Receiving payments directly into your bank account is a convenient and efficient way to manage your finances. Citibank, one of the world's largest financial institutions, offers a direct deposit service that allows you to receive payments directly into your account. In this article, we will guide you through the process of setting up a Citibank direct deposit form and highlight the benefits of using this service.

Direct deposit is a widely used payment method that allows employers, government agencies, and other organizations to transfer funds directly into an individual's bank account. This method of payment is fast, secure, and reliable, eliminating the need for paper checks and the associated risks of loss, theft, or delay. With Citibank's direct deposit service, you can receive payments from various sources, including your employer, the government, and other organizations.

Benefits of Citibank Direct Deposit

Citibank's direct deposit service offers numerous benefits, including:

- Convenience: Direct deposit allows you to receive payments directly into your account, eliminating the need to visit a bank branch or ATM to deposit a check.

- Speed: Funds are deposited quickly, usually on the same day or the next business day, allowing you to access your money sooner.

- Security: Direct deposit is a secure method of payment, reducing the risk of lost, stolen, or forged checks.

- Reliability: Payments are deposited regularly, providing a predictable income stream.

How to Set Up Citibank Direct Deposit

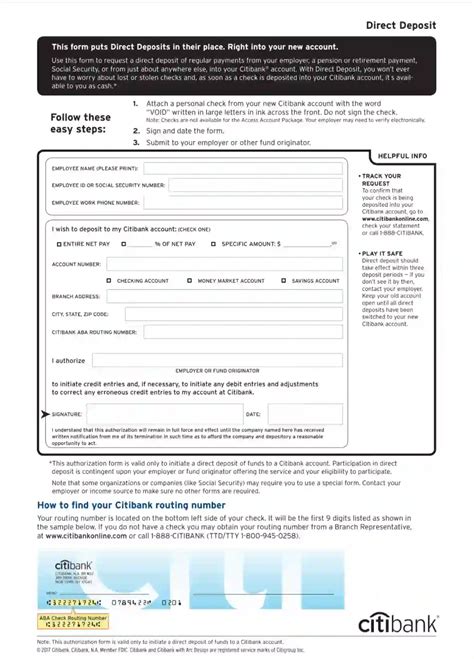

Setting up a Citibank direct deposit form is a straightforward process that can be completed in a few steps:

- Gather required information: You will need to provide your Citibank account number, routing number, and other personal and financial information.

- Obtain a direct deposit form: You can obtain a direct deposit form from your employer, government agency, or other organization, or download one from Citibank's website.

- Complete the form: Fill out the form with your account information and other required details.

- Submit the form: Return the completed form to your employer, government agency, or other organization.

Citibank Direct Deposit Form Requirements

To set up a Citibank direct deposit form, you will need to provide the following information:

- Account number: Your Citibank account number, which can be found on your account statement or online banking platform.

- Routing number: Citibank's routing number, which is 021000089 for accounts opened in New York and 022000046 for accounts opened in other states.

- Account type: The type of account you want to deposit funds into, such as a checking or savings account.

- Account holder information: Your name, address, and other personal details.

Citibank Direct Deposit Form for Employers

Employers can also use the Citibank direct deposit form to set up direct deposit for their employees. To do this, they will need to:

- Obtain employee consent: Obtain consent from employees to participate in the direct deposit program.

- Gather employee information: Collect employee account information, including account numbers and routing numbers.

- Complete the form: Fill out the direct deposit form with the employee's information and other required details.

- Submit the form: Return the completed form to Citibank or the relevant payroll processing center.

Citibank Direct Deposit Fees

Citibank may charge fees for certain direct deposit services, including:

- Setup fees: A one-time fee for setting up direct deposit.

- Maintenance fees: Ongoing fees for maintaining the direct deposit service.

- Transaction fees: Fees for each direct deposit transaction.

It is essential to review Citibank's fee schedule and terms and conditions before setting up direct deposit.

Citibank Direct Deposit Customer Support

Citibank offers customer support for direct deposit services, including:

- Phone support: Customers can contact Citibank's customer support team by phone to ask questions or report issues.

- Online support: Customers can also access online support resources, including FAQs and user guides.

- Branch support: Customers can visit a Citibank branch for in-person support.

Citibank Direct Deposit Security

Citibank takes security seriously and has implemented various measures to protect direct deposit transactions, including:

- Encryption: Citibank uses encryption to protect sensitive information, such as account numbers and routing numbers.

- Firewalls: Citibank uses firewalls to prevent unauthorized access to its systems and networks.

- Authentication: Citibank uses authentication protocols to verify the identity of users and ensure that only authorized individuals can access account information.

Citibank Direct Deposit Alternatives

While Citibank's direct deposit service is a convenient and reliable way to receive payments, there are alternative services available, including:

- PayPal: A digital payment service that allows users to send and receive payments online.

- Venmo: A peer-to-peer payment service that allows users to send and receive payments online.

- Zelle: A digital payment service that allows users to send and receive payments online.

Conclusion

Citibank's direct deposit service is a convenient and secure way to receive payments directly into your account. By following the steps outlined in this article, you can easily set up a Citibank direct deposit form and start enjoying the benefits of direct deposit. Remember to review Citibank's fee schedule and terms and conditions before setting up direct deposit.

We hope this article has provided you with a comprehensive guide to Citibank's direct deposit service. If you have any questions or need further assistance, please don't hesitate to comment below.

What is Citibank's direct deposit service?

+Citibank's direct deposit service allows you to receive payments directly into your account, eliminating the need for paper checks and the associated risks of loss, theft, or delay.

How do I set up a Citibank direct deposit form?

+To set up a Citibank direct deposit form, you will need to gather required information, obtain a direct deposit form, complete the form, and submit it to your employer, government agency, or other organization.

What are the benefits of Citibank's direct deposit service?

+The benefits of Citibank's direct deposit service include convenience, speed, security, and reliability.