The world of mortgage lending is complex, and one of the key players in this process is the appraiser. An appraiser's role is to provide an objective opinion of a property's value, which is crucial for mortgage lenders to determine the amount they can safely lend to borrowers. One of the most widely used appraisal forms in the industry is the Form 1025, also known as the Individual Condominium Unit Appraisal Report. In this article, we will delve into the world of Form 1025 appraisal and explore its significance for mortgage lenders.

The Form 1025 appraisal report is specifically designed for individual condominium units, which presents unique challenges for appraisers. Unlike single-family homes, condominium units are part of a larger complex, and their value is influenced by various factors, including the overall condition of the building, the quality of amenities, and the ownership structure. A thorough understanding of these factors is essential for appraisers to provide accurate and reliable opinions of value.

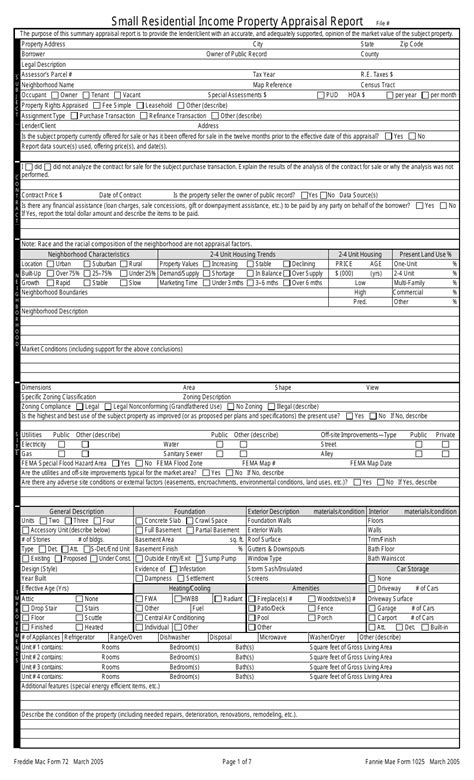

What is Form 1025 Appraisal?

The Form 1025 appraisal report is a standardized document used by appraisers to provide an opinion of value for individual condominium units. The form is designed to collect and present data in a clear and concise manner, making it easier for mortgage lenders to review and understand the appraisal results. The report typically includes information on the property's physical characteristics, location, and market conditions, as well as an analysis of the sales comparison approach, income approach, and cost approach.

Key Components of Form 1025 Appraisal

A Form 1025 appraisal report typically includes the following key components:

- Property identification and location

- Physical characteristics of the condominium unit

- Analysis of the sales comparison approach

- Analysis of the income approach

- Analysis of the cost approach

- Reconciliation of the value opinions

- Certification and limiting conditions

Benefits of Form 1025 Appraisal for Mortgage Lenders

Form 1025 appraisal reports offer several benefits for mortgage lenders, including:

- Accurate risk assessment: By providing a thorough analysis of the property's value, Form 1025 appraisal reports help mortgage lenders assess the risk of lending and make informed decisions.

- Compliance with regulatory requirements: The use of standardized appraisal forms like Form 1025 ensures that lenders comply with regulatory requirements and industry standards.

- Improved loan quality: Form 1025 appraisal reports help lenders identify potential issues with the property, which can improve loan quality and reduce the risk of default.

Challenges and Limitations of Form 1025 Appraisal

While Form 1025 appraisal reports provide valuable insights into the value of individual condominium units, there are some challenges and limitations to consider:

- Limited availability of comparable sales data: In some markets, there may be limited availability of comparable sales data, which can make it challenging for appraisers to provide accurate opinions of value.

- Complexity of condominium ownership structures: Condominium ownership structures can be complex, with multiple stakeholders and interests involved. This can make it challenging for appraisers to accurately assess the value of the property.

- Subjectivity of appraisal opinions: Appraisal opinions are inherently subjective, and different appraisers may have different opinions of value for the same property.

Best Practices for Mortgage Lenders

To get the most out of Form 1025 appraisal reports, mortgage lenders should follow best practices, including:

- Working with experienced appraisers: Mortgage lenders should work with experienced appraisers who have a deep understanding of the local market and the unique challenges of condominium appraisal.

- Reviewing appraisal reports carefully: Mortgage lenders should carefully review appraisal reports to ensure that they understand the appraiser's opinion of value and any potential risks or issues.

- Using appraisal reports as part of a comprehensive risk assessment: Mortgage lenders should use appraisal reports as part of a comprehensive risk assessment, which includes other factors such as creditworthiness and income verification.

Conclusion

In conclusion, Form 1025 appraisal reports play a critical role in the mortgage lending process, providing valuable insights into the value of individual condominium units. By understanding the key components of Form 1025 appraisal reports and following best practices, mortgage lenders can make informed decisions and minimize risk.

We encourage our readers to share their thoughts and experiences with Form 1025 appraisal reports in the comments section below. Your feedback is invaluable in helping us improve our content and provide more value to our readers.

What is the purpose of Form 1025 appraisal?

+The purpose of Form 1025 appraisal is to provide an opinion of value for individual condominium units, which is used by mortgage lenders to assess the risk of lending.

What are the key components of Form 1025 appraisal?

+The key components of Form 1025 appraisal include property identification and location, physical characteristics of the condominium unit, analysis of the sales comparison approach, income approach, and cost approach, reconciliation of the value opinions, and certification and limiting conditions.

What are the benefits of Form 1025 appraisal for mortgage lenders?

+The benefits of Form 1025 appraisal for mortgage lenders include accurate risk assessment, compliance with regulatory requirements, and improved loan quality.