The Internal Revenue Service (IRS) is tasked with collecting taxes from individuals and businesses across the United States. However, tax laws and regulations can be complex, and mistakes can occur, resulting in penalties. One way to potentially reduce or waive certain penalties is by filing Form 9325 with the IRS. In this article, we will delve into the world of Form 9325, exploring its purpose, benefits, and the steps involved in filing it.

Understanding Form 9325

What is Form 9325?

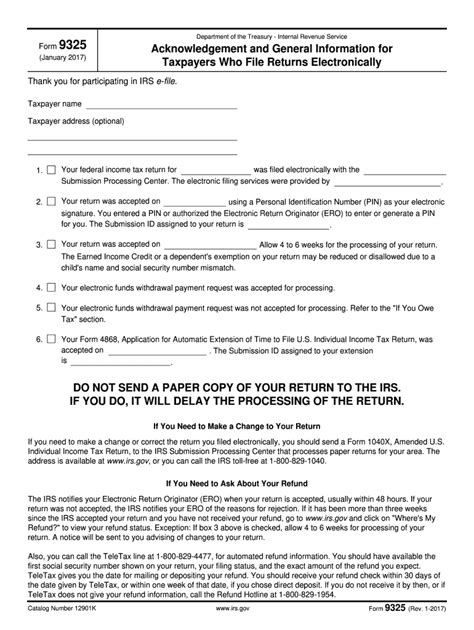

Form 9325, also known as the "Acknowledgement and General Information for Certain Returns and Claims," is a document used by taxpayers to request a reduction or waiver of certain penalties imposed by the IRS. The form is typically filed in conjunction with other tax returns or claims, such as the Form 1040 or Form 1120.

Benefits of Filing Form 9325

Why File Form 9325?

Filing Form 9325 can provide several benefits to taxpayers, including:

- Reduction or waiver of certain penalties

- Avoidance of additional penalties and interest

- Opportunity to provide explanations and supporting documentation for tax errors or omissions

- Potential to reduce tax liability

Who Can File Form 9325?

Eligibility to File Form 9325

Form 9325 can be filed by individuals, businesses, and other entities that have been assessed certain penalties by the IRS. This includes:

- Individuals who have been assessed penalties for late filing or payment of taxes

- Businesses that have been assessed penalties for employment tax errors or omissions

- Estates and trusts that have been assessed penalties for tax errors or omissions

How to File Form 9325

Step-by-Step Guide to Filing Form 9325

To file Form 9325, taxpayers must follow these steps:

- Gather required documents: Collect all relevant tax returns, notices, and supporting documentation related to the penalty assessment.

- Complete Form 9325: Fill out the form accurately and thoroughly, providing explanations and supporting documentation for the tax errors or omissions.

- Attach supporting documentation: Attach all required supporting documentation, including tax returns, notices, and explanations.

- Submit the form: Mail the completed form and supporting documentation to the IRS address listed in the instructions.

Tips and Reminders

Important Considerations When Filing Form 9325

When filing Form 9325, keep the following tips and reminders in mind:

- File the form timely: Submit the form within the required timeframe to avoid additional penalties and interest.

- Provide accurate information: Ensure all information provided is accurate and complete to avoid delays or rejection of the form.

- Attach required documentation: Attach all required supporting documentation to avoid delays or rejection of the form.

Common Penalties and How to Avoid Them

Understanding Common Penalties and How to Avoid Them

The IRS imposes various penalties for tax errors or omissions. Some common penalties include:

- Late filing penalty: Imposed for failure to file tax returns on time.

- Late payment penalty: Imposed for failure to pay taxes on time.

- Accuracy-related penalty: Imposed for errors or omissions on tax returns.

To avoid these penalties, taxpayers can take the following steps:

- File tax returns timely: Submit tax returns on or before the required deadline.

- Pay taxes timely: Pay taxes on or before the required deadline.

- Review tax returns carefully: Ensure all information on tax returns is accurate and complete.

Frequently Asked Questions

What is the purpose of Form 9325?

+Form 9325 is used to request a reduction or waiver of certain penalties imposed by the IRS.

Who can file Form 9325?

+Individuals, businesses, and other entities that have been assessed certain penalties by the IRS can file Form 9325.

What documentation is required to file Form 9325?

+All relevant tax returns, notices, and supporting documentation related to the penalty assessment are required to file Form 9325.

Take Action

If you have been assessed certain penalties by the IRS, consider filing Form 9325 to request a reduction or waiver of these penalties. By following the steps outlined in this article and providing accurate and complete information, you may be able to reduce your tax liability and avoid additional penalties and interest. Don't hesitate to reach out to a tax professional or the IRS for guidance on filing Form 9325. Share your experiences and tips for filing Form 9325 in the comments below!