The 14-317 Texas Form is a crucial document for individuals dealing with real estate transactions in the state of Texas. As a buyer, seller, or real estate agent, it's essential to understand the intricacies of this form to ensure a smooth and hassle-free transaction. In this article, we will delve into the details of the 14-317 Texas Form, providing a step-by-step guide to help you navigate its complexities.

The 14-317 Texas Form, also known as the "Seller's Disclosure Notice," is a mandatory document required by Texas law for all residential real estate transactions. Its primary purpose is to provide potential buyers with information about the property's condition, defects, and other essential details. This disclosure notice is designed to protect both buyers and sellers by promoting transparency and reducing the risk of potential disputes.

Why is the 14-317 Texas Form Important?

The 14-317 Texas Form is crucial for several reasons:

- It provides buyers with essential information about the property's condition, enabling them to make informed decisions.

- It helps sellers avoid potential lawsuits by disclosing known defects and issues.

- It promotes transparency and honesty in real estate transactions, reducing the risk of disputes.

Benefits of the 14-317 Texas Form

The 14-317 Texas Form offers numerous benefits to both buyers and sellers:

- Informed decision-making: Buyers can make informed decisions about the property, considering its condition and potential defects.

- Reduced risk of disputes: Sellers can avoid potential lawsuits by disclosing known issues, promoting a smoother transaction process.

- Transparency and honesty: The form promotes transparency and honesty in real estate transactions, fostering trust between buyers and sellers.

Step-by-Step Guide to the 14-317 Texas Form

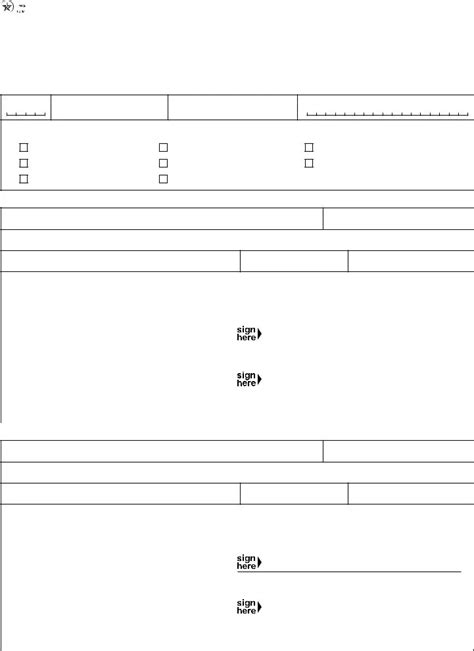

To ensure a thorough understanding of the 14-317 Texas Form, we'll break down the document into sections, providing a step-by-step guide:

- Section 1: Seller's Information

- The seller's name, address, and contact information.

- The property's address and type (residential, commercial, etc.).

- Section 2: Property Condition

- The seller's disclosure of the property's condition, including:

- Any known defects or issues.

- Any repairs or maintenance performed.

- Any environmental concerns (e.g., lead-based paint, asbestos).

- The seller's disclosure of the property's condition, including:

- Section 3: Additional Disclosures

- Any additional information the seller deems relevant, such as:

- Any pending lawsuits or disputes related to the property.

- Any outstanding liens or debts.

- Any neighborhood or community issues.

- Any additional information the seller deems relevant, such as:

Additional Disclosures

In addition to the above sections, the 14-317 Texas Form requires sellers to disclose:

- Lead-based paint disclosure: Sellers must provide a lead-based paint disclosure statement, as required by federal law.

- Flood zone disclosure: Sellers must disclose if the property is located in a flood zone.

- Environmental concerns: Sellers must disclose any known environmental concerns, such as asbestos or contaminated soil.

Best Practices for Completing the 14-317 Texas Form

To ensure a smooth transaction process, follow these best practices when completing the 14-317 Texas Form:

- Be honest and transparent: Sellers must disclose all known defects and issues to avoid potential disputes.

- Use clear and concise language: Avoid using technical jargon or ambiguous terms that may confuse buyers.

- Provide supporting documentation: Sellers should provide supporting documentation, such as repair receipts or inspection reports, to substantiate their disclosures.

Consequences of Non-Compliance

Failure to comply with the 14-317 Texas Form requirements can result in:

- Lawsuits and disputes: Buyers may sue sellers for non-disclosure or misrepresentation.

- Financial penalties: Sellers may face financial penalties for non-compliance.

- Reputation damage: Sellers may suffer reputation damage, impacting future real estate transactions.

Conclusion

The 14-317 Texas Form is a critical document in Texas real estate transactions. By understanding its requirements and providing accurate disclosures, sellers can ensure a smooth transaction process, avoid potential disputes, and promote transparency and honesty. Buyers can make informed decisions, and both parties can benefit from a successful and stress-free transaction.

We hope this article has provided valuable insights into the 14-317 Texas Form. If you have any questions or concerns, please don't hesitate to comment below. Share this article with your friends and colleagues to help them navigate the complexities of Texas real estate transactions.

Get Ready for a Smooth Transaction

Before signing any documents, make sure you understand the 14-317 Texas Form requirements. If you're a seller, provide accurate disclosures to avoid potential disputes. If you're a buyer, carefully review the form to ensure you're making an informed decision.

Share Your Thoughts

Have you encountered any issues with the 14-317 Texas Form? Share your experiences and tips in the comments below. Let's work together to make Texas real estate transactions smoother and more successful.

Additional Resources

For more information on the 14-317 Texas Form, visit the Texas Real Estate Commission website or consult with a real estate agent. Stay up-to-date with the latest Texas real estate news and trends to ensure a successful transaction.

FAQs

What is the purpose of the 14-317 Texas Form?

+The 14-317 Texas Form is designed to provide potential buyers with information about the property's condition, defects, and other essential details.

What are the consequences of non-compliance with the 14-317 Texas Form?

+Failure to comply with the 14-317 Texas Form requirements can result in lawsuits, financial penalties, and reputation damage.

Can I use the 14-317 Texas Form for commercial properties?

+No, the 14-317 Texas Form is specifically designed for residential real estate transactions. Commercial properties require a different set of disclosures.