The Missouri Form 943 is a crucial document for employers in the state of Missouri, as it helps them report and pay their annual federal income tax withholding and Social Security and Medicare taxes. In this article, we will delve into the Missouri Form 943 filing requirements and instructions, ensuring that you have a comprehensive understanding of the process.

Who Needs to File Missouri Form 943?

Before we dive into the filing requirements and instructions, it's essential to understand who needs to file the Missouri Form 943. Employers who have paid wages to employees and have withheld federal income tax, Social Security tax, or Medicare tax are required to file this form. This includes:

- Employers who have paid wages of $1,500 or more in a calendar quarter

- Employers who have paid wages to 10 or more employees in a calendar quarter

- Employers who have withheld federal income tax, Social Security tax, or Medicare tax from employee wages

When is the Missouri Form 943 Due?

The Missouri Form 943 is due on January 31st of each year. However, if you have made timely deposits, you can file the form by February 10th. It's essential to note that if you fail to file the form on time, you may be subject to penalties and interest.

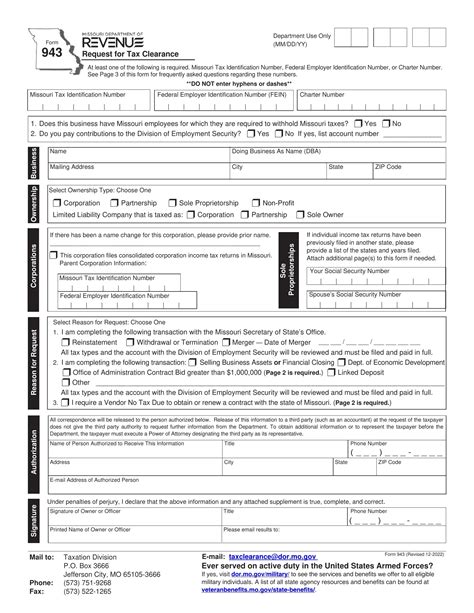

Missouri Form 943 Filing Requirements

To ensure that you file the Missouri Form 943 accurately, you need to meet the following requirements:

- Account Number: You need to have a valid Employer Identification Number (EIN) to file the Missouri Form 943.

- Wage and Tax Information: You need to report the total wages paid to employees, as well as the federal income tax, Social Security tax, and Medicare tax withheld.

- Deposit Schedule: You need to report the deposit schedule you used to make payments throughout the year.

How to File Missouri Form 943

You can file the Missouri Form 943 electronically or by mail. Electronic filing is recommended, as it's faster and more convenient. You can use the Electronic Federal Tax Payment System (EFTPS) to make payments and file the form.

If you choose to file by mail, you need to send the completed form to the following address:

Internal Revenue Service 1973 Rulon White Blvd. Ogden, UT 84404

Missouri Form 943 Instructions

To ensure that you complete the Missouri Form 943 accurately, follow these instructions:

- Line 1: Enter your Employer Identification Number (EIN)

- Line 2: Enter your business name and address

- Line 3: Enter the total wages paid to employees

- Line 4: Enter the federal income tax withheld

- Line 5: Enter the Social Security tax withheld

- Line 6: Enter the Medicare tax withheld

- Line 7: Enter the total tax liability

- Line 8: Enter the deposit schedule used

Common Errors to Avoid

When completing the Missouri Form 943, it's essential to avoid common errors that can lead to penalties and delays. Some common errors to avoid include:

- Incorrect EIN: Make sure you enter your correct EIN

- Inaccurate wage and tax information: Ensure that you report accurate wage and tax information

- Incorrect deposit schedule: Make sure you report the correct deposit schedule

Conclusion

Filing the Missouri Form 943 is a critical task for employers in the state of Missouri. By understanding the filing requirements and instructions, you can ensure that you complete the form accurately and avoid common errors. Remember to file the form on time and make timely payments to avoid penalties and interest.

What is the deadline for filing the Missouri Form 943?

+The deadline for filing the Missouri Form 943 is January 31st of each year. However, if you have made timely deposits, you can file the form by February 10th.

Who needs to file the Missouri Form 943?

+Employers who have paid wages to employees and have withheld federal income tax, Social Security tax, or Medicare tax need to file the Missouri Form 943.

What is the penalty for late filing of the Missouri Form 943?

+The penalty for late filing of the Missouri Form 943 can range from 5% to 25% of the unpaid tax, depending on the number of days the payment is late.