information on filing your Minnesota state tax form, visit the Minnesota Department of Revenue website. They offer a range of resources, including tax forms, instructions, and FAQs.

Conclusion

Filing your Minnesota state tax form can be a straightforward process if you're well-prepared and informed. By following these five tips and staying up-to-date with tax law changes, you can ensure a smooth and efficient filing experience. Remember to take advantage of tax credits and deductions, and don't hesitate to seek professional help when needed.What is the penalty for late filing of Minnesota state tax form?

+The penalty for late filing of Minnesota state tax form is 4% of the unpaid tax for each month or part of a month, up to a maximum of 24%.

Can I file an amended Minnesota state tax form?

+How do I contact the Minnesota Department of Revenue?

+You can contact the Minnesota Department of Revenue by phone at 651-296-3781 or by email at .