In the state of Maryland, tax season can be a daunting task for many residents. With numerous forms to fill out and deadlines to meet, it's easy to feel overwhelmed. However, with the right strategies and tools, filing your Maryland state tax return can be a much simpler process. In this article, we'll explore five ways to simplify your Maryland state tax form filing.

Understanding Maryland State Tax Forms

Before we dive into the ways to simplify your tax filing, it's essential to understand the different types of tax forms you may need to file. The most common forms for Maryland state taxes include:

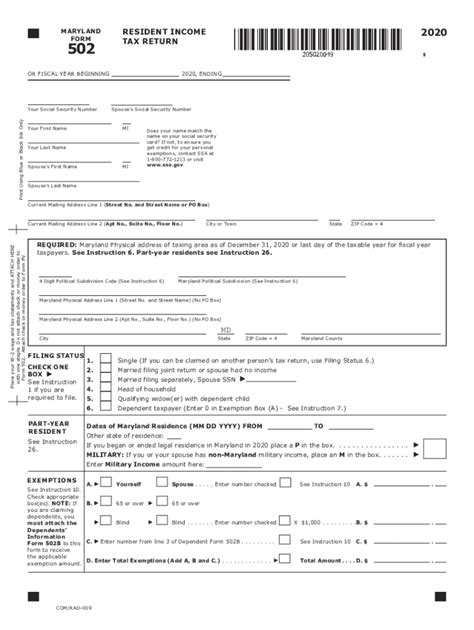

- Form 502: This is the standard form for Maryland residents who need to file a state income tax return.

- Form 502B: This form is used for amended returns, which is necessary if you need to make changes to a previously filed return.

- Form 505: This form is used for Maryland residents who are claiming a refund or making a payment.

1. E-File Your Taxes

One of the simplest ways to file your Maryland state taxes is to e-file. Electronic filing, or e-filing, allows you to submit your tax return online, which can save you time and reduce errors. The Maryland Comptroller's Office offers free e-filing options for qualifying taxpayers, including those who earn less than $60,000 per year.

When you e-file, you'll need to create an account on the Maryland Comptroller's website and follow the prompts to complete your tax return. You'll need to have your social security number, date of birth, and other identifying information ready.

2. Use Tax Preparation Software

Another way to simplify your tax filing is to use tax preparation software. These programs guide you through the tax preparation process, ensuring you don't miss any deductions or credits. Some popular tax preparation software options include TurboTax, H&R Block, and TaxAct.

These programs often include features such as:

- Automatic calculation of tax liability

- Error checking to reduce mistakes

- Importing of W-2 and 1099 forms

- Free e-filing options

When choosing tax preparation software, consider the following factors:

- Cost: What is the cost of the software, and are there any additional fees?

- Ease of use: How user-friendly is the software, and what kind of support is available?

- Features: What features does the software offer, and are they relevant to your tax situation?

3. Take Advantage of Tax Credits and Deductions

Tax credits and deductions can significantly reduce your tax liability, but it's essential to understand what you're eligible for. Some common tax credits and deductions in Maryland include:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Mortgage Interest Deduction

- Charitable Donation Deduction

To take advantage of these credits and deductions, keep accurate records throughout the year, including:

- W-2 and 1099 forms

- Receipts for charitable donations

- Mortgage interest statements

- Childcare receipts

4. Hire a Tax Professional

If you're not comfortable preparing your taxes yourself, consider hiring a tax professional. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), have the expertise to navigate complex tax situations and ensure you're taking advantage of all eligible credits and deductions.

When hiring a tax professional, consider the following factors:

- Qualifications: What are their qualifications, and do they have experience with Maryland state taxes?

- Fees: What are their fees, and what services do they offer?

- Reputation: What is their reputation, and do they have any online reviews?

5. File for an Extension

If you're unable to file your taxes by the deadline, consider filing for an extension. The Maryland Comptroller's Office allows taxpayers to file for a six-month extension, which gives you until October 15th to file your taxes.

To file for an extension, you'll need to submit Form 502E by the original deadline, April 15th. Keep in mind that filing for an extension does not extend the deadline for paying any tax liability.

By following these five ways to simplify your Maryland state tax form filing, you can reduce stress and ensure you're taking advantage of all eligible credits and deductions.

Call to Action

Filing your Maryland state taxes doesn't have to be a daunting task. By e-filing, using tax preparation software, taking advantage of tax credits and deductions, hiring a tax professional, and filing for an extension if necessary, you can simplify the process and ensure you're in compliance with state tax laws.

If you have any questions or concerns about filing your Maryland state taxes, leave a comment below or share this article with a friend who may need help.

FAQ Section

What is the deadline for filing Maryland state taxes?

+The deadline for filing Maryland state taxes is April 15th.

Can I file for an extension if I'm unable to file my taxes by the deadline?

+Yes, you can file for a six-month extension by submitting Form 502E by the original deadline, April 15th.

What is the Maryland Comptroller's Office?

+The Maryland Comptroller's Office is the state agency responsible for collecting taxes and providing tax information to residents.